Margin Trading for Beginners

December 5, 2025

by Kamil S

December 5, 2025

Welcome to the world of margin trading. In this article, we hope to briefly provide you with the basic details so you can have a better understanding of how you can integrate margin in your investment and trading.

Buying on margin entails borrowing money from a broker or an exchange and using it to purchase more securities than you would otherwise be able to with just your available funds on hand. While this sounds easy, there are things you need to know about the challenges of margin trading.

An important characteristic of margin trading, more specifically with long and short orders, is that you can make money regardless of market conditions, making margin trading a useful tool during bear markets.

Simply put, when you engage in margin trading - or buying on margin - you borrow money from a brokerage firm or an exchange, use it to buy assets, and then repay the loan along with any applicable interest.

When compared to trading with your original funds, buying on margin may prove to be more profitable, but it is crucial to realize that there is also a bigger risk involved.

Investors employ margin trading, which is a type of leverage, to increase their returns. However, if the investment doesn't turn out as expected, the losses may be equally significant.

Let’s have a look at a theoretical example from the crypto scene. With margin trading, you can buy, for example, $25,000 worth of Bitcoin with only $5,000, that is, leveraging 5:1, or 5x.

This means that you invest $5,000 and borrow the other $20,000 from your cryptocurrency broker (most of the time - the exchange you are trading on). As a result, because you are borrowing money, you owe the money back along with any applicable fees. Please read all the terms and conditions of the selected exchange carefully before starting to trade on margin!

Learn what you need to know before you start margin trading:

Increased Losses

When you trade with leverage, you can lose much more than you originally invested, this being the biggest risk of margin trading.

For instance, when assets that were partially financed with a loan decrease by 50% or more in price, your portfolio will experience a loss of up to 100%, plus interest and commission.

Margin Call

You can be forced to sell at the last minute due to margin calls.

When a margin account runs out of money, typically as the result of a losing trade, a margin call occurs. That is, you must increase your investment in order to meet the lending requirements set by the broker or regulatory body. If you don't make the margin call, the broker may sell off your positions without prior notice, as well as impose any necessary commissions, fees, and interest.

Interest Charges & Maintenance Margin

Margin loans have interest charges that you owe on loans made between you and your broker regarding the assets in your portfolio.

What’s more, brokerages have complete discretion over when and how much maintenance margin is required. After a purchase has been made, you must maintain a certain level of equity in your margin trading account - in other words, maintenance margin.

Tax on Crypto Margin Trading

Overall, margin trading in cryptocurrencies is not taxable. However, any capital gains, losses, or interest income from lending or trading on margin must be taxed and reported. However, taxation might differ from country to country. To learn more, read this blog on Crypto Taxes of Leverage Trading.

For seasoned traders, margin trading is a great way to increase their purchasing power and explore more trading opportunities. However, margin trading comes with considerable risk, particularly if handled poorly. It’s important that you get knowledgeable and are fully aware of how margin trading works before engaging in it.

Here is another brief example of opening a long position on margin. Going long means profiting from an asset's price rise. For instance: you open a long position for $10 with a 5x margin leverage - a total of $50. The price then rises 25%. You can now lock in $12.50 in profits (5 x $2.50).

It’s important to remember that an asset's price can theoretically rise indefinitely. On the contrary - with short positions, an asset’s price can only decline to a minimum of its overall value, more precisely, to 0.

Do you want to learn more about margin trading, long and short positions and other investing strategies? Keep your eyes on our Learning Lab for more valuable educational articles about margin trading, crypto and blockchain.

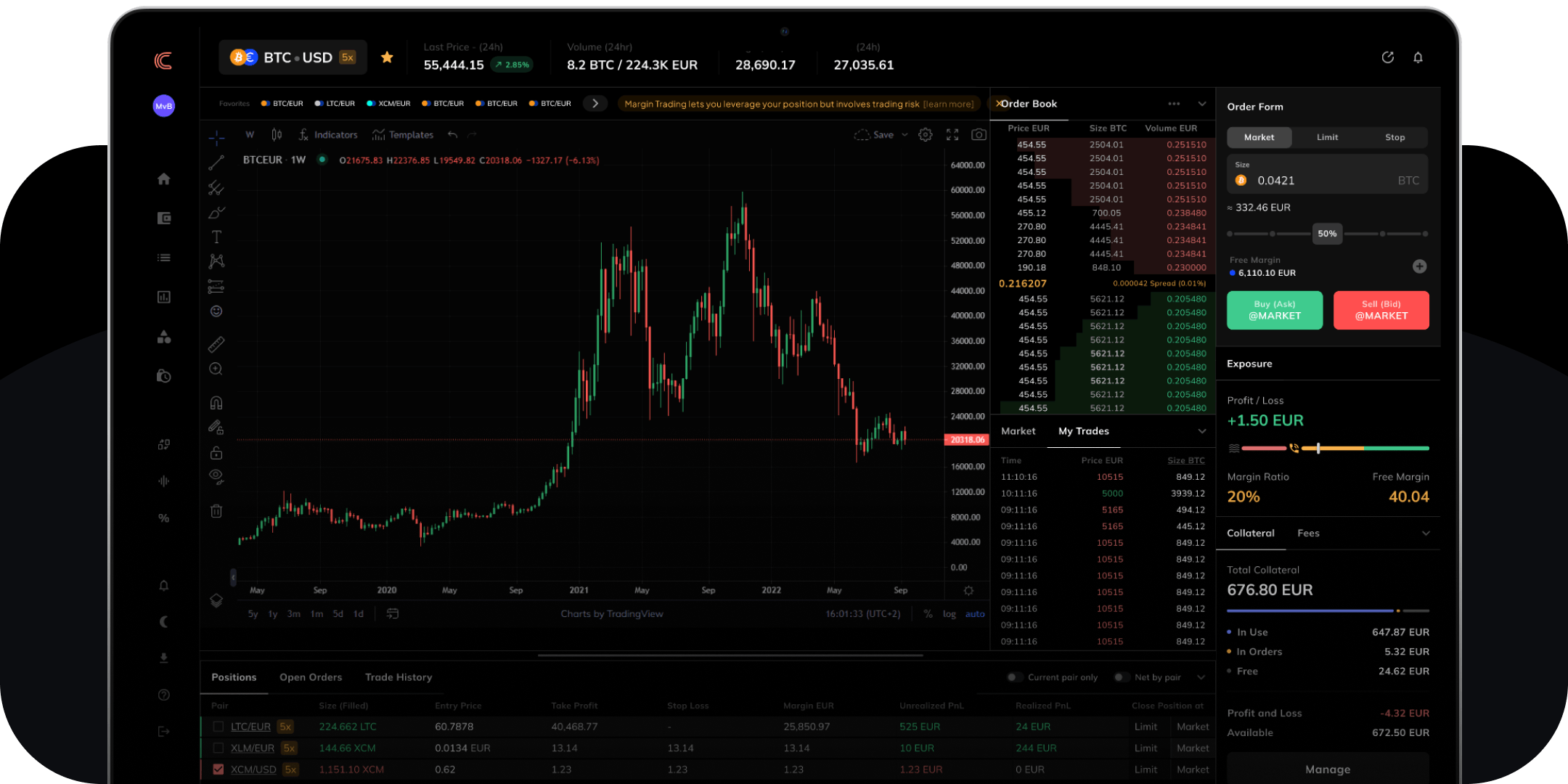

Did you know that recently Coinmetro pushed forward one of the biggest product updates in recent times? Among several innovations in UX/UI, Spot exchange and Mobile App, we introduced a brand new Margin Platform that has been designed with the purpose of giving you a performant, safe and user-friendly experience, while helping you learn and develop your trading skills.

For sure, one of the advantages of margin trading is that you can profit from both long and short positions. More precisely, if you are skilled enough, you can make money regardless of market conditions. While currently no coin or token is going #tothemoon, let us ask you this: do you have a trading strategy for the current bear market?

If you are just starting out, we advise you to opt for a margin trading demo experience with Coinmetro, just so that you become familiar and start building some experience.

When you feel confident and are ready to margin trade live, we welcome you to open a Coinmetro account. Are you a registered user? You can head over to the exchange now.

To stay current on the most urgent crypto topics and chat with like-minded people, you can also join our Discord and Telegram communities.

Tags

Related Articles

Regulatory Sandboxes: Fostering Crypto Innovation Within Legal Frameworks

The cryptocurrency industry’s fast rise fuels an important debate. Innovation aims to transform finance, enhancing speed and access. Yet, regulators…

5m

Crypto Options Trading: Strategies and Market Insights

Cryptocurrency markets have rapidly expanded beyond simple buying and selling. One of the most significant developments has been the rise of…

6m

The Rise of Social-Fi: Blending Social Media with Decentralized Finance

In recent years, social media and finance have started to merge, creating Social-Fi. This concept blends the engagement of social platforms with…

6m

DeFi Insurance Platforms to Watch in 2024

Decentralized Finance (DeFi) insurance addresses the growing need for insurance against hacks, smart contract failures, and other DeFi-related risks.…

7m