AMA Summary April 1st, 2022

April 1, 2022

by Kamil S

April 1, 2022

Here’s your summary of CEO Kevin Murcko’s weekly live AMA from Friday, April 1st 2022. Check out his “tease” of the platform update at the beginning!

Spoke at AIBC, talked to a few people and that’s it. Met with the committee currently shaping the regulations in Dubai. Binance and FTX already acquired a registration to an MVP (it’s a Sandbox) and I had a discussion with the VARA (Virtual Asset Regulatory Authority). Received an MOU from them and we will send feedback to be included in the registration as well.

Point is that we will be in the room with all the people who want to shape the regulatory framework in the UAE.

They have some good ideas and even nodded when I talked s%^t about Binance. I will be back in May and hopefully align with some other market participants.

We will be sharing and hearing plans from all the major players in the industry on how they will attack that specific region of the world.

One of the interesting things is that they will allow derivates on crypto assets, but not tokenized stocks.

Decentralized bridges are there to move between assets on other chains. We support Wrapped KDA on ETH and will support kETH and kBTC. The bridge will facilitate swapping between different assets, which generates fees and that supports bonding.

Those decentralized bridges have proven to be more difficult than they imagined (KDA team) so they are looking at other options. We will be offering centralized bridges services as we do on Wrapped KDA on ETH and for other assets as well.

We will be providing centralized bridging services, which means there will be some form of revenue. TokenSoft does the wrapping and we facilitate the process.

There needs to be a discussion between the 3 parties to see how we can support bonding.

How Can Assets Like THT Profit From a Rising Coinmetro Popularity?

We build a mutual relationship. Exchanges benefit from listings and listings benefit from exchanges.

EU’s New Transfer of Funds Regulation

Nothing in there outlaws the use of noncustodial wallets. The idea is simple and not a terrible one.

The world is moving quickly to try to mitigate the move of funds leaving Russia and repatriated due to the current war in Ukraine.

Just because this passed the first vote doesn’t mean it’s is going to happen. Just like with the POW ban, I expect something similar here.

But even in the worst case, not one centralized exchange can comply with the interpretation that most people are giving to this new law.

So if no one technically can comply, then no one is going to comply.

Merchant services are still on the list and we call this client segment “gateway users.” It is still on the list as we go deeper down the challenger bank rabbit hole. Third-party transfers will become a “thang” then.

Which Region is Delivering the Most Customers at Coinmetro?

The US was growing fastest at the end of last year. In terms of growth, it is still going to be the US as the fastest growing market for us.

Coinmetro as a Top 3 Exchange?

We need growth. We build and continue building amazing products, an amazing community and an amazing group of people at Coinmetro. We know what clients cost us and how much money we make from clients. We are ready to go full blast and the growth engines will turn on soon.

And then it is just timing. How long it takes to get this number of clients, this amount of revenue, etc. The question is not if but when.

Thanks for joining. We’ll see you next week!

Loading video player...

Related Articles

Coinmetro 2026 Roadmap: Focus, Simplicity & Real-World Impact

This post explains not only what we’re building in 2026 — but why. This year represents a deliberate strategic choice. The exchange market has…

3m

Coinmetro Officially Files for MiCA in Malta

This is a major milestone for Coinmetro. We’re proud to announce that Coinmetro has successfully filed its MiCA application in Malta, marking the…

2m

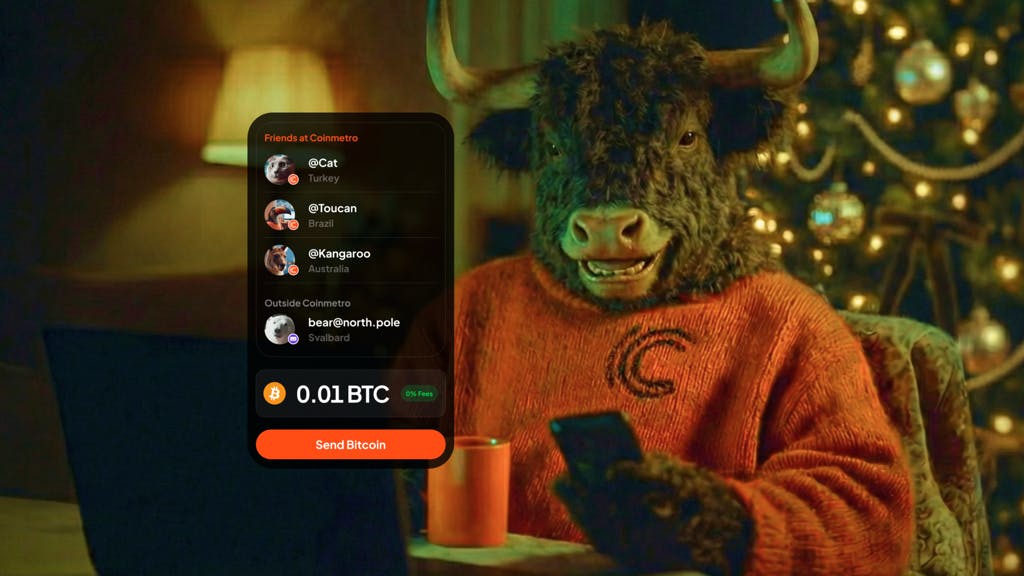

Zero Fees. Zero Waiting. Introducing Coinmetro Internal Transfers.

Moving value to friends and family just became instant, free, and borderless. Crypto was built to move at the speed of the internet. But too often,…

4m

Worldcoin (WLD) Now Listed on Coinmetro

We’re adding another asset to broaden user choice on Coinmetro: Worldcoin (WLD). This listing gives users who are interested in emerging…

2m