Crypto Market Data Providers: Ensuring Transparency and Accuracy

December 5, 2025

by Coinmetro Editorial Team

December 5, 2025

Accurate and transparent data drives cryptocurrency markets. Prices shift fast, and information often scatters across sources. Unlike traditional finance, crypto data comes from various sources, challenging reliability. Leading providers like Chainlink and CoinMarketCap deliver precise data. Investors, traders, and institutions rely on them daily for critical decisions.

This blog will explore how crypto market data providers maintain high standards of accuracy, covering different types of data. This includes price feeds, trading volumes, and market depth. You will also understand how this transparency influences the market's stability and growth.

In this blog, you will learn about:

- Why transparent and accurate data is essential in crypto

- Key players in the crypto market data space

- Common practices

- The role of APIs in crypto market data distribution

- Importance of independent audits and transparency reports

- Challenges faced by market data providers

Discover Crypto Market Sentiment Indicators: Beyond the Fear and Greed Index

Transparent and accurate data guides trading and investment in crypto markets. Traders rely on real-time, reliable data to assess prices, liquidity, and market conditions. Without it, they risk poor choices, increased volatility, and financial losses.

Transparent data also fosters trust and is crucial for regulatory compliance. Regulators and institutions use clear data to detect fraud and ensure fair practices. Accurate data ties directly to crypto market stability and investor confidence.

CoinMarketCap is a popular crypto data aggregator for millions of users. It tracks real-time prices, rankings, and market capitalization for many cryptocurrencies. Investors use its tools to check trading volumes and liquidity.

CoinMarketCap updates often and provides clear, reliable data. Both retail and big investors trust it for decisions. Its easy design and broad coverage make it a favorite.

CoinGecko gives more than just price updates for crypto fans. It tracks community engagement and developer activity for DeFi projects. Users can track ecosystem health, not only price data.

CoinGecko adds NFT token metrics, boosting its popularity. Its clear data and frequent updates draw in investors. People pick it for detailed crypto insights.

Glassnode offers advanced on-chain metrics for traders and analysts. It follows wallet balances and transaction volumes for Bitcoin and Ethereum. Investors watch whale movements to guess market trends. Its data-driven insights help with more informed decision-making in crypto trading, making Glassnode a crucial player.

Chainlink is a decentralized network connecting smart contracts to outside data. It brings accurate off-chain data to DeFi and smart contracts. Developers integrate trusted external data sources into their smart contracts, improving the utility of decentralized applications (dApps). Chainlink is known to keep data secure and tamper-proof. This sets it apart from traditional providers. Today, Chainlink is key for DeFi growth and reliability.

Band Protocol is a decentralized oracle that securely and efficiently provides real-world data to blockchains at scale. It differs from Chainlink by using a delegated proof-of-stake (dPoS) system to ensure scalability and lower transaction costs, which is crucial for applications requiring high-frequency data feeds. Band is widely used in DeFi platforms that require fast and accurate data without the high gas fees associated with other protocols. Its low-cost, efficient infrastructure makes it appealing for projects that need real-time data to drive decentralized applications.

These platforms are vital in providing accurate, reliable, and transparent data that helps ensure the integrity of the crypto market. By leveraging data from these providers, traders, developers, and investors can make better-informed decisions, thus contributing to overall market stability and trust.

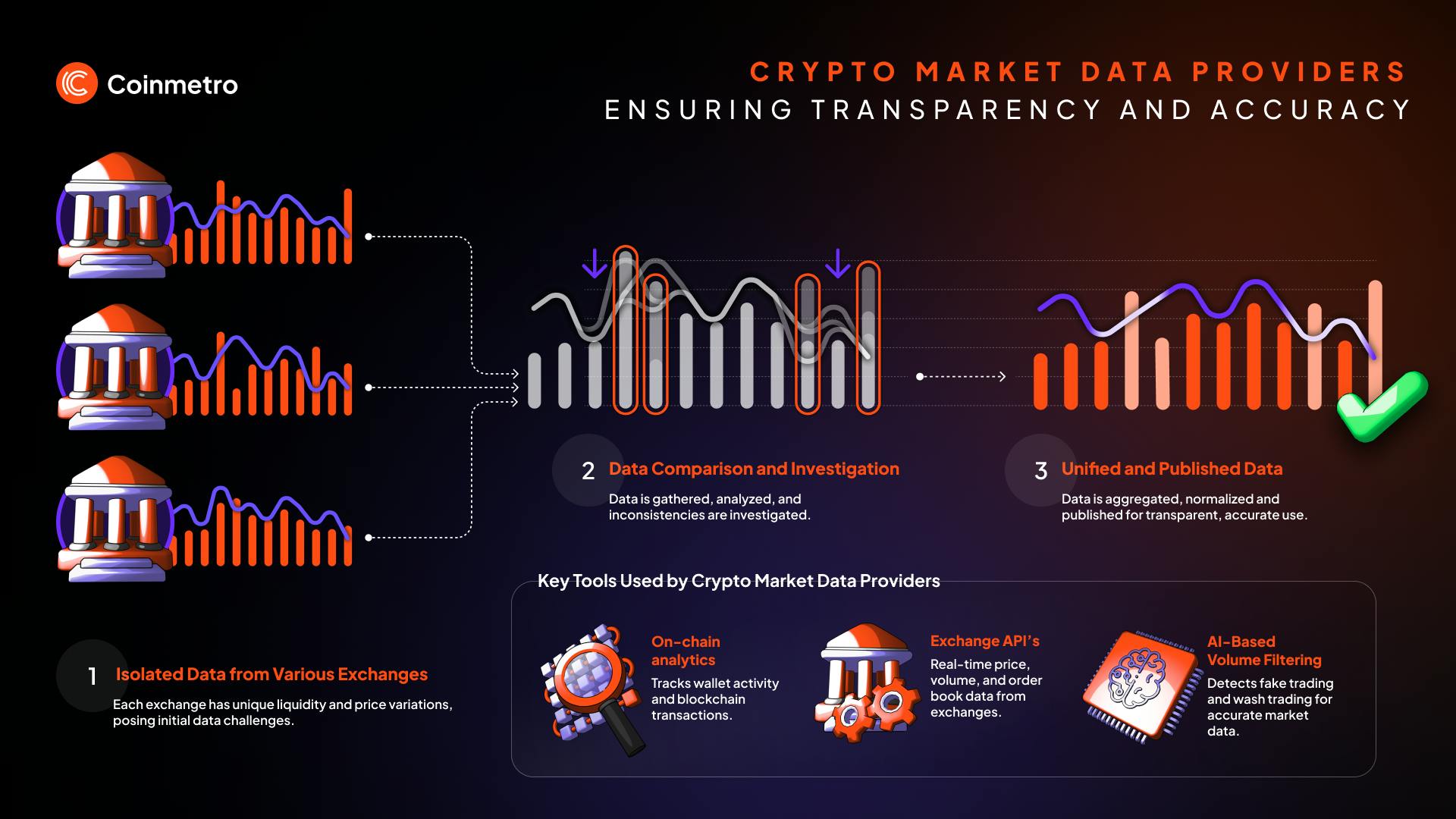

Crypto market data providers gather info from many exchanges for accuracy. This cuts bias and errors from using just one exchange. They build a full market picture with data from varied liquidity and order books. This is critical to minimize discrepancies caused by exchange-specific factors such as outages or thin liquidity.

Fake trading volumes and wash trading inflate crypto market numbers. Providers use smart algorithms to spot and remove these tricks. They check patterns, like matching buy and sell orders, to filter out fraud. This keeps reported volumes real and boosts transparency. Investors can rely on accurate market activity, while trust grows with clean data.

Historical data helps investors track trends and test trading plans. Providers store years of market info for long-term insights. This supports technical analysis and better price predictions.

Traders use past market behavior to make smart choices, revealing cycles and patterns clearly. Simply said, reliable history strengthens decision-making in crypto.

What an API Is: An API, or Application Programming Interface, is a set of protocols and tools that connects software applications. In crypto market data, APIs deliver real-time prices, volumes, and historical data to exchanges, platforms, and traders.

Benefits of API access: APIs offer low latency, providing near-instant data updates. Traders need this speed to make fast, informed decisions. They also ensure high accuracy and integrate smoothly into trading platforms, research tools, and portfolio systems.

Why APIs Are the Backbone of Crypto Market Data: APIs drive the core functionality of crypto platforms and trading systems. They integrate real-time market data into applications, delivering precise, up-to-date insights to users. In the fast-paced crypto markets, this data ensures platforms remain agile and competitive.

Learn Crypto Market Cycles Historical Patterns & Future Predictions

Some crypto data providers prioritize independent audits to validate their data processes. Third-party firms study methods for gathering, processing, and delivering market data. These audits ensure systems remain accurate, unbiased, and up to industry standards. This builds user and investor trust by showing data stays reliable.

Many reputable data providers publish transparency reports, offering insights into how they gather and verify their data. These reports reveal sources, ways to spot fake volumes, and fixes for errors. Publishing this boosts platform credibility and gives users solid, verified data. The reports support market integrity with true conditions, which is essential for compliance and trust.

Discover: Coinmetro Integrates with CCXT - An Industry-Leading Software Library

Data Manipulation: Data manipulation creates problems with fake trading volumes and wash trading. These tricks confuse users about market activity and affect decisions. Providers fight this with algorithms and patterns to remove false trades. The goal is to ensure that only genuine trading activity is reflected in the data, helping users trust the information they are using.

Fragmentation Across Exchanges: Many decentralized exchanges have different trading pairs and liquidity amounts. Data providers face the challenge of aggregating data from these disparate sources while ensuring consistency. Providers fix it by standardizing data into clear, full market views. The fragmented nature of exchanges means extra effort is needed to reconcile varying data points, ensuring accuracy.

Blockchain Data Complexity: Blockchain data is another challenge for on-chain analytics because it’s vast and spread out. Platforms like Glassnode study wallets, transactions, and smart contracts. They use smart algorithms to make data easy and useful. This lets investors and analysts act on clear, digestible insights.

Discover The World's Number 1 Cryptocurrency Market Data API

Accurate, transparent data can drive success in cryptocurrency trading and investing. Conversely, poor data raises risks of bad choices and big losses. Retail investors, traders, and developers need providers focused on transparency and real-time accuracy.

Consider your needs when picking a crypto market data provider. Retail investors value easy interfaces, while institutional traders may seek deeper, precise data. On the other hand, developers look for strong API support and smooth data integration.

Cryptocurrency markets expand rapidly, pushing data providers to enhance their technology. They focus on transparency and accuracy to strengthen a dependable ecosystem. Choosing the right provider today can provide a strategic edge tomorrow.

▶️ Watch: Ultimate Guide on How to Research Crypto

Join the Coinmetro community on Discord and Telegram, where forward-thinking traders and investors gather to share insights, explore new opportunities, and dive deep into cryptocurrencies. Should you need any help, please contact our world-class Customer Support Team via 24/7 live chat or email at hello@coinmetro.com.

To become a Coinmetro user today, Sign Up now or head to our new Exchange if you are already registered to experience our premium trading platform.

Tags

Related Articles

Regulatory Sandboxes: Fostering Crypto Innovation Within Legal Frameworks

The cryptocurrency industry’s fast rise fuels an important debate. Innovation aims to transform finance, enhancing speed and access. Yet, regulators…

5m

Crypto Options Trading: Strategies and Market Insights

Cryptocurrency markets have rapidly expanded beyond simple buying and selling. One of the most significant developments has been the rise of…

6m

The Rise of Social-Fi: Blending Social Media with Decentralized Finance

In recent years, social media and finance have started to merge, creating Social-Fi. This concept blends the engagement of social platforms with…

6m

DeFi Insurance Platforms to Watch in 2024

Decentralized Finance (DeFi) insurance addresses the growing need for insurance against hacks, smart contract failures, and other DeFi-related risks.…

7m