Guide to Margin Trading on the New Coinmetro Platform

December 5, 2025

by Kamil S

December 5, 2025

When going through a crypto winter, you will need new and ingenious ways to profit from the markets. Beginners and pro traders alike are choosing margin trading to enhance their buying power and get an edge during bear markets.

By trading with leverage, you can supercharge your portfolio when you know what you’re doing. Margin trading requires calm and discipline, as well as a thought-out investment strategy. Do you have one already?

On the new Coinmetro Margin Exchange, you will find a premium margin trading platform that is performant, safe and user-friendly. We have designed the new exchange to help you learn and develop your trading skills. One trait of sharp investors is they don’t need tokens going to the moon every day. Why? Because they have learned to profit regardless of market sentiment. Are you such a trader yourself?

Read on to understand why margin trading can be such a powerful tool, even in the hands of a new investor.

At its core, margin trading is a simple concept. It involves using borrowed funds to trade financial assets. You can do this both with stocks and with cryptocurrencies.

One of the key concepts with margin trading is the fact that you're using leverage. This means you're utilizing your own assets as collateral with a lender, allowing you to leverage yourself into a position where you can make larger trades with borrowed funding. This process, known as margin trading, can significantly increase your purchasing power.

This can lead to amplified profits when things go well. In the event of a loss, traders can terminate a position quickly, to avoid losing borrowed funding. In essence, margin trading can be regarded as a high-risk, high-reward investment activity.

In a traditional exchange transaction, you sell one asset for its current market value and then purchase another. For instance, you might trade Bitcoin for XCM, instantly liquidating a portion of a BTC into its equivalent value in XCM.

Margin trading is very similar in the sense that you trade one asset for another. However, what changes are the timing, the risk-reward ratio, and the fees associated with the trade.

Rather than an instant exchange, a margin trade automatically borrows the funds from an exchange like our new Margin Trading Platform. From there, the trade remains “open,” floating between the two currencies with an open-ended profit and loss calculation updating in real time as prices change. This continues until the trade closes, and the final profit or loss is decided based on the price evolution of the asset you’re purchasing.

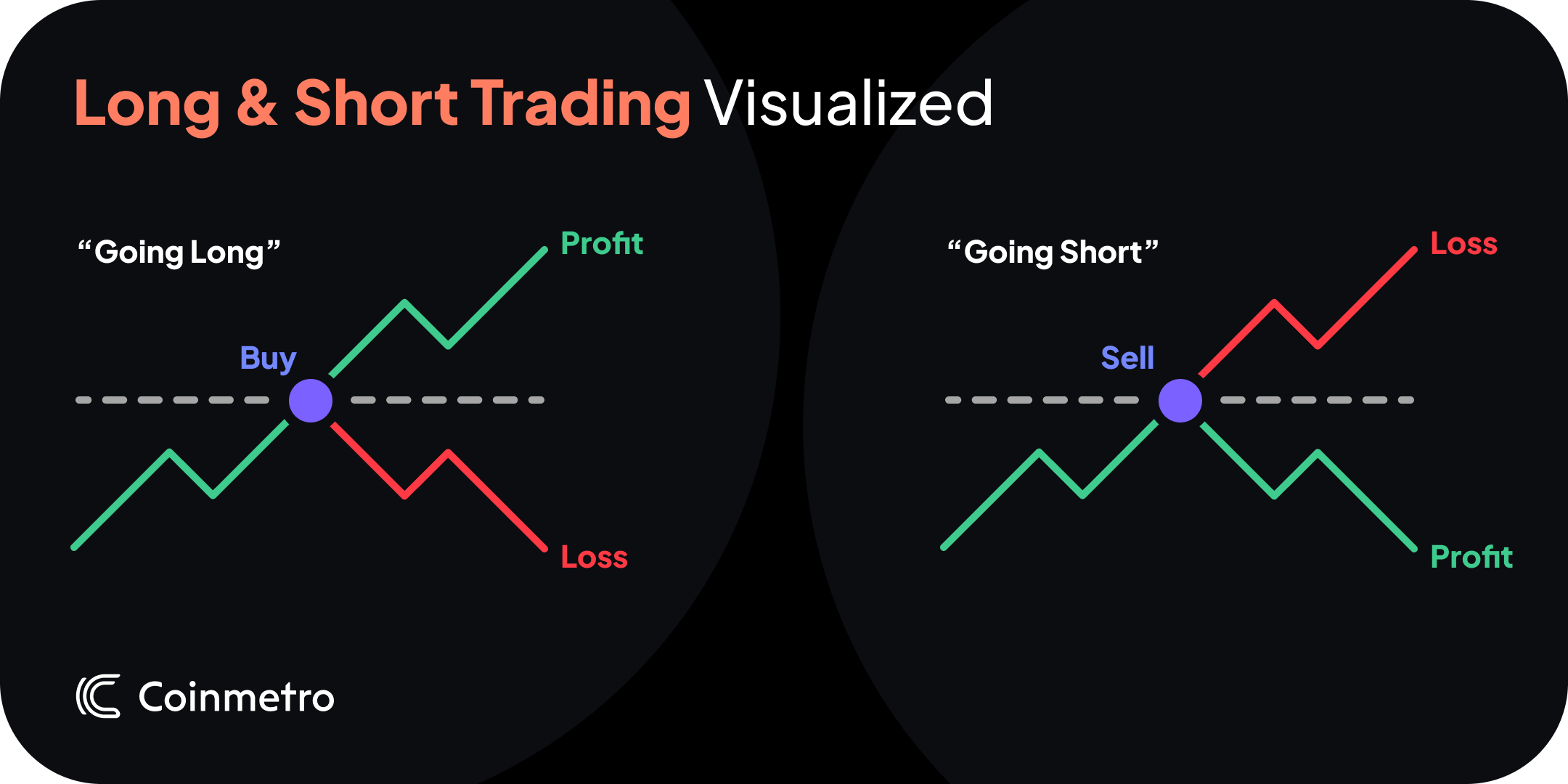

One good thing about margin trading is that you can benefit regardless of market volatility. In margin trading, you can open a long or short position. A long position involves a trade in which you assume the price of a particular crypto will increase over time. A short position means you want to borrow an asset to immediately sell with the intention of buying it later if the price goes down, to repay the initial loan and keep the profits.

When you initiate a margin trade, it comes with a “margin fee.” This additional fee is generated throughout the time that the trade is open as interest on the borrowed assets. While this is a cost consideration, crypto margin trades are relatively light on fees and regulations. In comparison, stock margin trading often requires special circumstances like minimum margin and initial margin requirements just to start.

On the new Coinmetro Margin Exchange, you can use our native token XCM on Margin as collateral. This allows you to use our Margin product even when just holding XCM.

As long as your profit is higher than the minimal fees involved in crypto margin trading, you’re doing well. With a cryptocurrency platform like Coinmetro, you’ll get some of the lowest transactional costs and the fees are rarely a concern. Instead, you can stay in the zone and focus on what’s important - market behavior and asset price evolution, so you can act with confidence and lock in profits.

Most unbiased financial professionals will admit that there are both pros and cons to trading on margin. Let’s consider both for a minute. Starting with the pros, here are a few of the major benefits that come with margin trading:

- You can use borrowed funds to expand your trading potential: This doesn’t just mean you can maximize your trading capabilities. You can also work with fewer of your assets actively housed on a trading platform at any given moment.

- You can short-sell assets that aren’t yours: The ability to borrow assets and short-sell them can lead to quick, impressive gains — when you have a strategy that allows you to time the market correctly.

- You can access a higher degree of trading flexibility: If you’re trading to make a profit (and who isn’t?), margin trading gives you access to more investment capital. This means you create the potential to make a lot more money in a shorter amount of time.

- You can use margin trading to hedge long-term positions: If you have a lot of a specific coin, you can open a leveraged short-term position against that same crypto to offset any sudden losses.

- You can use margin trading as an easy, hassle-free financing option: Margin trading can help you meet your investment-related financial needs without additional paperwork or fees.

Along with these positive considerations, there are some important things that everyone should be aware of when margin trading:

- You cannot withdraw assets bought in a margin trade until you’ve closed the trade and have established profits: This means your traded assets remain in the marketplace and cannot be withdrawn to an external wallet until you complete a trade.

- Crypto market volatility coupled with higher leverage makes margin trading riskier. You take on more risk trading borrowed funds and you should have a strategy that times the market well.

- You can automatically lose money due to a stop-out if an open leveraged trade loses too many funds: It’s important to know that at Coinmetro, we use a margin call at 0% and a stop loss at -70%. This way we are trying to protect our users and make them aware before their position slips into too big of an exposure.

Do you want to get more knowledgeable and learn more about margin trading? Dive into our Learning Lab:

So you started learning more and now you’re asking yourself: Is margin trading for me? The truth is that margin trading has both benefits and risks. By now, you probably know how to deal with risk. You can’t eliminate risk completely. Risk is being dealt with by efficiently mitigating it.

New investors should approach margin trading as an opportunity to learn — particularly when markets are down and volatility is still a daily concern. If you’re looking for ways to benefit from the current crypto winter, margin trading can be the perfect opportunity. The important thing is for you to acclimate to this higher-paced, higher-profit approach carefully. Here are a few tips to get started:

- As with all investing, never use money or crypto you can’t afford to lose: Use small portions of your assets to learn more about margin trading with minimal risk.

- Don’t max out your margin trading capabilities: Work within what you have without feeling the need to put every penny into an open trade at all times.

- Always use moderation with margin trading: It doesn’t matter if you’re finding success or taking a hit. Don’t let emotions dictate your decisions; keep margin trading in the mix as part of a larger investment strategy.

Finally, ensure you find a good cryptocurrency platform to help walk you through the margin trading basics. The newly reimagined Coinmetro Margin Trading Platform is now the only margin exchange you will ever need.

This new tool is one of our most significant products of 2022. It provides up to 5x leverage with high margin limits — potentially up to $250,000. The feature-rich platform will allow you to easily view, manage, and open positions, taking advantage of advanced API access in the process.

In true Coinmetro fashion, the Margin exchange will also have low daily fees. On borrowed margin, fees are calculated hourly and charged only once daily at 0.08%. It doesn’t get much simpler and more affordable.

So, if you’re looking for a way to maximize your cryptocurrency profits, even in a sluggish investing season, consider margin trading on our new platform. Allocate a portion of your assets and experience the opportunity to learn about this fascinating, superpowered method of trading.

In the end, let us ask you this: Do you have a plan for the current bear market? The next bull run will inevitably come at one point. When exactly, nobody knows for sure. But until then, this bear market is no time to sleep for investors who want to become better.

If you already paid a visit to our Learning Lab and you are starting to get familiar with margin trading, we suggest you open a demo account to get a better feel of the markets. A demo account is a great way to start your margin journey and learn more without the risk of losing money.

When you feel confident, Sign-Up now, or head to our new Margin Exchange if you are already registered and experience our premium trading platform. Investment and trading are different when you are part of a growing and supportive community. Join our Discord and Telegram groups to chat, have fun, and learn something new every day. What will we learn from you in the next year? Stay close to Coinmetro - the most trusted crypto exchange on Trustpilot.

Tags

Related Articles

Regulatory Sandboxes: Fostering Crypto Innovation Within Legal Frameworks

The cryptocurrency industry’s fast rise fuels an important debate. Innovation aims to transform finance, enhancing speed and access. Yet, regulators…

5m

Crypto Options Trading: Strategies and Market Insights

Cryptocurrency markets have rapidly expanded beyond simple buying and selling. One of the most significant developments has been the rise of…

6m

The Rise of Social-Fi: Blending Social Media with Decentralized Finance

In recent years, social media and finance have started to merge, creating Social-Fi. This concept blends the engagement of social platforms with…

6m

DeFi Insurance Platforms to Watch in 2024

Decentralized Finance (DeFi) insurance addresses the growing need for insurance against hacks, smart contract failures, and other DeFi-related risks.…

7m