Beginner's Guide to Regenerative Finance (ReFi)

December 5, 2025

by Coinmetro Editorial Team

December 5, 2025

Regenerative finance (ReFi) is a fresh way to think about money and sustainability. It connects financial systems with environmental and social goals. ReFi helps create economic practices that support our world. Financial systems need new solutions for global challenges. Traditional methods often ignore long-term environmental impacts. ReFi provides a way to make money while protecting the planet.

Investments in ReFi focus on positive global change, like renewable energy and sustainable farming. Community projects become central to financial decision-making. With sustainability at the heart, ReFi shows how finance can help solve global ecological issues. It connects economic growth with environmental protection and offers a hopeful path for future financial systems.

This blog will outline:

- Understanding the basics of ReFi

- How regenerative finance works

- Regenerative finance vs. greenwashing

- Case studies of successful ReFi projects

- Future outlook

Regeneration in finance creates systems that rebuild natural and social capital. It differs from traditional finance, which often solely focuses on profits. This approach builds lasting value with sustainable practices for economic, environmental, and social strength.

The concept comes from ecology, where ecosystems recover after damage. In finance, it means supporting and improving key resources. Examples are funding renewable energy, sustainable farming, and community efforts for fairness and care.

Regenerative finance has developed over the years, driven by environmental and social needs. It gained traction in the early 2000s alongside the rise of sustainable and impact investing, which balances financial returns with positive social and environmental outcomes.

John Fullerton, once a Wall Street executive, shaped regenerative finance deeply. He started the Capital Institute and called for a fresh economic approach. Fullerton said old capitalism, tied to extraction, fails and needs regeneration for future success.

Sustainability: Sustainability lies at the heart of regenerative finance. It keeps economic activities from harming resources or the environment. This supports planetary health with investments in renewable energy, sustainable farming, and restoration projects. These steps help biodiversity and ecosystems grow stronger.

Long-term thinking: Regenerative finance looks for benefits that last, not just quick profits. It studies how financial choices affect the future carefully. The aim is to build value for the environment, society, and economy. This stands apart from traditional finance’s short-term focus.

Community and ecological impact: ReFi emphasizes the importance of community and environmental well-being. This principle involves investing in projects that benefit local communities and ecosystems. For example, regenerative finance supports social equity initiatives, such as affordable housing and community development programs. It also includes investments in ecological restoration projects that improve the health of natural systems and increase resilience to environmental changes.

By integrating these key principles, regenerative finance offers a transformative approach to economic development. It seeks to create a financial system that generates returns and supports the planet's and its inhabitants' health and vitality. This approach is essential for addressing the complex challenges of the 21st century and building a more sustainable and equitable future.

Regenerative finance (ReFi) employs several mechanisms to achieve its goals of sustainability and regeneration. These mechanisms leverage advanced technologies and innovative financial structures to create a more equitable and environmentally friendly financial system.

ReFi often links with decentralized finance platforms to increase transparency and access. DeFi uses blockchain technology to provide financial services without banks or middlemen. This setup lets ReFi projects run openly, welcoming all participants equally.

DeFi handles peer-to-peer deals, lending, and borrowing, easing entry for people. It cuts out traditional financial controls effectively. This integration keeps ReFi fair and smooth for everyone.

Blockchain technology drives ReFi with a clear, secure record of all transactions. It tracks financial transactions openly, building trust and responsibility every time. Its design skips central control, lowering corruption and boosting system strength.

ReFi uses blockchain to check where investments go accurately. This ensures funds hit their planned environmental or social targets. Blockchain’s openness builds faith in these financial systems.

In ReFi, smart contracts facilitate the efficient and transparent management of funds. For example, they can be used to automate the distribution of funds to environmental projects or to manage decentralized green bonds, ensuring that all processes are carried out as intended.

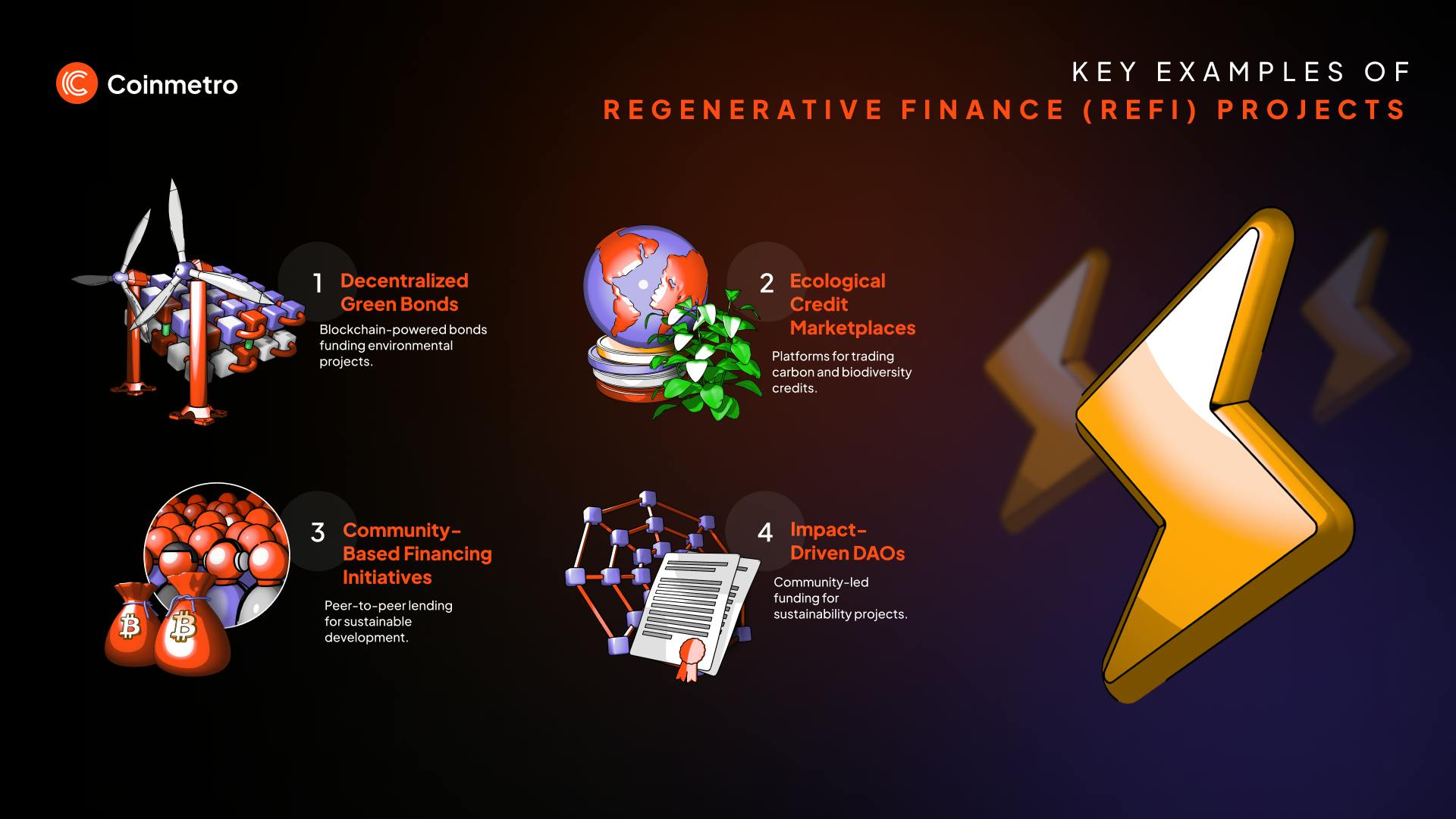

ReFi encompasses a wide range of projects, each aimed at promoting sustainability and regeneration. Here are a few notable examples:

Decentralized green bonds: Green bonds help fund environmental projects. Blockchain makes these investments clear and trackable. Investors can now support clean energy easily.

Decentralized green bonds democratize access to green investments, allowing a broader range of investors to participate in sustainable finance.

Ecological credit marketplaces: Facilitate the trading of credits for activities like carbon offsetting and biodiversity conservation. These marketplaces use blockchain to tokenize ecological credits, making them easily tradable and verifiable. Companies and individuals can purchase these credits to offset carbon emissions or support conservation efforts. By creating a transparent and efficient market for ecological credits, ReFi promotes environmental sustainability and incentivizes positive ecological practices.

Community-based financing initiatives: In ReFi, community-based financing initiatives aim to empower local communities by providing them with the financial resources needed for sustainable development. These initiatives often involve using DeFi platforms to facilitate peer-to-peer lending and borrowing. Funds raised through community-based financing can be used for sustainable agriculture, renewable energy installations, and infrastructure development projects. These initiatives foster economic resilience and social equity by focusing on local needs and leveraging community participation.

Learn About the Future of Programmable Money: Smart Contracts in Finance

Greenwashing has been a prevalent issue in the corporate world for years. Companies often claim to be environmentally friendly, but their actions frequently fall short. They use marketing tactics to project a green image without making substantial efforts to reduce their environmental impact. This superficial approach allows them to continue exploiting resources and communities while maintaining a facade of sustainability. Corporations may highlight minor eco-friendly initiatives while ignoring their larger, more harmful activities. For example, a company might promote its use of recycled packaging but must address its overall carbon footprint or harmful production processes. This practice deceives consumers and undermines genuine efforts to promote sustainability.

In contrast, regenerative finance (ReFi) offers a transparent and accountable financial and environmental sustainability approach. ReFi uses blockchain technology to ensure all transactions are open, verifiable, and immutable. This transparency makes it difficult for companies to engage in greenwashing since every action and investment is recorded on a public ledger. Stakeholders can track where funds are going and how they are used, ensuring that projects genuinely contribute to ecological and social regeneration.

Seize Opportunities and Manage Risk with Synthetic Assets in DeFi

One notable ReFi project is SolarCoin, a cryptocurrency incentivizing solar energy production. SolarCoin rewards solar energy producers with tokens for every megawatt-hour (MWh) of solar energy generated. This initiative encourages investment in renewable energy, providing financial incentives for adopting solar power. SolarCoin's transparent and decentralized approach ensures that all transactions are verifiable, promoting trust and accountability in the renewable energy sector.

Another successful ReFi project is Moss.Earth, a platform that sells tokenized carbon credits. Moss.Earth uses blockchain technology to verify and track carbon credit transactions, ensuring transparency and reducing the risk of fraud. By purchasing these tokens, companies and individuals can offset their carbon emissions, supporting conservation projects in the Amazon rainforest. This project demonstrates how ReFi can leverage blockchain to drive positive environmental impacts while providing a transparent and efficient market for carbon credits.

Grassroots Economics is a community currency initiative in Kenya that uses blockchain to support local economies. By creating community inclusion currencies (CICs), Grassroots Economics enables communities to trade goods and services locally, enhancing economic resilience. The blockchain-based system ensures transparency and trust, allowing community members to track and verify transactions. This initiative highlights how ReFi can empower local communities and promote sustainable development.

From these projects, several key lessons and best practices emerge:

Transparency and accountability: Leveraging blockchain technology ensures that all transactions are transparent and verifiable, building trust among participants.

Community engagement: Successful ReFi projects often involve and empower local communities, ensuring that initiatives meet their needs and promote sustainable development.

Incentive alignment: Providing financial incentives, such as tokens or credits, encourages participation and investment in sustainable practices.

As awareness of environmental and social issues grows, demand for sustainable finance rises. ReFi projects meet this need, using innovative tech for real, positive impact. Blockchain advancements boost transparency, security, and scalability in ReFi initiatives. This drives adoption as solutions grow more reliable and efficient.

Regulatory frameworks now adapt to support these new financial models. ReFi gains legitimacy, but awareness and effort are still key for broad use. Corporations should incorporate ReFi principles into their financial strategies to ensure transparency, accountability, and sustainability for long-term success. This shift builds a more equitable financial ecosystem. It aligns corporate goals with broader sustainability objectives.

Lessons from successful ReFi projects show their strength in addressing challenges. They position ReFi as a leader in sustainable finance transitions. ReFi drives change by blending transparency, community input, and smart incentives.

▶️Watch: From DeFi to ReFi - Can Blockchain Technology Regenerate The World?

Join the Coinmetro community on Discord and Telegram, where forward-thinking traders and investors gather to share insights, explore new opportunities, and dive deep into cryptocurrencies. Should you need any help, please contact our world-class Customer Support Team via 24/7 live chat or email at hello@coinmetro.com.

To become a Coinmetro user today, Sign Up now or head to our new Exchange if you are already registered to experience our premium trading platform.

Tags

Related Articles

Regulatory Sandboxes: Fostering Crypto Innovation Within Legal Frameworks

The cryptocurrency industry’s fast rise fuels an important debate. Innovation aims to transform finance, enhancing speed and access. Yet, regulators…

5m

Crypto Options Trading: Strategies and Market Insights

Cryptocurrency markets have rapidly expanded beyond simple buying and selling. One of the most significant developments has been the rise of…

6m

The Rise of Social-Fi: Blending Social Media with Decentralized Finance

In recent years, social media and finance have started to merge, creating Social-Fi. This concept blends the engagement of social platforms with…

6m

DeFi Insurance Platforms to Watch in 2024

Decentralized Finance (DeFi) insurance addresses the growing need for insurance against hacks, smart contract failures, and other DeFi-related risks.…

7m