AMA Summary February 25th, 2022

February 24, 2022

by Kamil S

February 24, 2022

Happy Friday, Coinmetroids! Below is a summary from Kevin’s AMA today. Thanks to everyone for joining!

We keep your information on file for up to five years after you close your account with us, per current legal obligations.

Energy prices are rising and if that would continue it would slow down the FED’s raising of interest rates. Everyone is affected by rising energy prices. If the Ukraine situation continues and energy is cut off, then we could be seeing weeks, months of high energy prices, which would in my opinion curtail the FED raising interest rates. This is potentially good news for crypto.

Russia does not want Ukraine to join NATO and the next few days and weeks will tell us how things will unfold. Maybe we will see a similar situation like in Crimea, where Ukraine has its independence, but there will be parts of the country that pledge their alliance to Russia, which to be honest was already the case.

All prices are going to further inflate, on top of what already happened cause of Covid. That inflation will be beneficial to crypto, even though now it will follow the equity markets.

In situations like these, people go to gold, silver, or cash. However, probably anyone age 30 or younger has put some of that money into Bitcoin. Anyone older, who is a trend follower might put some money in Bitcoin as well. Question is if they see Bitcoin as a risk-on asset, even though it has been doing really well in the last 14 years.

Investing in Crypto Versus Gold

Gold has lost value over the last 10 years. Crypto has adjusted to prices and it continues to rise in value. So why would you choose an asset like Gold?

Some people choose something that you can touch as something that has intrinsic value. You can hold a lot of things without any value, like a piece of shit. The fact that you can’t hold it doesn’t mean that it doesn’t have value.

The 6 million XCM Raise will help us to maintain treasury once the bonds expire. It also depends on what people will do, whether they will convert the bonds to XCM or not.

We want to be able to support everything we promised. At some point, we are going to burn the XCM in the treasury. There will be a point where there will be a massive XCM burn because we know that on a monthly basis we are recouping x amount of XCM, not only from the exchange but also from other things like Tokenomics.

When we collect fees from different assets, we take the fees and buy XCM. We have a system that breaks down platform value, how much we owe our clients, how many assets we have, etc. On occasion, we do add orders as limit orders to the book, adding liquidity to the book.

Roughly 9 1/2 weeks from today the office should be ready.

What Type of Company is Coinmetro

Coinmetro is an OU company which is similar to a Limited Liability Company, which is more of a Corporation than a Partnership.

In the way it feels, we have always run the Company as a Partnership. We have taken a lot of feedback, used it for good changes, etc. In that aspect, we have always been more of a Partnership, but from a legal standpoint, we are a Corporation.

We do have native Terra assets. At some point in the future, we will be offering some type of yielding asset on the Terra ecosystem.

We took our IP, we spent to build the IP and used a 2-20 multiplier, which is standard. We then took the projected revenues that we saw in the next three years and based on that we came up with a valuation.

Now we have enough data to do a runway valuation. Everyone in the Fin sector in the last 12 months has done a runway valuation. You take your highest monthly revenue from last year and you project it. There is yearly recurring revenue and the multiplier is between 15 and 55. Coinbase has a 30x valuation between market cap and yearly recurring revenue.

For us, our highest revenue was in November, €800,000 without staking revenue, which was another €250,000 – €300,000.

We took a conservative multiplier of 20x and that would come close to a 192 million valuation. We discounted it to 180 million for easier math as last year was 60 million. We are shooting for a valuation of over 500 million in our official funding round later this year, which would roughly be another 3x.

By the end of March, we will have a new case-handling system and a completely new compliance system which will help with onboarding. This will allow us to focus more on marketing and advertising again.

As we grow, we want to make less money per product per service but more money overall and offer better staking opportunities.

Thanks for joining us this week and we hope you got some insight into the inner workings of Coinmetro. Please like the full video below and subscribe to our YouTube channel. See you next week!

Loading video player...

Related Articles

Coinmetro 2026 Roadmap: Focus, Simplicity & Real-World Impact

This post explains not only what we’re building in 2026 — but why. This year represents a deliberate strategic choice. The exchange market has…

3m

Coinmetro Officially Files for MiCA in Malta

This is a major milestone for Coinmetro. We’re proud to announce that Coinmetro has successfully filed its MiCA application in Malta, marking the…

2m

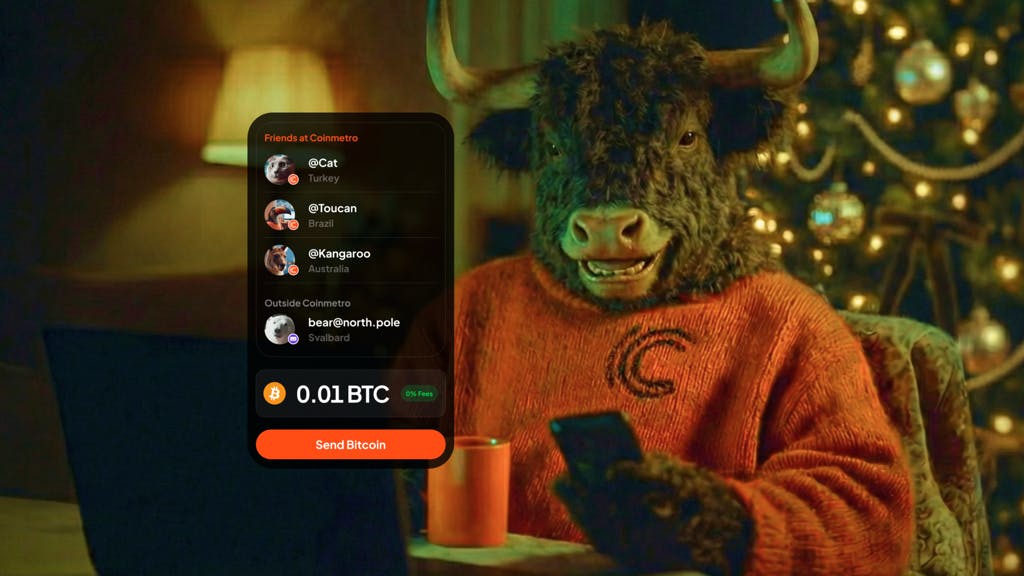

Zero Fees. Zero Waiting. Introducing Coinmetro Internal Transfers.

Moving value to friends and family just became instant, free, and borderless. Crypto was built to move at the speed of the internet. But too often,…

4m

Worldcoin (WLD) Now Listed on Coinmetro

We’re adding another asset to broaden user choice on Coinmetro: Worldcoin (WLD). This listing gives users who are interested in emerging…

2m