AMA Summary April 22nd, 2022

April 22, 2022

by Kamil S

April 22, 2022

Happy Friday, Coinmetroids! Here’s the summary from Kevin’s AMA on Friday, April 22nd.

Current bonding will end in July. There are plans to provide a centralized bridge for multiple things inside the Kadena ecosystem. This could potentially support a new form of bonding once the current bonding coming from treasury ends. Currently no updates yet though.

How long is trading history being saved on the backend?

We save the past five years as a bare minimum because this is necessary from a regulatory standpoint.

Yes, we have challenges in compliance, some have been rectified, others still need to be rectified and there still is a backlog. For a thorough explanation of how scammers try to trick us, make sure to watch the replay.

High inflation barrier for passive income exchange?

We don’t necessarily want to be a long-term passive income-only exchange. It is going to be massive for us and the industry as well. Inflation won’t last forever. With inflation at 18% and you put your money in the bank, you will not be able to cover inflation. Most people are not traders and we should not try to make everyone traders. The HODL mentality is what keeps stocks afloat and it is what is going to make crypto stay afloat. I don’t see how high inflation will negatively impact staking and hodling.

Lots focused on Kadena and its partnership.

We have been talking about it for a while and that is going to be a feature but not sure when yet.

Lots of things we want to include into the tokenomics and burning more margin fees could be one of them.

Will be back in Dubai in the second week of May and hopefully talk to the regulators there. In Miami, I talked to some investors and there is definitely a lot of optimism and a renewed focus on exchanges.

Yes, there are issues around and always have been. Alignment has been historically difficult, we are aligned more but still some friction. From a high level, the direction is clear but from the low level still some work that needs to be done. We have been building up leadership and are actively doing it.

Last questionnaire that needed to be answered

Those questions were required under AMLD-5. The new law in Estonia specifically requires having these questions answered as we need to risk classify our clients. It will help us to streamline compliance when we can better risk classify our clients. They are very simple questions. The goal is to better serve you as a client.

More lobbying to avoid overregulation of crypto?

Initially, nobody wanted to talk to regulators and now lots of people want to talk to regulators, which is good. Governments are mainly reactive. Once a problem arises they do something fast, not well thought out and it often doesn’t work. They go back to the drawing board and do it again.

Could compliance make growth impossible?

We need to protect our clients, abide by the law and at the same time have an active business. Finding that balance is a challenge and we are finding a better balance every day. I am more optimistic about our growth than in Year 1, 2 or 3. We have all the elements in place and I have seen quick growth at Coinmetro. When we do it, we want to make sure we do it right. As a company, we sometimes do the wrong things. But we do those wrong things always with the vision to do the right thing. I do believe this is a winning strategy. You can find examples of this being a winning strategy.

It is somewhere on the list, soon we will have the Fireblocks integration, which will help us with listings.

Thanks for all the questions! We’ll see you next week.

Loading video player...

Related Articles

Coinmetro 2026 Roadmap: Focus, Simplicity & Real-World Impact

This post explains not only what we’re building in 2026 — but why. This year represents a deliberate strategic choice. The exchange market has…

3m

Coinmetro Officially Files for MiCA in Malta

This is a major milestone for Coinmetro. We’re proud to announce that Coinmetro has successfully filed its MiCA application in Malta, marking the…

2m

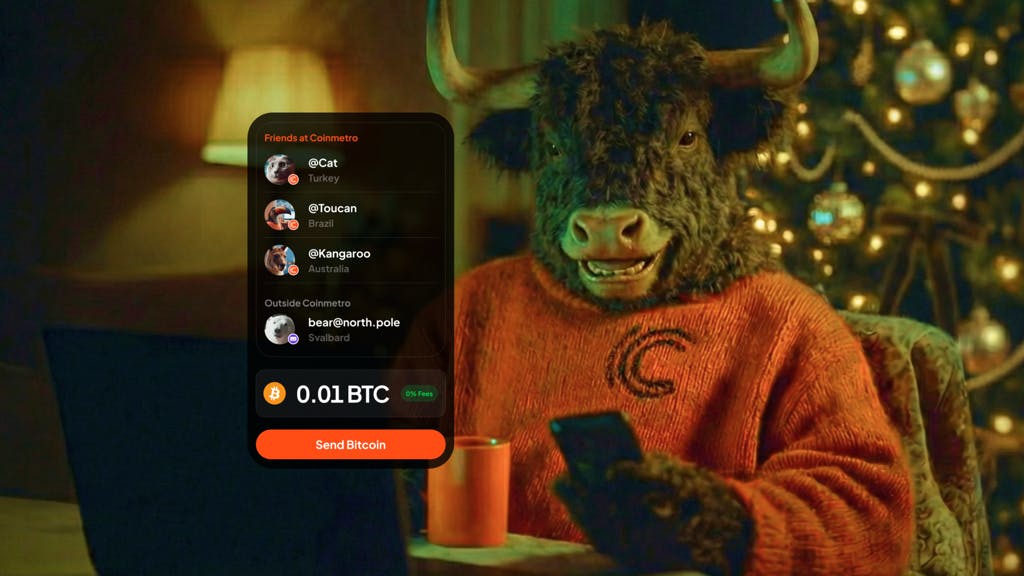

Zero Fees. Zero Waiting. Introducing Coinmetro Internal Transfers.

Moving value to friends and family just became instant, free, and borderless. Crypto was built to move at the speed of the internet. But too often,…

4m

Worldcoin (WLD) Now Listed on Coinmetro

We’re adding another asset to broaden user choice on Coinmetro: Worldcoin (WLD). This listing gives users who are interested in emerging…

2m