Crypto Market Making: How It Works

December 5, 2025

by Coinmetro Editorial Team

December 5, 2025

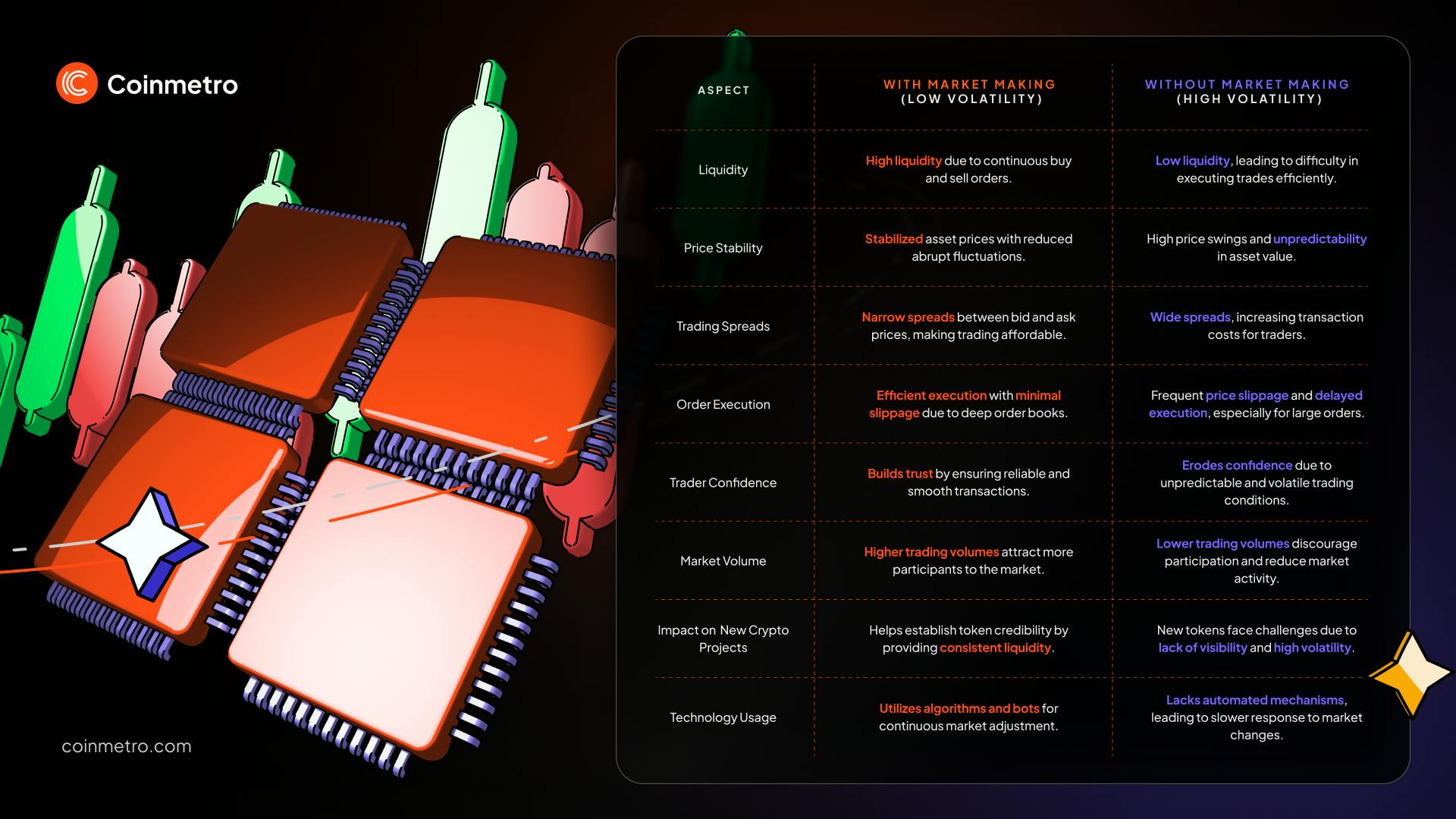

Ever wondered how crypto exchanges maintain liquidity and stability in volatile markets? Crypto market making is vital in ensuring smooth transactions and a reliable trading experience. Exchanges add liquidity by placing buy and sell orders, which helps reduce price swings and improve trading. This benefits everyone, from exchanges to traders and token projects. This article will explain market making, its process, and why it's vital for the crypto world.

In this blog, you will learn about:

- What is market making?

- How does market making work?

- Who are the players in crypto market making?

- Benefits for crypto projects

- Challenges and risks

- How to start market making in crypto

Market making refers to providing liquidity on a trading platform by simultaneously placing buy and sell orders for an asset. This activity keeps transactions flowing smoothly, allowing traders to trade assets without delays or big price changes.

Ensures Low Spreads: Market makers keep the gap between buy and sell prices small. This makes trading cheaper and more predictable for everyone.

Reduces Volatility: By offering constant buy and sell orders, they help reduce volatility, minimizing sudden market swings.

Increases Trading Volume: More liquidity means more traders join in, which increases market activity and improves the trading experience.

Market making helps not just traders but also exchanges and crypto projects by creating a vibrant, efficient trading environment.

Bid and Ask Orders: Market makers place simultaneous buy (bid) and sell (ask) orders for a cryptocurrency. The difference between these two prices is called the spread. This ensures that traders can always find counterparties for their transactions.

Order Books: An order book records all active buy and sell orders on an exchange. Market makers populate this book with offers, creating depth and liquidity for the market.

Spread and Profit Margins: Market makers earn profits by maintaining a spread. The narrower the spread, the more efficient the market, but a small spread must still cover the market maker's costs, such as fees and risks.

Algorithmic Trading in Market Making: Algorithms handle order placement and adjustments based on market conditions. They react quickly to price changes, providing constant liquidity and maintaining good spreads.

Tools and Software Used by Market Makers: Market makers employ trading bots or custom software linked to exchange APIs. Tools like Hummingbot or firm-specific algorithms offer speed, precision, and efficiency in trading.

Market making uses strategic order placement, technology, and live market data. By always placing orders, market makers facilitate stable trading. This benefits both small traders and big investors.

Market Makers: Market makers are firms or traders who place buy and sell orders to add liquidity. They keep markets efficient and accessible using algorithms and capital. They support trading on both centralized and decentralized platforms.

Liquidity Providers: Liquidity providers supply assets to exchanges for seamless trading. They work with market makers to keep spreads tight and reduce price swings. In DeFi, like Uniswap, they fund AMM (Automated Market Maker) pools for constant trading. Coinmetro partners with Wintermute, Lmax, and Stillman Digital to offer deep liquidity, tight spreads, and a smooth trading experience.

Crypto Exchanges: Reputable exchanges like Coinmetro, Coinbase, and Kraken work with market makers. These partnerships improve trading by deepening the order book and reducing price slippage. They might also offer fee reductions or partnerships to maintain liquidity for certain pairs.

Therefore, market makers, liquidity providers, and exchanges work together to ensure a stable crypto market with good liquidity and price stability for all users.

Learn More: Coinmetro Partners with Stillman Digital for Enhanced Liquidity

For Projects: Market making keeps buy and sell prices close, attracting traders. Stable trading builds trust and boosts token visibility. Liquidity helps new projects build credibility in competitive markets.

For Exchanges: Market making adds depth to the order book, allowing smooth trading without radical price jumps. Less slippage improves user experience, drawing more traders. This leads to more trades, higher revenue, and a stronger reputation.

For Traders: Market making stabilizes prices, avoiding sudden drops or spikes. High liquidity lets traders place big orders without big price moves. This improves the trading experience for everyone involved.

Market making drives the growth of crypto projects, exchanges, and communities by making markets stable, liquid, and reliable.

High Volatility in Crypto Markets: Cryptocurrency prices can fluctuate significantly within minutes. Market makers must constantly adjust their orders, making their jobs harder and riskier.

Regulatory Uncertainty: Many jurisdictions don't have clear rules for crypto trading. Unexpected laws or actions can harm market making, leading to legal and financial troubles.

Impermanent Loss: Market makers can lose money when providing liquidity to decentralized pools. This happens if token values change from their initial deposit, causing potential losses.

Thin Liquidity on Newer Tokens: New or less popular tokens are hard to support. Without enough trading, market makers might hold onto assets they can't easily sell.

Examples: Many market making companies have struggled with these issues. In 2022's crash, some couldn't adjust orders fast enough, leading to big losses. Projects with poor liquidity saw their token prices drop sharply.

By understanding these risks, market makers can develop ways to reduce losses while supporting crypto markets.

Market-Making Bots: Automated tools like Hummingbot and Autonio simplify market making. These programs follow set strategies to trade, manage spreads, and react to market shifts.

APIs for Exchanges: APIs link market-making software with exchanges. They help place orders, fetch live data, and tweak trading methods. Exchanges like Coinmetro offer strong API support.

Capital Requirements: Market making requires sufficient capital to place buy and sell orders. The amount depends on the liquidity needs of the trading pair and the spread size.

Choosing the Right Exchange: Select an exchange with high trading volume, reliable infrastructure, and transparent fee structures such as Coinmetro. Exchanges with incentivized programs for market makers can reduce costs.

Understanding Spreads and Fees: Calculate the potential profit margin by analyzing the difference between bid and ask prices (the spread) while factoring in exchange fees and operational costs.

Diversify Trading Pairs: Avoid concentrating on a single trading pair. By diversifying, market makers reduce risk and maximize opportunities across different assets.

Stay Informed About Market Trends: Monitor news, price movements, and regulatory updates to adapt strategies. Use analytics tools to predict trends and maintain profitability.

Starting as a market maker involves planning, tools, and smart choices. By using the right platforms and staying alert, you can build a successful operation.

Market Making in Crypto: Market making adds liquidity, reduces price swings, and makes trading easier in crypto. It's vital for exchanges, projects, and traders wanting smooth deals and stable prices.

Next Steps: Start by checking out tools like Hummingbot, which lets you build and run trading bots easily, or Autonio, making automation cheaper and more accessible. These tools are great for refining strategies or boosting liquidity.

Are You Ready? Consider how market-making can enhance your crypto experience. Explore platforms that make trading automation simple and see the benefits yourself.

Start market-making today on Coinmetro with Hummingbot or Autonio!

Join the Coinmetro community on Discord and Telegram, where forward-thinking traders and investors gather to share insights, explore new opportunities, and dive deep into cryptocurrencies. Should you need any help, please contact our world-class Customer Support Team via 24/7 live chat or email at hello@coinmetro.com.

To become a Coinmetro user today, Sign Up now or head to our new Exchange if you are already registered to experience our premium trading platform.

Tags

Related Articles

Regulatory Sandboxes: Fostering Crypto Innovation Within Legal Frameworks

The cryptocurrency industry’s fast rise fuels an important debate. Innovation aims to transform finance, enhancing speed and access. Yet, regulators…

5m

Crypto Options Trading: Strategies and Market Insights

Cryptocurrency markets have rapidly expanded beyond simple buying and selling. One of the most significant developments has been the rise of…

6m

The Rise of Social-Fi: Blending Social Media with Decentralized Finance

In recent years, social media and finance have started to merge, creating Social-Fi. This concept blends the engagement of social platforms with…

6m

DeFi Insurance Platforms to Watch in 2024

Decentralized Finance (DeFi) insurance addresses the growing need for insurance against hacks, smart contract failures, and other DeFi-related risks.…

7m