Tokenized Real Estate: Fractional Ownership through Blockchain

December 5, 2025

by Coinmetro Editorial Team

December 5, 2025

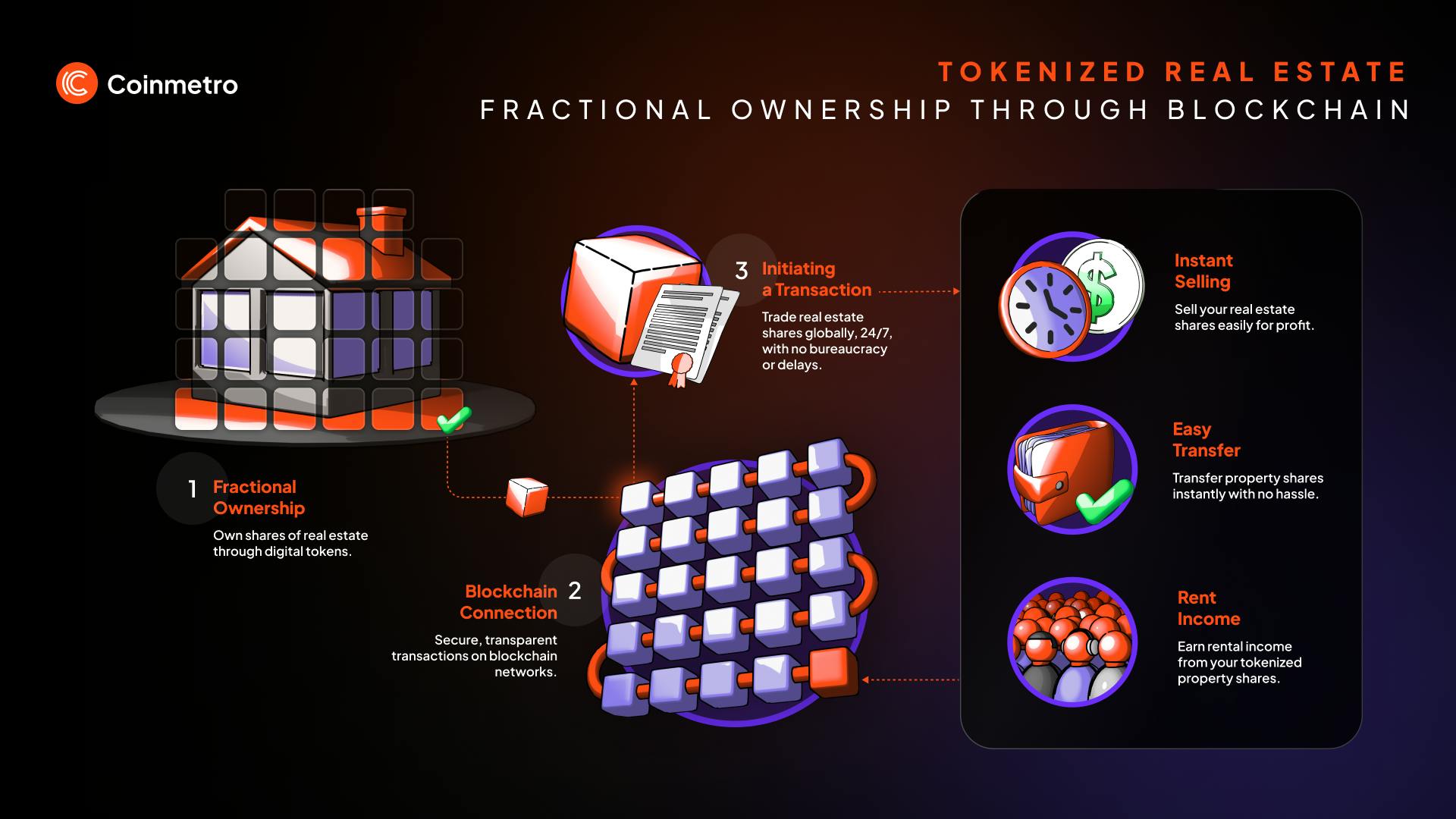

Blockchain technology is reshaping how we invest in property. It tokenizes real estate on blockchain networks, splitting assets into shares. This lets many investors buy parts of costly properties, opening access to more people.

Tokenization boosts transparency, security, and speed in real estate deals. It fixes old problems like stiff bureaucracy and slow transactions. Blockchain keeps ownership data safe and clear, making trades faster for everyone.

This process shows huge potential to change property markets. Real estate is tokenized on blockchain and traded easily. This technology cuts barriers, improves liquidity, and includes more investors.

This blog will outline:

- Understanding tokenization

- The mechanics of fractional ownership

- Benefits of tokenized real estate

- Real-world examples and case studies

- Challenges and risks

- Future outlook

Learn About the Future of Programmable Money: Smart Contracts in Finance

Tokenization converts physical assets into digital tokens that exist on a blockchain. In real estate, a property can benefit from an undisputed proof of ownership and be divided into many digital shares, allowing multiple investors to own a portion.

To tokenize a real estate asset, the property is first valued. Then, a digital token is created to represent a fraction of the property's value. For instance, if a property is worth $1 million and divided into 1,000 tokens, each token would represent $1,000 of the property's value. These tokens can be bought, sold, or traded on a blockchain platform. However, a tokenized real estate property such as an apartment or commercial space does not necessarily need to be divided into smaller fractions, as some owners may rather prefer to own 100% of a given asset.

Blockchain technology ensures that these transactions are secure and transparent. Every transaction is recorded on the blockchain, providing a clear, immutable record of ownership. Smart contracts automate the process, ensuring that terms and conditions are met without intermediaries. This reduces costs and speeds up transactions.

Traditional real estate often ties ownership to one person or a small group. Fractional ownership splits the property among many investors with tokenized shares on blockchain. This setup lets people buy small parts of pricey real estate.

Blockchain creates tokens that stand for shares in the property. Each token matches a piece of the asset’s worth. Investors trade these tokens on blockchain platforms with speed and ease.

Smart contracts run fractional ownership by setting rules that work on their own. They send rental income to token holders based on shares. This skips middlemen, cuts fees, and speeds up payments.

Smart contracts also lock in token trades, keeping records clear and safe. Every transaction is permanently recorded on the blockchain, ensuring transparency and immutability. Blockchain and smart contracts make real estate investment fast and simple.

Discover A New Era of Crypto Financing: Security Token Offerings (STOs)

Imagine owning shares in top real estate from London to Manhattan. You could sell those shares fast in a liquid market and take profits. Compare that to selling one property in your native country - a slow and complex task. Tokenized real estate brings key benefits over traditional property investment. It offers better access, liquidity, lower entry costs, clear records, and strong returns. These advantages tackle old limits in the real estate market.

Increased Accessibility & Liquidity: Tokenized real estate opens high-value properties to more investors. It splits assets into digital tokens traded on blockchain platforms. This setup boosts liquidity, making sales quick and global.

Lower Entry Barriers for Investors: Real estate investment once demanded big money, keeping many people out. Tokenization lets people buy small shares with less cash. More investors can now join this asset class easily.

Enhanced Transparency & Security: Blockchain tracks every deal on a public ledger, ensuring clear ownership. This cuts fraud risk and keeps records safe and accurate. Smart contracts automate terms, securing trades with precision.

Potential for Higher Returns & Diversification: Tokenized real estate spreads investments across many properties for better returns. Investors avoid tying all funds to one asset, reducing risk. Diversification softens market swings, potentially increasing overall gains.

Read More: The Future Of Real Estate with Blockchain Tokenization

Tokenized real estate is making significant strides, with several projects demonstrating its potential. Two notable examples are Propbase (PROPS) and Blocksquare (BST).

Propbase (PROPS) taps blockchain to ease real estate investment. It splits properties into tokens, letting users buy shares in big assets. For instance, a Berlin luxury apartment let investors start with as low as $500, cutting entry costs. Propbase CEO Maria Novak says the goal is broader access to premium properties. The platform aims to democratize real estate investment effectively. Low costs open doors for more investors.

Blocksquare (BST) offers a similar approach, focusing on fractional real estate ownership. A prominent case was the tokenization of a commercial property in New York. Investors could acquire tokens representing a share in the property, providing them with returns proportional to their investment. This approach not only increased liquidity but also streamlined the investment process. Blocksquare's founder, Alex Carter, noted, "Tokenization is transforming real estate by providing liquidity and transparency that traditional methods lack."

Buy & Sell Propbase (PROPS) - The Real Estate Tokenization Platform

Tokenized real estate presents several challenges and risks that investors and developers must consider:

Regulatory Hurdles & Legal Considerations: Rules for digital tokens and real estate vary across countries. Many nations still shape laws for blockchain-based assets, causing uncertainty. Investors must follow local regulations to stay clear of legal trouble.

Technology Adoption & Integration Issues: Blending blockchain with real estate systems takes strong technical skills. Not all property experts know blockchain, slowing its use. The tech must stay reliable to keep operations smooth.

Market Volatility & Investor Education: Market swings can shift tokenized real estate values, like traditional property. Investors need to understand these changes and deal with volatility. A good education helps them decide wisely and cut risks.

Potential Risks of Fraud and Cybersecurity Threats: Tokenized assets are susceptible to cyberattacks and fraudulent schemes. Strong blockchain security is key to protecting investments and trust.

Buy & Sell Blocksquare (BST) - The Fractional Property Investment Platform

Tokenized real estate innovates property investment using blockchain technology. It turns physical properties into digital shares, providing access for more investors. This change breaks down barriers in traditional real estate.

The shift boosts access, liquidity, and efficiency in operations. Investors buy and sell property fractions, cutting costs and increasing market flow. Blockchain secures transactions, curbing fraud and building trust.

Despite its advantages, tokenized real estate faces challenges, including varying regulatory environments, technology integration issues, and potential market volatility. Solving these is key to a wider global adoption. Looking forward, tokenized real estate could transform global markets with a fresh, open way to own property. As tech and regulation evolve, the impact on traditional real estate investment could be profound.

▶️ Watch: How Tokenization Can Disrupt The $52 Trillion U.S. Real Estate Market

Join the Coinmetro community on Discord and Telegram, where forward-thinking traders and investors gather to share insights, explore new opportunities, and dive deep into cryptocurrencies. Should you need any help, please contact our world-class Customer Support Team via 24/7 live chat or email at hello@coinmetro.com.

To become a Coinmetro user today, Sign Up now or head to our new Exchange if you are already registered to experience our premium trading platform.

Tags

Related Articles

Regulatory Sandboxes: Fostering Crypto Innovation Within Legal Frameworks

The cryptocurrency industry’s fast rise fuels an important debate. Innovation aims to transform finance, enhancing speed and access. Yet, regulators…

5m

Crypto Options Trading: Strategies and Market Insights

Cryptocurrency markets have rapidly expanded beyond simple buying and selling. One of the most significant developments has been the rise of…

6m

The Rise of Social-Fi: Blending Social Media with Decentralized Finance

In recent years, social media and finance have started to merge, creating Social-Fi. This concept blends the engagement of social platforms with…

6m

DeFi Insurance Platforms to Watch in 2024

Decentralized Finance (DeFi) insurance addresses the growing need for insurance against hacks, smart contract failures, and other DeFi-related risks.…

7m