Yield Farming 2.0: New Strategies in DeFi Liquidity Provision

March 3, 2025

by Coinmetro Editorial Team

March 3, 2025

Yield farming, also known as liquidity mining, has played a significant role in the rise of decentralized finance (DeFi). In Yield farming, users add assets to DeFi protocols and get token rewards. They supply liquidity pools used for lending, trading, or borrowing. Participants earn platform fees or native tokens in return. Risks include impermanent loss and costly gas fees. These factors can potentially lower returns for liquidity providers.

With the emergence of Yield Farming 2.0, new strategies have been introduced to address some of the limitations seen in early models. This new generation of yield farming focuses on efficiency, sustainability, and smarter risk control. Smart contracts now offer protocol-owned liquidity and auto-compounding benefits.

As DeFi continues to evolve, Yield Farming 2.0 potentially offers more sustainable and efficient ways to provide liquidity. These new strategies reshape how investors approach DeFi and strengthen the ecosystem by reducing risks and enhancing returns. Understanding the shift from traditional yield farming to Yield Farming 2.0 is important for anyone looking to profit from opportunities in the DeFi space.

In this article, you will learn about:

- What is yield farming 2.0?

- The benefits of yield farming 2.0

- Popular yield farming 2.0 platforms

- New strategies in yield farming 2.0

Learn More About Passive Income in Crypto: Staking, Lending, and Yield Farming

Yield Farming 2.0 marks the next phase of DeFi liquidity strategies. It enhances the basic yield farming model with key improvements to fix common problems. The new approach tackles high gas fees, impermanent loss, and unstable returns that plagued earlier models.

Protocol-owned Liquidity: A major shift in Yield Farming 2.0 is the move toward protocol-owned liquidity. This gives platforms more control over their liquidity pools. It reduces reliance on external providers and creates more stable conditions. The result is less volatility than traditional yield farming methods.

Auto-compounding Vaults: Yield Farming 2.0 leverages auto-compounding vaults for better returns. These vaults reinvest rewards back into the pool without user action. Users gain from compound growth over time. This feature greatly improves yield efficiency compared to manual methods.

Smart Contract Enhancements: Better smart contracts are central to Yield Farming 2.0 security. More protocols now use audited, optimized contracts to protect users. These improved contracts make liquidity provision safer with less risk of attacks. They also help manage and balance liquidity to reduce impermanent loss.

Yield Farming 2.0 upgrades the traditional approach with advanced tools. Protocol-owned liquidity and auto-compounding make the system more efficient. These innovations increase profits while lowering risks. This evolution represents a significant step forward in DeFi technology.

Yield Farming 2.0 offers key upgrades over older models. It boosts efficiency, cuts costs, and manages risks better. These changes help users earn more while facing fewer problems than before.

Yield Farming 2.0 tackles impermanent loss more effectively. This common problem occurs when token prices shift in liquidity pools. The new system uses advanced methods to balance pools and adjust rewards. Users can now provide liquidity with less risk during market swings.

The new platforms include built-in auto-compounding features. These systems reinvest rewards without user action. This saves time and boosts returns through constant reinvestment. Users gain more yield without doing extra work.

High gas fees were a major issue in early yield farming. Yield Farming 2.0 solves this through layer-2 solutions like Arbitrum and Polygon. These systems process trades off the main Ethereum chain. This cuts costs while keeping the benefits of liquidity mining.

With cheaper fees, smaller investors can now join yield farming. They no longer face high costs that eat into profits. More users can access DeFi without major barriers to entry.

Risk control has greatly improved in Yield Farming 2.0. Many platforms now offer better tools to manage market swings. Some use protocol-owned liquidity, where the platform holds part of the pool. This creates more stable conditions and reduces dependence on outside providers.

Discover a Comprehensive Guide to Ethereum 2.0 Staking Rewards

As DeFi evolves, Yield Farming 2.0 has introduced more efficient and safer strategies for liquidity providers. Below are some of the top platforms embracing this evolution, each offering unique features that distinguish them from traditional models:

Overview: Aave is one of the most popular decentralized lending platforms, allowing users to lend and borrow a wide range of cryptocurrencies. Yield farmers can earn interest on deposits while the protocol manages risk using over-collateralization.

Unique Offerings:

- Aave pioneered flash loans, allowing users to borrow without collateral as long as the loan is repaid within the same transaction.

- It integrates layer-2 solutions like Polygon to reduce gas fees.

- It offers stable rate borrowing, reducing volatility for long-term borrowers.

Reward Structure:

- Users earn interest from lending and can also receive AAVE tokens as rewards through liquidity mining.

- Aave pushes Yield Farming 2.0 forward by integrating cross-chain capabilities and providing more flexible lending models.

Overview: Yearn.finance is a yield optimization protocol that automates the movement of user funds across various DeFi platforms to maximize yield. It specializes in "vaults," where funds are deployed automatically into the highest-yielding strategies.

Unique Offerings:

- Auto-compounding vaults that continuously reinvest earnings to optimize returns.

- Access to a wide range of DeFi protocols, making it easy for users to farm yields across different platforms without manually managing their assets.

Reward Structure:

- Users deposit tokens into vaults, and the system automatically optimizes yields. YFI token holders also have governance rights over the platform.

- Yearn.finance epitomizes Yield Farming 2.0 by simplifying complex strategies through automation and smart contracts.

Overview: As one of the largest decentralized exchanges (DEX), Uniswap allows users to provide liquidity and earn a share of the trading fees. Uniswap V3 introduced concentrated liquidity, allowing liquidity providers (LPs) to specify price ranges for their contributions, improving capital efficiency.

Unique Offerings:

- Concentrated liquidity: LPs can allocate their liquidity to specific price ranges, maximizing capital efficiency and earning higher rewards.

- Uniswap operates on multiple chains, including Ethereum and layer-2 solutions like Arbitrum and Optimism, reducing gas fees for users.

Reward Structure:

- Liquidity providers earn a portion of the trading fees based on their capital contribution and how close their liquidity is to the market price.

- Uniswap’s concentrated liquidity model has transformed yield farming by improving efficiency and maximizing returns for LPs.

Overview: Vesper offers a simplified, automated DeFi platform where users can deposit assets into pools and earn yield through automated strategies. Vesper is focused on long-term, sustainable growth.

Unique Offerings:

- Automated yield strategies: Users can earn yield without needing to constantly manage their positions.

- Focus on sustainability and long-term strategies instead of short-term high-risk returns.

Reward Structure:

- Vesper rewards users in its native VSP token, which can be used for governance or reinvested into the protocol.

- Vesper pushes Yield Farming 2.0 by focusing on sustainable, hands-off yield farming strategies.

Overview: Curve is a decentralized exchange for stablecoins, offering low-slippage trading between similar assets. It’s one of the most popular platforms for yield farming with stablecoins, minimizing impermanent loss.

Unique Offerings:

- Stablecoin-focused liquidity pools, reducing impermanent loss risks.

- Users can lock CRV tokens to receive veCRV, which boosts rewards and grants governance power.

- Cross-chain support through integrations with other DeFi platforms, further optimizing liquidity.

Reward Structure:

- Curve provides rewards in the form of CRV tokens, with higher rewards for those who lock their CRV for longer periods (boosting their yields).

- Curve is a leader in Yield Farming 2.0 by focusing on stability and integrating boosted reward structures through governance participation.

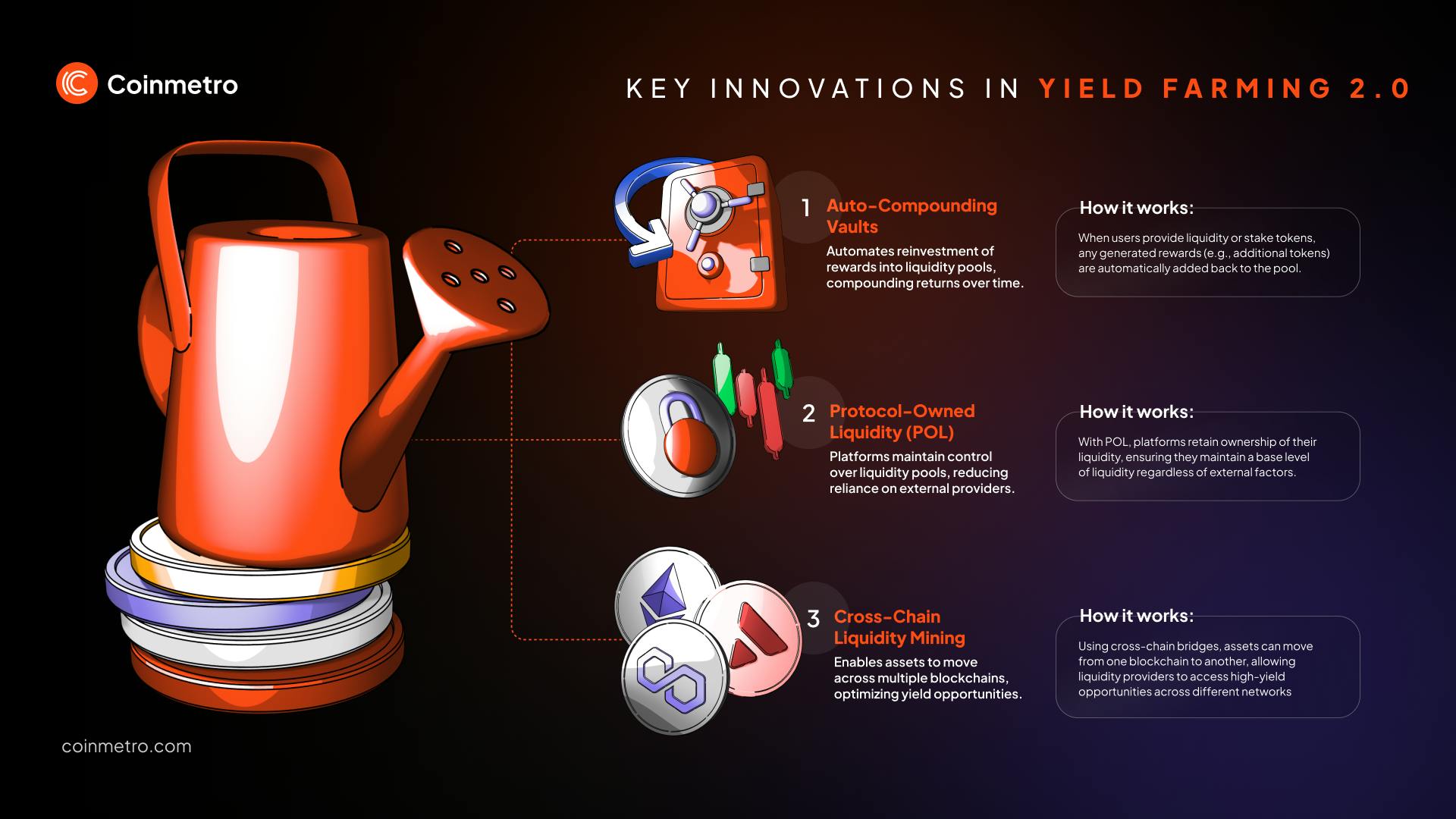

Yield Farming 2.0 has introduced advanced strategies to maximize returns, reduce risks, and enhance flexibility. Let’s explore three key strategies that define this evolution:

Explanation: Auto-compounding vaults put earned rewards back into your pool without manual steps. This method helps users earn more by constant reinvestment to grow their yield.

How it works: When you provide liquidity or stake tokens, the system adds new rewards back to your pool. This removes the need to claim rewards by hand. Users miss fewer chances to earn and can gain more over time.

Explanation: Protocol-owned liquidity means the platform owns part of its liquidity pools. This reduces reliance on outside providers. The system gains more control and stability for its asset pools.

How it works: In older yield farming, users could add or remove funds at any time. This often caused unstable conditions. With protocol-owned liquidity, platforms keep their own liquidity base. This ensures stable pools despite market changes.

Benefits: Protocol-owned liquidity creates better long-term stability. It reduces the impact of market swings on liquidity pools. The system's goals align with those of liquidity providers. This leads to a more stable system for all users.

Explanation: Cross-chain liquidity mining lets users provide liquidity across multiple blockchains. This opens more paths to earn yield. The method uses bridges to connect different chains for better asset flow.

How it works: Assets move between blockchains through cross-chain bridges. This helps providers access high-yield opportunities across different networks. Users can utilize chains like Avalanche or Polygon. These often offer lower fees than Ethereum.

Benefits: Operating across different blockchains gives users greater flexibility and higher yields. Transaction fees remain lower while returns improve. Diversifying across multiple ecosystems also helps mitigate overall risk.

Yield Farming 2.0 brings major changes to DeFi systems. It offers more efficient, profitable, and sustainable strategies for liquidity provision. These new systems make the DeFi world more stable. The new features help address earlier challenges. Auto-compounding vaults work to grow funds with no manual steps. Protocol-owned liquidity keeps pools more stable over time. Cross-chain liquidity mining lets users work across many networks.

These tools address key issues in DeFi. They reduce the impact of impermanent loss on users. They also reduce high fees, making it easier for small traders to profit. Yield farming now serves as a strong source of passive income. More people and big firms see its value each day. The system potentially gives steady returns without constant work.

DeFi platforms have become easier to use than before. Their tools work better and offer more options. This makes now a great time to look at yield farming. The new systems let users earn more while facing less risk. By embracing these new strategies, participants benefit financially and contribute to the long-term stability and growth of the DeFi ecosystem.

Watch: Crypto Yield Farming Tutorial (Strategies Explained)

Join the Coinmetro community on Discord and Telegram, where forward-thinking traders and investors gather to share insights, explore new opportunities, and dive deep into cryptocurrencies. Should you need any help, please contact our world-class Customer Support Team via 24/7 live chat or email at hello@coinmetro.com.

To become a Coinmetro user today, Sign Up now or head to our new Exchange if you are already registered to experience our premium trading platform.

Tags

Related Articles

Introduction to Cosmos (ATOM): The Internet of Blockchains

Cosmos is a decentralized network designed to connect multiple independent blockchains. Often referred to as the "Internet of Blockchains," Cosmos…

6m

NFT Ticketing: Revolutionizing Event Management and Fan Experiences

Did you know that approximately 12% of event tickets globally are counterfeit? This leads to millions in lost revenue and disappointed fans every…

6m

AI-Powered Crypto Trading: The Rise of Advanced Algorithmic Strategies

Artificial intelligence has the potential to transform crypto trading with better market analysis and fast decisions. Smart tools like machine…

7m

Passive Income in Crypto: A Guide to Staking, Lending, and Yield Farming

Passive income in the crypto world means earning money with minimal active involvement. In other words, let your money work for you. Unlike…

7m