Optimizing Coinmetro for a Better Trading Experience: What’s Changing and How It Benefits You

November 12, 2024

by Coinmetro Editorial Team

November 12, 2024

At Coinmetro, we’re constantly evolving to provide the best trading experience for our users. 🚀 Our latest platform optimizations are designed to enhance your trading environment, streamline liquidity, and improve our visibility on major crypto aggregators like CoinMarketCap and CoinGecko. Here’s everything you need to know about the upcoming changes and what they mean for you!

👉 USDT Pairs Consolidation: We’re aligning most of our projects with USDT trading pairs to streamline liquidity. By focusing on a single pair, we can reduce price spikes on smaller projects, making trading smoother and more reliable. This also helps us source better liquidity support from LPs (Liquidity Providers) and MMs (Market Makers), optimizing costs and trade execution.

👉 Expanded Margin & SWAP Limits: We’re significantly increasing SWAP and Margin limits. This upgrade caters to clients with bigger trading appetites, providing more flexibility to leverage positions.

👉 Adjusting Low-Volume Pairs: We’ll be optimizing trading pairs by delisting those with consistently low or no activity. Important Note: No project will be completely delisted—we’re only changing pairs. This means withdrawing tokens is not necessary at any point.

A complete list of all affected pairs can be found below.

No Project Delistings: We’re only adjusting trading pairs. Your assets remain safe, and you do not need to withdraw any tokens.

Minimal Trading Disruption: There will be three planned 1-hour maintenance breaks to update affected pairs. Outside of these brief windows, trading will continue as usual.

Proactive Communication: All users with active orders on SPOT or Margin for affected pairs will receive email notifications detailing the planned steps, so you’re always in the loop.

✅ Better Trading Experience: By consolidating to USDT pairs and optimizing liquidity, you’ll benefit from reduced price volatility, faster execution, and improved reliability.

✅ Higher CoinMarketCap & CoinGecko Rankings: These changes will enhance our visibility, attracting more users and increasing trading volumes, which ultimately benefits our community.

✅ Onboarding More LPs & MMs: Streamlined pairs and volumes will allow us to onboard more liquidity providers and market makers, reducing trading costs and boosting performance.

✅ Enhanced Limits for Advanced Traders: With higher SWAP and Margin limits, users with a taste for larger trades can maximize their potential returns.

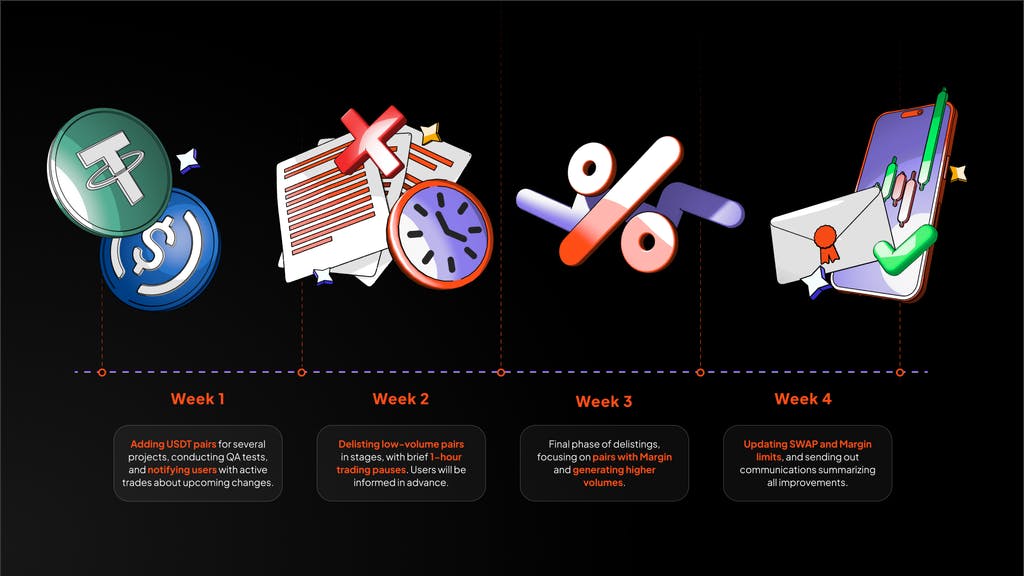

🔄 Week 1 (Nov 11-17): Adding USDT pairs for several projects, conducting QA tests, and notifying users with active trades about upcoming changes.

🛠️ Week 2 (Nov 18-24): Delisting low-volume pairs in stages, with brief 1-hour trading pauses. Users will be informed in advance.

📈 Week 3 (Nov 25-Dec 1): Final phase of delistings, focusing on pairs with Margin and generating higher volumes.

⚡Week 4 (Dec 2-Dec 8): Updating SWAP and Margin limits, and sending out communications summarizing all improvements.

These optimizations streamline operations, reduce costs, and make Coinmetro an even more attractive platform for both existing and new users. By enhancing liquidity and cutting costs on inefficient trades, we’re paving the way for a more efficient trading ecosystem.

This project is driven by your feedback. We’re committed to continuously improving your trading experience and creating a user-friendly, reliable platform. Together, we’re building a stronger Coinmetro!

We’ll keep you updated on our progress throughout November. If you have any questions or concerns, feel free to reach out to our support team or check our Help Desk for the latest updates.

As part of our Listing Optimization Project, we will be delisting and adding trading pairs in phases across the coming weeks. Below is the complete list of pairs that will be affected, categorized by the week of planned changes.

We will be introducing new USDT trading pairs to streamline liquidity:

- USDT Pairs to be Added:

FLUX/USDT, KDA/USDT, QNT/USDT, LTC/USDT, CHZ/USDT, XTZ/USDT, CRV/USDT, XLM/USDT, 1INCH/USDT, GALA/USDT, LDO/USDT, LRC/USDT, GRT/USDT, LILAI/USDT, VXV/USDT, YFI/USDT, PRQ/USDT, SNX/USDT, NXRA/USDT, HTR/USDT, LTO/USDT, QRDO/USDT, DYDX/USDT, LMWR/USDT, CVX/USDT, CELO/USDT, BLUR/USDT, ENJ/USDT, STORJ/USDT, DNA/USDT, WHL/USDT, RPL/USDT, ENS/USDT, IMX/USDT, PERP/USDT, STG/USDT, CTSI/USDT, AUDIO/USDT, ANKR/USDT, HOT/USDT, BAND/USDT, NMR/USDT, NOIA/USDT, OMG/USDT, UOS/USDT, COVAL/USDT, VSP/USDT, OCEAN/USDT

These pairs will be delisted due to low trading activity:

- SPOT Pairs to be Delisted:

APT/USD, APT/EUR, PERP/USD, PERP/EUR, ANKR/USD, ANKR/EUR, QRDO/USD, QRDO/EUR, AUDIO/EUR, OMG/EUR, CTSI/USD, CTSI/EUR, UOS/USD, UOS/EUR, WHL/USD, WHL/EUR, STG/USD, STG/EUR, CELO/USD, CELO/EUR, ENA/EUR, IMX/EUR, CVX/USD, CVX/EUR, ENS/EUR, RPL/USD, RPL/EUR, NMR/USD, NMR/EUR, RIO/USD, RIO/EUR, DNA/USD, HOT/USD, HOT/EUR, COVAL/USD, COVAL/EUR, VSP/USD, STORJ/USD, STORJ/EUR, LMWR/EUR, OCEAN/USD, OCEAN/EUR, FET/USD, FET/EUR, RNDR/USD, RNDR/USDC, RNDR/EUR, NOIA/USD, NOIA/EUR, PRO/USD, PRO/EUR, NXRA/USD, NXRA/EUR, LDO/USD, LDO/EUR, LDO/USDC, DAI/USD, DAI/EUR, HTR/USD, HTR/EUR, VXV/USD, PRQ/USD, PRQ/EUR, TIA/USD, TIA/EUR, LILAI/USDC, LILAI/ETH, LTO/USD, LTO/EUR, YFI/USD, YFI/USDC, YFI/EUR, BLUR/USD, BLUR/EUR, DYDX/USD, DYDX/EUR, GALA/USDC, GALA/EUR, BCH/GBP, BCH/USD, BCH/USDC, BCH/EUR, CHZ/USD, CHZ/USDC, CHZ/EUR

These pairs will be delisted from both SPOT and Margin platforms due to low trading activity:

- SPOT & Margin Pairs to be Delisted:

ENJ/USD, ENJ/EUR, HBAR/USDC, XLM/GBP, XLM/USD, XLM/USDC, ALGO/USD, ALGO/USDC, ALGO/EUR, LRC/USD, LRC/USDC, LRC/EUR, GRT/USD, GRT/USDC, GRT/EUR, BAT/USD, BAT/USDC, BAT/EUR, 1INCH/USD, 1INCH/USDC, 1INCH/EUR, SAND/USD, SAND/USDC, SAND/EUR, MANA/USD, MANA/USDC, MANA/EUR, CRV/USDC, CRV/EUR, MATIC/USD, MATIC/USDC, SUSHI/USD, SUSHI/USDC, SUSHI/EUR, OP/USD, OP/USDC, OP/EUR, SNX/USD, SNX/EUR, NEAR/USDC, NEAR/EUR, ATOM/GBP, ATOM/USD, ATOM/USDC, ATOM/EUR, MKR/USD, MKR/USDC, MKR/EUR, UNI/USDC, UNI/EUR, AVAX/USD, AVAX/USDC, AAVE/USD, AAVE/USDC, DOT/GBP, DOT/USD, DOT/USDC, COMP/USD, COMP/USDC, COMP/EUR, XTZ/USD, XTZ/USDC, XTZ/EUR, KSM/USD, KSM/USDC, KSM/EUR, BTC/AUD, BTC/GBP, ETH/AUD, ETH/GBP, SOL/GBP, THT/EUR, THT/USD, XCM/ETH, USDC/GBP, DOGE/USD, DOGE/USDC, XRP/GBP, XRP/USDC, XRP/BTC, LINK/GBP, LINK/USDC, LINK/USD, ARB/USD, ARB/USDC, ARB/EUR, ADA/GBP, ADA/USDC, ADA/USD, QNT/USDC, QNT/BTC, APE/USD, APE/USDC, APE/EUR, LTC/GBP, LTC/USD, LTC/USDC, LTC/BTC

We will be adjusting margin limits on high-volume pairs to enhance trading flexibility:

- Margin Limits Adjustments:

BTC/USDT, ETH/USDT, LTC/USDT, XRP/USDT, SOL/USDT, ADA/USDT, QNT/USDT,

UNI/USDT, AAVE/USDT, DOGE/USDT, LINK/USDT, AVAX/USDT, ATOM/USDT,

SUSHI/USDT, SNX/USDT, COMP/USDT

We’re committed to ensuring a smooth transition during these updates and will notify users at each stage to minimize any disruptions to your trading activities. For more details, stay tuned to our community channels and Help Desk!

Thank you for your continued support in making Coinmetro the best crypto trading platform! 🌍🚀

Join the Coinmetro community on Discord and Telegram, where forward-thinking traders and investors gather to share insights, explore new opportunities, and dive deep into cryptocurrencies. Should you need any help, please contact our world-class Customer Support Team via 24/7 live chat or email at hello@coinmetro.com.

To become a Coinmetro user today, Sign Up now or head to our new Exchange if you are already registered to experience our premium trading platform.

Tags

Related Articles

Coinmetro 2026 Roadmap: Focus, Simplicity & Real-World Impact

This post explains not only what we’re building in 2026 — but why. This year represents a deliberate strategic choice. The exchange market has…

3m

Coinmetro Officially Files for MiCA in Malta

This is a major milestone for Coinmetro. We’re proud to announce that Coinmetro has successfully filed its MiCA application in Malta, marking the…

2m

Zero Fees. Zero Waiting. Introducing Coinmetro Internal Transfers.

Moving value to friends and family just became instant, free, and borderless. Crypto was built to move at the speed of the internet. But too often,…

4m

Worldcoin (WLD) Now Listed on Coinmetro

We’re adding another asset to broaden user choice on Coinmetro: Worldcoin (WLD). This listing gives users who are interested in emerging…

2m