Analyzing Historical Bull Runs: Lessons for the Next Crypto Surge

December 5, 2025

by Coinmetro Editorial Team

December 5, 2025

A bull run in cryptocurrency markets means digital asset prices rise steadily. Investor confidence grows, increasing trading volumes and gaining media focus. Bitcoin and other cryptocurrencies see quick value jumps, pulling in many new investors.

Studying past bull runs helps investors forecast trends and decide wisely. Historical patterns, like trading volume spikes, often hint at price surges, potentially mitigating risks. External factors, such as new regulations or technology developments, also affect market cycles. This knowledge can help you prepare for market shifts and boost returns. However, no past event can be a 100% accurate indicator of future market moves.

This blog analyzes key historical bull runs in cryptocurrency to extract valuable lessons, outlining the following insights:

- Understanding bull runs

- Historical bull runs in cryptocurrency

- Analyzing market dynamics during bull runs

- Market dips during a bull run

- Lessons for the next crypto surge 2024-2025

Analyze: Historical Patterns and Future Predictions in Crypto Market Cycles

Recognizing the signs of a bull run can give investors an edge. By monitoring market sentiment, following key technical indicators, and staying informed about fundamental changes, you can make smarter investment decisions and better navigate the market's ups and downs. These insights help you seize opportunities and manage risks more effectively, ensuring a more strategic approach to your crypto investments.

A bull run is a period during which the prices of assets, including cryptocurrencies, rise continuously and rapidly. This sustained increase in prices reflects growing investor confidence and market optimism. In the context of cryptocurrencies, bull runs can typically last anywhere from 3 to 4 months to over a year. During these periods, the market can experience substantial growth, with Bitcoin often seeing price increases of 300% to 1,000% or more. The broader cryptocurrency market usually follows suit, with many altcoins experiencing even higher percentage gains.

Role of Social Media: Platforms like X, Reddit, and Telegram shape crypto market sentiment. Influential figures and groups, such as r/Bitcoin, often drive price changes. Posts from leaders like Elon Musk can spark quick market reactions.

Media Coverage: Media tone and frequency strongly affect cryptocurrency prices. Positive news, like company adoption or new regulations, boosts investor confidence. Negative reports, such as security issues, can trigger selling and price drops.

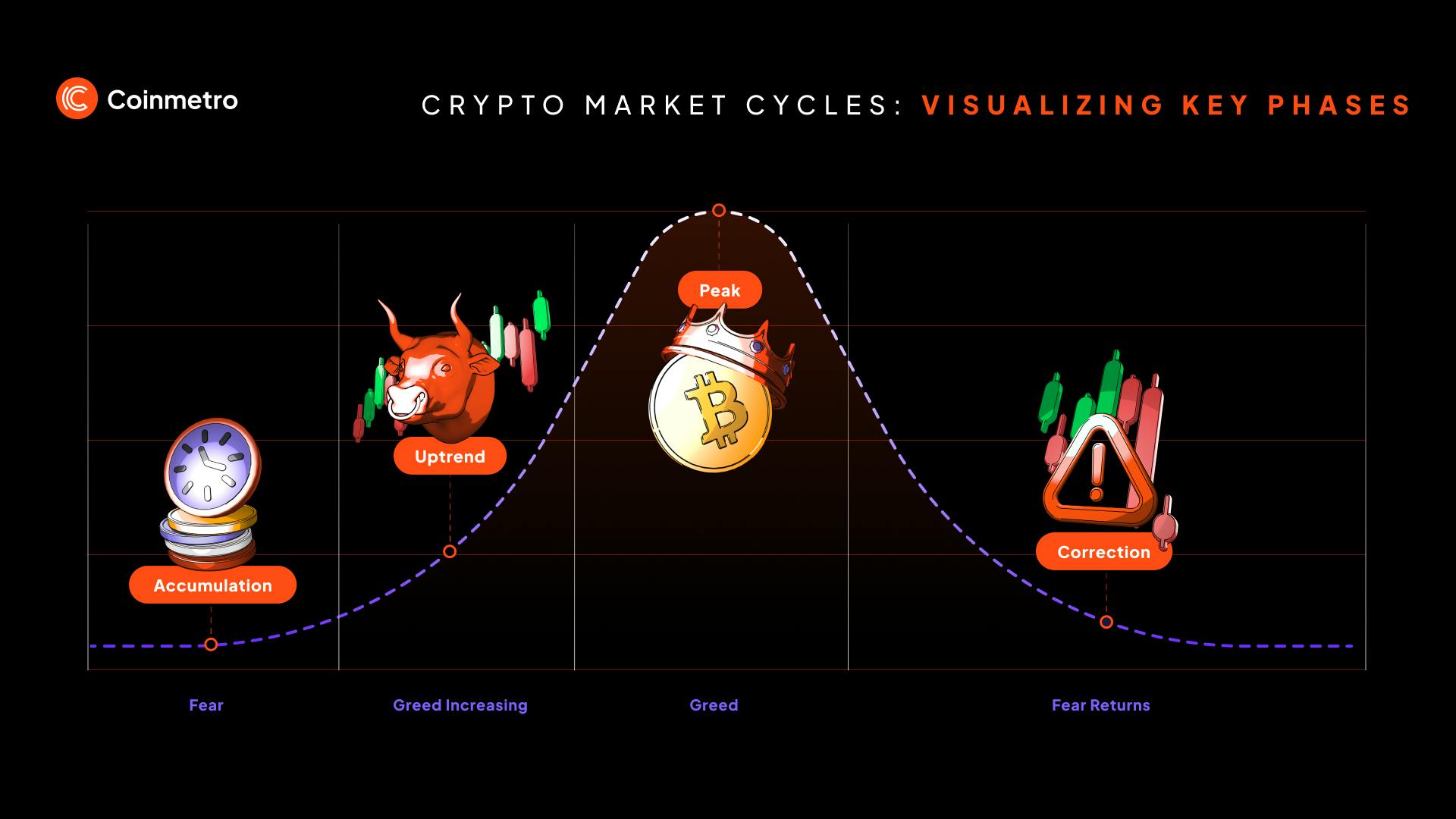

Price Patterns: Bull runs often show patterns like rapid parabolic price moves. These sharp increases usually lead to corrections, with prices dipping slightly. Spotting specific chart patterns, such as “cup and handle”, can help find entry points.

Volume Analysis: Trading volume spikes signal market strength in bull runs. High volume during price rises shows strong investor interest and trend support. On the other hand, low volume with rising prices may hint at a weak rally. Monitoring volume alongside price movements provides a clearer picture of market dynamics.

Technological Advancements: Innovations like DeFi, NFTs, and Layer 2 solutions can spark bull runs. Platforms such as Uniswap and Aave, or NFT markets, help attract new investors. Such developments create excitement while providing new avenues for earning and driving adoption forward.

Regulatory Impact: Regulations and institutional adoption heavily influence crypto market dynamics. Positive steps, like Bitcoin ETF approvals, lift confidence and attract funds. Negative news, such as China’s mining crackdown, can cause temporary price drops.

Discover: Crypto Market Sentiment Indicators - Beyond the Fear and Greed Index

Special emphasis must be placed on market dips during a bull season. Every bull run includes several temporary price drops of 10%- 30% or even more. These dips often cause panic among inexperienced investors, who may fear the bull run is over. However, seasoned investors use these dips as buying opportunities to increase their holdings at convenient prices.

Here’s what’s happening: During a bull run, prices generally rise, but not in a straight line. Market dips occur as natural corrections triggered by profit-taking, negative news, or broader market fluctuations. Despite these corrections, the overall trend during a bull run remains upward.

Experienced investors use strategies like dollar-cost averaging, setting buy orders at lower prices, and maintaining a long-term perspective to take advantage of lower prices during dips.

Historical data shows that market dips during bull runs are temporary. In the 2017 bull run, Bitcoin saw several dips but continued to rise, peaking at nearly $20,000. Similarly, during the 2020-2021 bull run, Bitcoin experienced dips but surged to around $69,000.

Learn Strategies and Market Insights for Crypto Options Trading

By studying past bull runs, we can identify key patterns and triggers that might indicate the onset of the next market surge. This knowledge enables investors to make strategic decisions and adeptly handle the inherent volatility of the cryptocurrency market.

Trigger events: The 2013 bull run began when Bitcoin gained mainstream media attention. The Cyprus banking crisis also played a significant role, as people sought alternatives to traditional banking.

Peak and correction: Bitcoin peaked at around $1,150 in December 2013 before experiencing a sharp correction.

Key takeaways: This bull run demonstrated how external economic events and media coverage could drive significant interest and investment in cryptocurrencies. The surge highlighted Bitcoin’s potential as a hedge against traditional financial systems.

Trigger events: The 2017 bull run was fueled by the increased interest in ICOs (Initial Coin Offerings), mainstream adoption, and extensive media hype. Many new investors entered the market, driven by stories of massive returns.

Peak and correction: Bitcoin reached nearly $20,000 in December 2017 before undergoing a significant correction.

Key takeaways: This period underscored the importance of regulation and the speculative nature of the market. The rise and fall of ICOs showed how new financial instruments could drive market excitement and volatility.

Trigger events: The latest bull run was influenced by several factors: substantial institutional investment from companies like MicroStrategy and Tesla, the boom in DeFi (Decentralized Finance), and the impacts of the COVID-19 pandemic, which led to increased interest in digital assets as a hedge against rampant inflation driven by reckless money printing.

Peak and correction: Bitcoin peaked at around $64,000 in April 2021 before experiencing a correction. It then bounced back to reach a new all-time high of approximately $69,000 in November 2021, followed by another significant crash.

Key takeaways: The 2020-2021 bull run highlighted the influence of institutional investors and technological innovations like DeFi and NFTs (Non-Fungible Tokens). It also showed how macroeconomic conditions like inflation could drive investment in cryptocurrencies.

According to most analysts, Bitcoin and the cryptocurrency market are currently in a bull run. This surge began in December 2022, when the markets bottomed out, followed by widespread skepticism. Since then, Bitcoin has risen approximately 400%, leading to significant gains, while some altcoins registered even higher gains. Even so, historical trends suggest that the best may be yet to come. Read on to understand what drives the current landscape and how you can potentially reap rewards yourself.

Several factors seem to be driving the current bull run:

Institutional Investment: Major companies and financial institutions are increasingly investing in Bitcoin, building trust in the market. Strategy (formerly MicroStrategy) now owns more than 500,000 BTC—about 2.5% of the total issuance—and continues to add more. The recent approval of Bitcoin ETFs in the U.S. has further accelerated institutional participation, fueling market growth.

Technological Advancements: Innovations like artificial intelligence (AI) are significant in the current bull run. AI technologies are being integrated into various blockchain projects, improving security, efficiency, and user experience. AI-driven trading bots and analytics platforms are also becoming popular, helping investors make more informed decisions. Blockchain projects focusing on AI are also gaining traction, attracting both attention and investment.

Regulatory Clarity: Positive regulatory developments and increased acceptance help cryptocurrencies spread faster. Leaders like President Donald Trump and Robert F. Kennedy Jr. support Bitcoin openly. Their backing builds trust, drawing more investors to the market.

Dollar-Cost Averaging (DCA): Dollar-cost averaging means investing a fixed amount in crypto regularly. This method potentially lowers the market volatility impact by averaging purchase prices over time. Strategy (former MicroStrategy) applied DCA since 2020, amassing half a million Bitcoin purchased at regular intervals.

Looking for Emerging Gems & Fields: Investing in new tech, like AI-driven blockchain projects, can bring big returns. Spotting promising projects early offers chances for gains as adoption grows. These emerging fields often drive market growth and attract investors.

Setting Goals and a Clear Strategy: Clear investment goals and strategies can help ensure success in crypto markets. Stop-loss orders protect against big losses, while profit-taking secures gains. A solid plan keeps investors disciplined in a volatile market.

Understanding Short-Term and Long-Term Investments: Cryptocurrencies allow both short-term trading and long-term holding strategies. Short-term trades benefit from market swings, while long-term holdings grow with the market. Combining both approaches helps balance risk and reward effectively.

Diversification: Spreading investments across different cryptocurrencies can reduce risk in a portfolio. Stablecoins, pegged to assets like the U.S. dollar, act as a hedge against volatility. This strategy can improve stability and protect against sudden market drops.

Staying informed: Following trusted news, forums, and discussions keeps investors updated on crypto trends. Engaging with the crypto community on social media offers valuable insights. Active participation helps investors make well-informed decisions in the market, instead of reacting impulsively.

Navigating the crypto market requires understanding the past and adapting to the present. The current bull run, sparked by institutional investments, AI advancements, and growing regulatory support, offers immense opportunities. Strategies like dollar-cost averaging, diversifying investments, and setting clear goals can help manage risk and maximize gains. Stay updated by engaging with the community and following reliable news sources. Learning from previous bull runs and staying adaptable will be key to making the most of this dynamic market.

▶️ Watch: The Cryptocurrency Bull Run Explained in 18 Minutes

Join the Coinmetro community on Discord and Telegram, where forward-thinking traders and investors gather to share insights, explore new opportunities, and dive deep into cryptocurrencies. Should you need any help, please contact our world-class Customer Support Team via 24/7 live chat or email at hello@coinmetro.com.

To become a Coinmetro user today, Sign Up now, or head to our new Exchange if you are already registered to experience our premium trading platform.

Tags

Related Articles

Regulatory Sandboxes: Fostering Crypto Innovation Within Legal Frameworks

The cryptocurrency industry’s fast rise fuels an important debate. Innovation aims to transform finance, enhancing speed and access. Yet, regulators…

5m

Crypto Options Trading: Strategies and Market Insights

Cryptocurrency markets have rapidly expanded beyond simple buying and selling. One of the most significant developments has been the rise of…

6m

The Rise of Social-Fi: Blending Social Media with Decentralized Finance

In recent years, social media and finance have started to merge, creating Social-Fi. This concept blends the engagement of social platforms with…

6m

DeFi Insurance Platforms to Watch in 2024

Decentralized Finance (DeFi) insurance addresses the growing need for insurance against hacks, smart contract failures, and other DeFi-related risks.…

7m