What Happens in a Bitcoin Transaction? A Step-by-Step Guide

December 5, 2025

by Coinmetro Editorial Team

December 5, 2025

Bitcoin is a digital currency that enables peer-to-peer transactions without a central authority, such as a bank. It operates on a decentralized network, allowing users to send and receive payments globally. Each Bitcoin transaction is recorded on a public ledger known as the blockchain, ensuring transparency and security.

Understanding how a Bitcoin transaction works is crucial for anyone using or investing in Bitcoin. It helps users protect their funds, recognize transaction fees, and prevent common mistakes during the transfer process. Additionally, knowing the transaction process builds trust in using Bitcoin as a reliable form of payment.

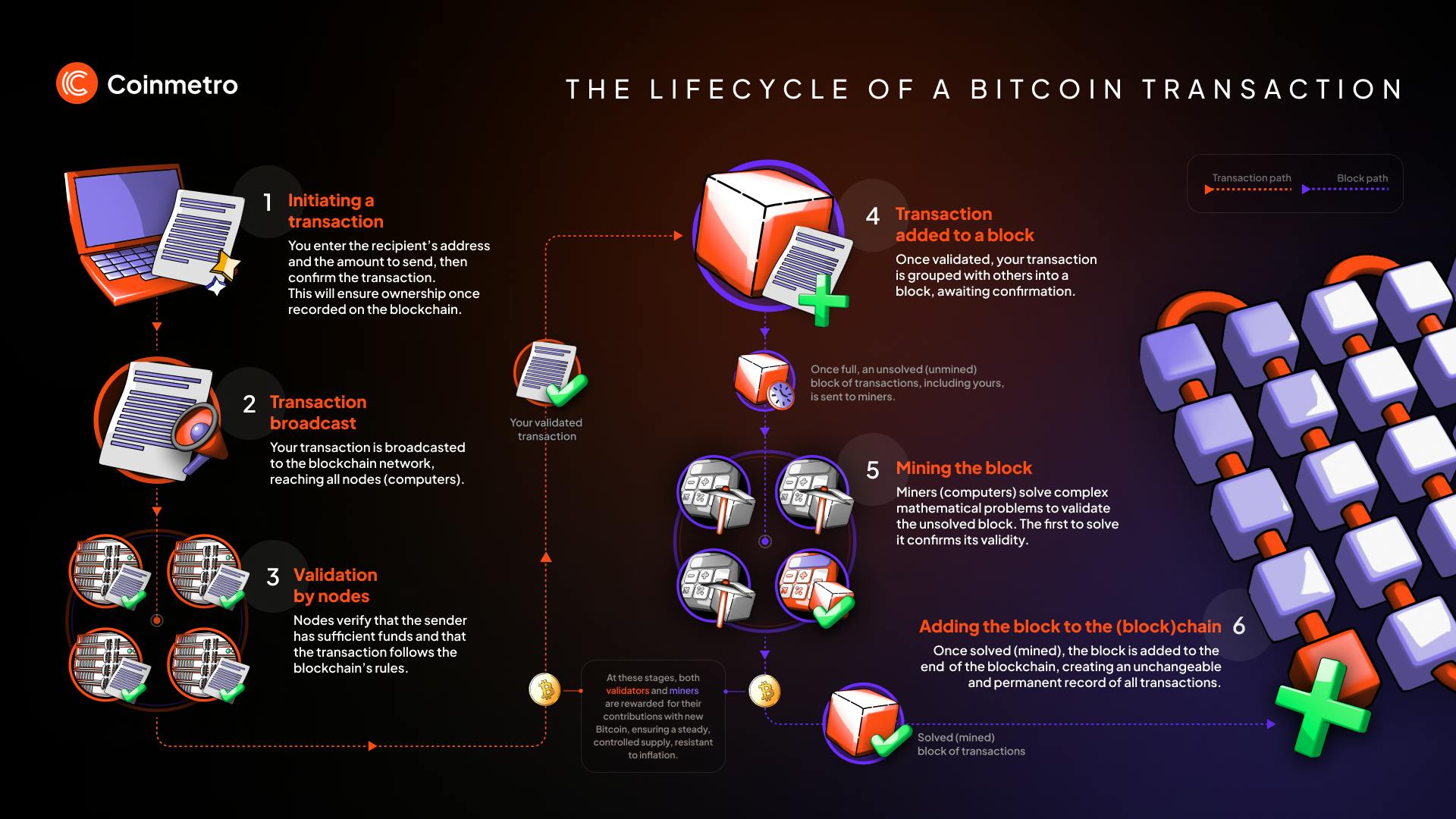

This guide provides a step-by-step explanation of what happens during a Bitcoin transaction. We will cover each phase in detail, from initiating a payment to confirming it on the blockchain. By the end of this guide, you’ll have a solid grasp of the entire process, making you more confident in managing your Bitcoin transactions.

A Bitcoin transaction is a process of transferring Bitcoin from one digital address to another. It involves moving a specific amount of Bitcoin from the sender’s wallet to the recipient’s wallet. Each transaction gets recorded on the blockchain, which acts as a public ledger, keeping a secure and transparent history of all transfers. However, while users use their wallets for transactions, the Bitcoin itself never leaves the blockchain and is not stored in the wallets; instead, the wallets manage access to the funds on the blockchain.

Inputs: Inputs are the sources of Bitcoin being used in the transaction. They refer to the previous transactions from which the sender has received Bitcoin. The input must match or exceed the amount being sent for a new transaction to occur.

Outputs: Outputs represent the destinations of the Bitcoin being transferred. A Bitcoin transaction can have multiple outputs, which means the sender can send different amounts to several recipients in a single transaction. After sending the specified amount, any leftover Bitcoin from the input is returned to the sender as "change" to a new output address controlled by the sender.

Addresses: Addresses are the unique identifiers for Bitcoin wallets. They consist of a string of letters and numbers representing the transaction's destination or source. Users specify the recipient's address when sending Bitcoin, ensuring the funds are directed to the right wallet. An address functions similarly to a bank account number but is used only for digital currency transfers.

Therefore, Bitcoin transactions involve:

- Using inputs to fund the transaction.

- Specifying outputs to determine where the Bitcoin goes.

- Using addresses to identify the sender and recipient.

These components work together to ensure the proper transfer of funds, making each transaction traceable and secure.

A Bitcoin wallet plays a crucial role in managing Bitcoin by securely storing the user’s private keys and generating public addresses. It acts like a digital bank account, allowing users to send and receive Bitcoin. Instead of holding physical coins, the wallet contains the cryptographic keys needed to access and control the Bitcoin associated with the user’s addresses.

When you create a Bitcoin wallet, it generates a private key and a public address. The private key is a secret code that gives the wallet owner control over the Bitcoin, while the public address functions as the wallet’s identifier for receiving funds. The wallet uses these keys to sign transactions, ensuring the authenticity of transfers.

Hot wallets (online): Hot wallets are connected to the internet, making them convenient for frequent transactions. They include mobile, desktop, and web-based wallets. While hot wallets provide easy access to funds, their online connection makes them more vulnerable to hacking and cyberattacks.

Cold wallets (offline): Cold wallets are not connected to the internet, making them more secure for storing large amounts of Bitcoin. They include hardware wallets (such as USB devices) and paper wallets. By keeping private keys offline, cold wallets reduce the risk of hacking, but they can be less convenient for everyday use.

Reputable crypto exchanges like Coinmetro prioritize both security and user experience. While providing safe and user-friendly access to crypto, Coinmetro keeps part of its assets in custody offline, in cold wallets. This approach increases security and minimizes risk, offering the best of both worlds.

A Bitcoin wallet is necessary for managing Bitcoin transactions. It allows users to securely send and receive funds using the private key to sign transactions and the public address to specify where the funds go. Users cannot access the Bitcoin network or manage their assets without a wallet. Choosing the right type of wallet depends on how often you use Bitcoin and your security needs.

Discover: Is Bitcoin Really Anonymous? Debunking Privacy Myths

To send Bitcoin, the sender needs to specify the amount they want to transfer and the recipient’s Bitcoin address. This process starts in the user’s wallet, where they input the recipient’s address—a unique string of letters and numbers—and the amount of Bitcoin to send. Double-checking these details is crucial, as mistakes can lead to lost funds.

When sending Bitcoin, the user also sets a transaction fee. This fee incentivizes miners to include the transaction in the next block. Higher fees usually result in faster processing times because miners prioritize transactions with higher fees. Wallets often provide suggested fee amounts based on current network activity, helping users choose an appropriate fee.

The sender confirms the transaction once the amount, recipient address, and fee are set. The wallet then creates a signed transaction using the sender's private key to verify the transfer.

After a Bitcoin transaction is signed, the wallet broadcasts it to the network. This means the transaction is sent to a network of nodes—computers that maintain the blockchain and validate transactions. The nodes check the transaction to ensure it meets the network's rules, such as verifying the digital signature and confirming that the sender has enough funds.

If the transaction passes these checks, the nodes accept it as valid and relay it to other nodes. This process helps spread the transaction across the network, preparing it for inclusion in a block by miners.

After a transaction is broadcasted to the network, miners compete to add it to a block. Miners collect valid transactions and use computing power to solve a complex mathematical puzzle. The first miner to solve this puzzle gets to add the block, which includes the transaction, to the blockchain.

The first confirmation is received once miners add the transaction to a block. Each new block added to the blockchain after that increases the number of confirmations. More confirmations strengthen the transaction's security, making it more difficult for anyone to reverse. Most services consider a transaction secure after six confirmations.

Bitcoin transactions can sometimes face issues like delays or high fees. Knowing how to avoid these problems can help ensure smoother transactions.

Low fees: When a transaction has a low fee, miners may prioritize other transactions with higher fees, causing delays. Set a competitive fee to avoid this, especially during peak network activity. Many wallets suggest appropriate fees based on current network conditions.

Network delays: Heavy network traffic can slow down transaction processing. To reduce delays, check the network status before sending large transactions and consider using a higher fee to speed up confirmation.

Double-check the recipient’s address: Always verify the address before sending to prevent irreversible mistakes.

Use wallets with fee adjustment options: Choose a wallet that allows you to manually set or adjust fees based on the urgency of your transaction.

Monitor network congestion: Use tools like blockchain explorers to see how busy the network is. If congestion is high, wait for lower activity to avoid higher fees.

Understanding the Bitcoin Transactions: A Complete Guide to Secure Transfers

Understanding each step in a Bitcoin transaction helps users manage their Bitcoin more safely. The process starts with setting up a wallet and initiating the transaction by specifying the amount and recipient's address. Next, the signed transaction is broadcasted to the network, where nodes validate it. Miners then add the transaction to a block on the blockchain, and it gains confirmations to ensure security.

By learning these steps, users can avoid common issues like delays or errors and better manage their fees. Knowing how the process works empowers users to make smarter decisions, ensuring smoother and safer Bitcoin transactions. Stay informed, double-check details, and always prioritize security for a confident Bitcoin experience.

Buy, Sell, and Hold Bitcoin (BTC) on Coinmetro Exchange

Join the Coinmetro community on Discord and Telegram, where forward-thinking traders and investors gather to share insights, explore new opportunities, and dive deep into cryptocurrencies. Should you need any help, please contact our world-class Customer Support Team via 24/7 live chat or email at hello@coinmetro.com.

To become a Coinmetro user today, Sign Up now or head to our new Exchange if you are already registered to experience our premium trading platform.

Tags

Related Articles

Regulatory Sandboxes: Fostering Crypto Innovation Within Legal Frameworks

The cryptocurrency industry’s fast rise fuels an important debate. Innovation aims to transform finance, enhancing speed and access. Yet, regulators…

5m

Crypto Options Trading: Strategies and Market Insights

Cryptocurrency markets have rapidly expanded beyond simple buying and selling. One of the most significant developments has been the rise of…

6m

The Rise of Social-Fi: Blending Social Media with Decentralized Finance

In recent years, social media and finance have started to merge, creating Social-Fi. This concept blends the engagement of social platforms with…

6m

DeFi Insurance Platforms to Watch in 2024

Decentralized Finance (DeFi) insurance addresses the growing need for insurance against hacks, smart contract failures, and other DeFi-related risks.…

7m