2025 Crypto Cycle: Where Are We Now and What’s Changed?

December 5, 2025

by Coinmetro Editorial Team

December 5, 2025

Up until now, crypto markets have danced to the rhythm of 4-year cycles—bull runs ignite euphoria, bear phases test patience, and kangaroo (choppy) markets hop unpredictably within a range. Yet, in 2025, is that beat still locked to the old groove? Government policies drive strategic Bitcoin reserves while institutions ramp up Bitcoin ETF investments and corporate treasuries. Meanwhile, banks appear to be getting the green light for trading and custody.

So is this time different? What has changed? Where are we in this current cycle, and has adoption rewritten the rules? No one can say for sure. While this blog is not a prediction article or technical analysis report, it’s meant to give you a compass so you can navigate the markets with awareness and confidence. Let’s unpack the 2025 crypto market cycle.

This blog will outline:

- Recap of past crypto cycles

- Factors shaping crypto in 2025

- 2025 crypto cycle: New dynamics or same playbook?

- Understanding bull, bear, and kangaroo (choppy) markets

- Macroeconomic factors and their impact on crypto

Read More About Crypto Market Cycles: Analyzing Historical Patterns for Future Predictions

Since its inception, crypto markets have followed a four-year pattern. This was largely driven by Bitcoin’s halving events but also by the governmental monetary policies (interest rate changes, quantitative easing and tightening). By reducing the mining rewards, Bitcoin halvings constrict supply, creating scarcity and historically propelling prices up before corrections ensue. Each cycle—from euphoria to fear—offers lessons for navigating today’s landscape.

2017 saw ICOs ignite excitement, raising billions and pushing Bitcoin to $19,797. The 2018 cooldown to approximately $3,200 adjusted valuations, refining the space for sustainable growth. This reset paved the way for smarter, stronger projects.

DeFi and NFTs took center stage in 2021, boosting altcoins like Ethereum (ETH), Solana (SOL), and Avalanche (AVAX). Bitcoin peaked at $69,000 in November 2021, then dipped to $16,548 about a year later. After a vibrant high, the market matured, spotlighting resilient innovations and starting the cycle once more.

The 2024 halving on April 20 broke new ground, with Bitcoin hitting a new all-time high of $73K a month before - something unprecedented in the history of BTC. By December, it reached above $100,000 reflecting robust demand and a shrinking supply. The early surge was also attributed to Spot Bitcoin ETFs introduced in January 2024.

Analyze Historical Bull Runs: Lessons for the Next Crypto Surge

Crypto in 2025 reflects unprecedented forces driving adoption and growth. Governments, institutions, and banks now play pivotal roles in shaping the markets. These shifts signal a maturing ecosystem with lasting impact.

President Trump’s Strategic Bitcoin Reserve, signed into order in March 2025, marks a bold step. It uses seized Bitcoin—roughly 200,000 BTC—to strengthen national holdings without taxpayer cost. This move positions the U.S. as a crypto leader, sparking global attention.

El Salvador and Bhutan already mine and hold Bitcoin in their treasuries, inspiring others to follow. With the recent U.S. initiative, this trend may accelerate, tightening global supply.

Bitcoin ETFs - Spot Bitcoin ETFs, launched in 2024, now channel billions into the market. BlackRock’s iShares Bitcoin Trust (IBIT) became the fastest-growing ETF in history, surpassing $50 billion in assets in just 228 days—outpacing even BlackRock’s iShares Gold Trust (IAU), which took years to reach a similar level. These inflows can potentially add stability to Bitcoin’s price. However, they could also curb the explosive altcoin rallies of past cycles by concentrating liquidity on institutional-grade assets.

Corporate Treasuries & Bitcoin - MicroStrategy leads the charge, holding 499,096 BTC as of February 24, 2025, a solid $28 billion bet on long-term value. Other companies like Marathon Digital (32,305 BTC) and Riot Platforms (17,557 BTC) stack coins diligently. This trend, tracked by the Bitwise Bitcoin Standard Corporations Index (OWNB), now lists over 70 public companies adopting Bitcoin as a treasury asset. By reducing circulating supply, these hodling strategies can increase prices in the long run. Semler Scientific (1,058 BTC) and Japan’s Metaplanet (855 BTC) have joined in, signaling global faith in Bitcoin’s long-term power.

A new order is aiming at allowing U.S. banks to offer trading and custody of crypto assets. The OCC’s March 7, 2025, ruling greenlights Bitcoin and Ethereum services for national banks. This follows the SEC’s January reversal of SAB 121, easing regulatory constraints. As banks integrate blockchain and crypto into traditional finance, adoption has the runway to accelerate.

Whether 2025 follows the past cycle playbook—or rewrites it entirely—will depend on how key forces interact in the coming months:

A Changing Landscape - As mentioned, Bitcoin’s price movements have historically followed a predictable halving-driven supply shock, retail speculation, and shifts in government monetary policies. However, 2024 marked a first in Bitcoin’s history—reaching a new all-time high before the halving, signaling a potential shift in market dynamics.

The Institutional Shift - Unlike past cycles, where retail speculation dictated market swings, institutional capital is now playing an important role. The rise of spot Bitcoin ETFs, corporate treasuries, and sovereign adoption has already injected deep liquidity, potentially reshaping Bitcoin’s volatility profile. This reinforces Bitcoin’s narrative as an institutional-grade asset rather than a high-risk, speculative play.

Liquidity 2.0 - The liquidity profile has fundamentally evolved. While Bitcoin may still experience sharp price swings, institutional accumulation and supply constraints could dampen the prolonged drawdowns of previous bear markets. Some analysts see rising institutional inflows as the foundation for a multi-year rally fueled by supply shocks and accelerating adoption. Others caution that macroeconomic risks and interest rate uncertainties could temper liquidity inflows.

Related - Trump Signs Order to Establish Strategic Bitcoin Reserve

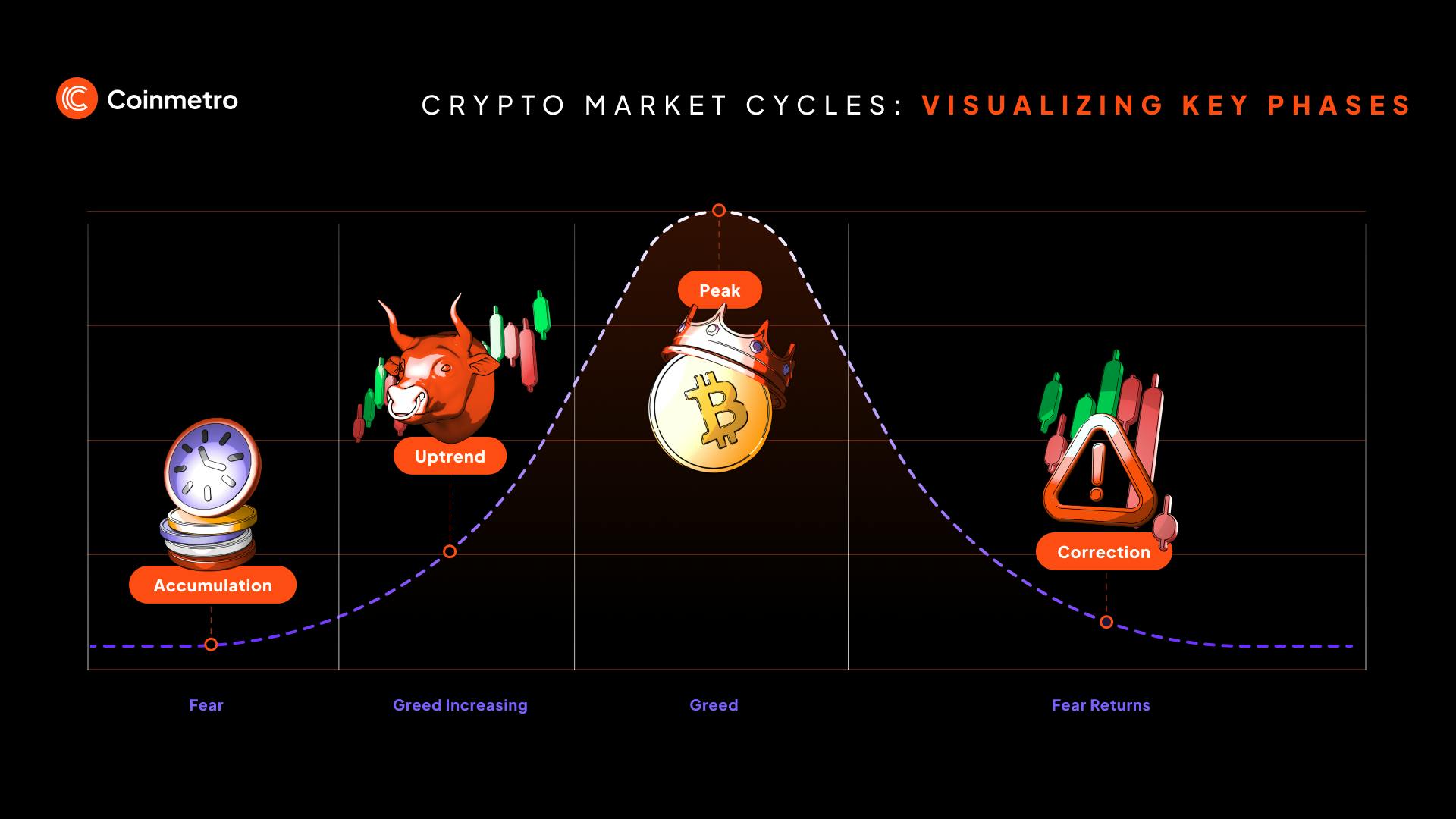

Markets don’t always follow a clear path—prices can rise, fall, or move unpredictably. Here’s a breakdown of bull, bear, and kangaroo markets and what they mean for investors:

Bull Market - Prices rise steadily over an extended period, driven by strong demand, investor optimism, and economic growth. These markets often see higher trading volumes, increased institutional and retail participation, and positive sentiment fueling further price appreciation.

Bear Market - Prices decline for a prolonged period, typically triggered by economic downturns, tightening monetary policies, or loss of investor confidence. Bear markets are characterized by widespread pessimism, reduced liquidity, and a preference for safer assets.

Kangaroo (Choppy) Market - Prices fluctuate unpredictably within a certain range, bouncing between gains and losses without establishing a clear long-term trend. This market is often driven by macro uncertainty, conflicting economic signals, and indecisive investor sentiment, making it difficult to predict future movements.

Read More: US Regulator Clears Path for Banks to Engage in Crypto Activities

Beyond crypto-native trends, macroeconomic conditions play a crucial role in shaping Bitcoin and digital asset markets. Historically, Federal Reserve policies have influenced liquidity flows, impacting Bitcoin’s correlation with risk assets. The 2025 market landscape introduces new variables—inflationary pressures, central bank policies, and global liquidity cycles that can heavily shape investor appetite for crypto assets.

Interest Rates & Liquidity – If central banks pause or cut rates, crypto could benefit from renewed capital inflows. However, prolonged tight monetary policy could limit speculative growth.

Inflation & Hard Assets – Bitcoin’s store-of-value narrative strengthens when inflation expectations rise. Institutional investors increasingly view Bitcoin and gold as a hedge against fiat devaluation.

M2 Money Supply & Bitcoin – Bitcoin’s price has historically correlated with the M2 money supply. Periods of expanding liquidity (increased M2) have often aligned with Bitcoin bull runs, while contractions in money supply have preceded market slowdowns. This relationship suggests that monetary expansion policies may remain a key driver of Bitcoin’s price cycles.

▶️ Watch: A Theory on the Bitcoin Market Cycle from Analyst Benjamin Cowen

The 2025 crypto market stands at a crossroads where past cycles and emerging forces collide. Bitcoin’s traditional four-year cycle may still play a role, but institutional capital, national reserves, and macroeconomic forces are already having an impact on market behavior.

Spot Bitcoin ETFs have transformed liquidity dynamics, corporate treasuries continue to accumulate BTC, and Bitcoin is increasingly viewed as a strategic risk-off asset at both institutional and governmental levels. Meanwhile, macro factors like inflation, interest rates, and M2 money supply expansion further shape market sentiment and capital flows.

Whether Bitcoin follows its historical cycle or enters a new phase of institutional-driven stability, one thing is clear—crypto’s landscape is more complex and interconnected than ever before. Investors navigating 2025 must adapt to a market shaped by institutional liquidity, macroeconomics, and regulatory shifts rather than relying solely on past patterns.

One final note on volatility: Crypto volatility is not a flaw - it’s a fundamental part of crypto market dynamics. While price swings can be unsettling, they also create opportunities for strategic positioning. Volatility is vitality, driving both accumulation and price discovery. Instead of avoiding it, understanding how it shapes the market can provide an edge. Regardless of direction, those who stay informed and adaptable will always be in a position of strength.

Join the Coinmetro community on Discord and Telegram, where forward-thinking traders and investors gather to share insights, explore new opportunities, and dive deep into cryptocurrencies. Should you need any help, please contact our world-class Customer Support Team via 24/7 live chat or email at hello@coinmetro.com.

To become a Coinmetro user today, Sign Up now or head to our new Exchange if you are already registered to experience our premium trading platform.

Tags

Related Articles

Regulatory Sandboxes: Fostering Crypto Innovation Within Legal Frameworks

The cryptocurrency industry’s fast rise fuels an important debate. Innovation aims to transform finance, enhancing speed and access. Yet, regulators…

5m

Crypto Options Trading: Strategies and Market Insights

Cryptocurrency markets have rapidly expanded beyond simple buying and selling. One of the most significant developments has been the rise of…

6m

The Rise of Social-Fi: Blending Social Media with Decentralized Finance

In recent years, social media and finance have started to merge, creating Social-Fi. This concept blends the engagement of social platforms with…

6m

DeFi Insurance Platforms to Watch in 2024

Decentralized Finance (DeFi) insurance addresses the growing need for insurance against hacks, smart contract failures, and other DeFi-related risks.…

7m