Introduction to Cardano (ADA)

December 5, 2025

by Coinmetro Editorial Team

December 5, 2025

Cardano is a decentralized blockchain platform designed for digital transactions and smart contracts. It uses a unique proof-of-stake system called Ouroboros. This method allegedly reduces energy use compared to traditional proof of work systems.

However, Ouroboros offers more than just energy savings. It speeds up transactions and scales the network by choosing validators based on their stake. This approach also ensures high security through mathematical methods. The protocol allows for smooth updates and growth. Its modular design helps avoid disruptions during upgrades. This makes Cardano both efficient and secure for long-term use.

Cardano's layered structure supports various applications like finance, supply chain, and identity checks. The native cryptocurrency, ADA, powers transactions and supports the network. This setup makes Cardano adaptable for businesses and developers. In summary, Cardano stands out as a leader in the blockchain industry. It meets diverse needs with its focus on efficiency, security, and sustainability.

As of December 2024, Cardano (ADA) has a market capitalization of $38.17 billion, ranking as the 9th largest cryptocurrency by market cap, trading at ~$1.09.

In this blog, you will learn about:

- Key features of Cardano

- Cardano (ADA) cryptocurrency

- Use cases and applications

- Recent developments

- Charles Hoskinson and Cardano controversy

Cardano uses Ouroboros, a proof-of-stake method. It picks validators by their ADA stake, which saves energy and speeds up transactions. However, critics think this system might favor those with more ADA, which could lead to centralization concerns. Ouroboros uses math for security and random selection to defend against attacks. Its design allows for easy updates, letting the network grow.

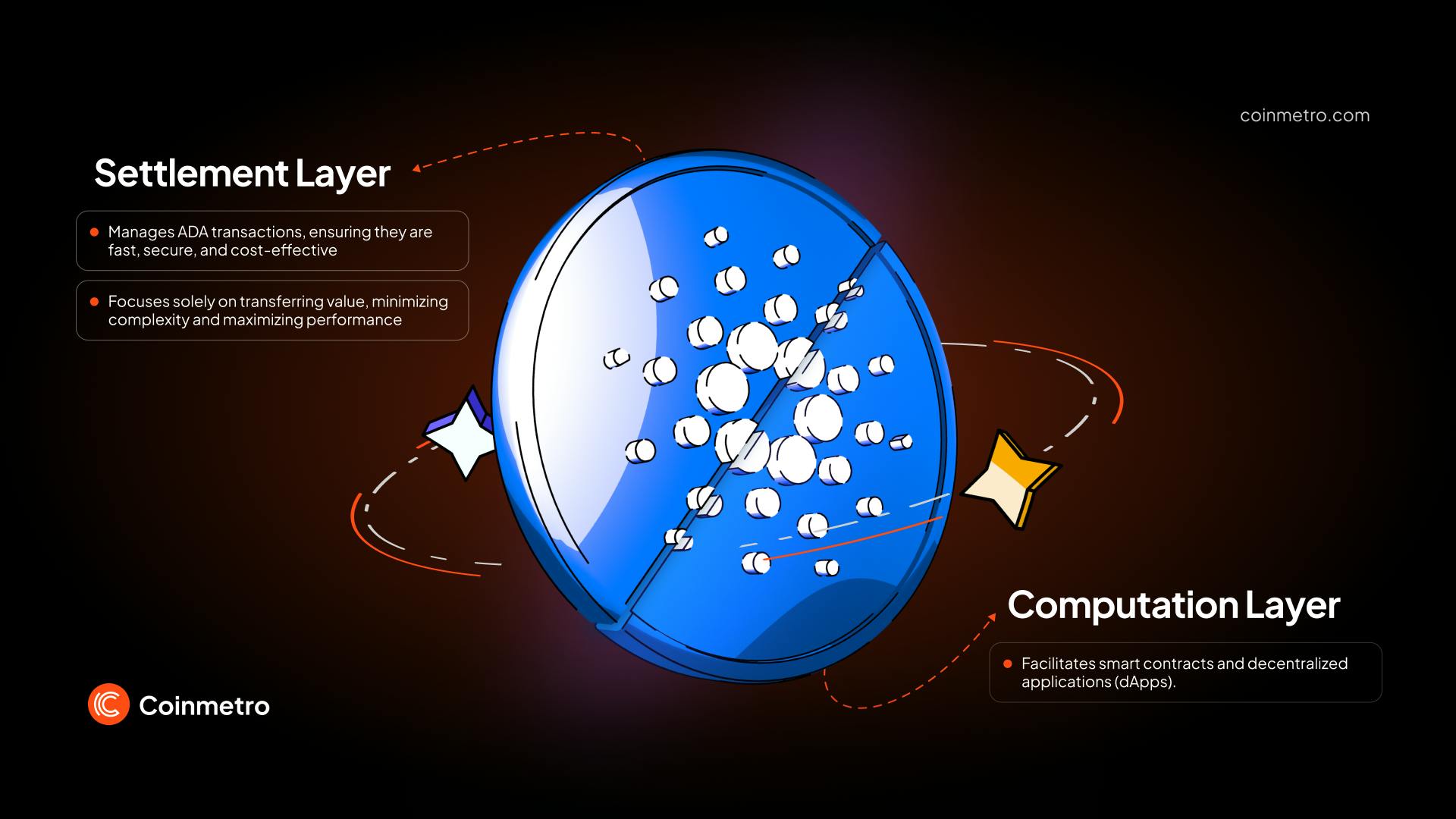

Cardano's architecture separates the blockchain into two distinct layers, offering flexibility and efficiency.

Settlement Layer: Handles ADA Transactions: This layer deals with ADA transfers, making them fast, secure, and cost-effective. It concentrates on moving value keeping things simple and efficient.

Computation Layer: Supports Smart Contracts and Applications: This layer is for smart contracts and apps. The split design lets developers build versatile apps without messing with transactions.

Cardano stands out with its scientific approach. Experts review every part of its growth to ensure that innovations are safe and reliable. By focusing on research, Cardano prepares for long-term use and changes in blockchain tech.

Overview of ADA: ADA ADA is the cryptocurrency used by the Cardano blockchain. It's named after Ada Lovelace, an early programmer. ADA serves as both a currency for transactions and a utility token for the network's functions.

Role of ADA in the Cardano Ecosystem: ADA allows for quick, secure value transfers with low fees across Cardano. It enables smart contracts and decentralized applications on the platform. Additionally, ADA holders participate in governance, voting on network changes to keep decision-making decentralized.

Staking and Rewards: ADA holders can stake their tokens. They lend their ADA to staking pools, which validate transactions and secure the blockchain. This participation is rewarded with more ADA. The reward amount depends on the staked amount and the pool's performance. This system promotes decentralization, security, and efficiency. Staking ADA means you contribute to Cardano's development while earning passive income through rewards.

Cardano makes financial transactions simple. It's secure and has low fees. Users can send ADA across borders without banks, perfect for remittances. Its quick processing and low costs help include people where banks are scarce.

Cardano improves supply chains with clear records. It tracks products from start to finish. This transparency helps verify products, cut fraud, and build consumer trust by showing how items are made and sourced.

Cardano secures academic credentials on its blockchain. Schools can issue certificates that can't be changed. This makes checking credentials easy for employers and prevents fraud. Students get a lasting digital record of their education.

Cardano's network has grown impressively. By December 2024, it handled 100 million transactions. It supports over 1,300 projects, from DeFi to NFT markets. Over 9 million native assets are now in circulation, showing strong adoption.

Cardano works with big organizations and governments. It collaborates with Ethiopia to manage student credentials for 5 million students. This reduces fraud in education. Cardano also partners with New Balance to check product authenticity. These projects show Cardano's ability to scale and adapt.

ADA's price in 2024 went from $0.31 to $1.22. On December 4, 2024, ADA was at $1.22. Analysts predict it might hit its 2021 peak of $2.9 again. This optimism comes from Cardano's upgrades, more projects, and market trends. The use of smart contracts could boost ADA's value, making it a key player in blockchain.

Cardano and Ethereum are key players in blockchain. They both support dApps and smart contracts but differ in approach:

Consensus Mechanism: Cardano uses Ouroboros, a proof-of-stake system. It picks validators based on ADA ownership, saving energy and improving scalability. Ethereum switched from proof-of-work to PoS in 2022 for similar reasons.

Development Philosophy: Cardano focuses on research, using peer-reviewed studies for development. This makes it secure but slow in adding features. Ethereum updates quickly, promoting a vast dApp and DeFi ecosystem.

Smart Contract Functionality: Ethereum pioneered smart contracts with Solidity. Cardano uses Plutus, which is secure but harder to learn due to its Haskell base.

Scalability: Cardano splits its blockchain into layers for better performance. Its Hydra solution aims for 1,000 TPS. Ethereum handles about 30 TPS but is working on sharding for more.

Governance: Cardano lets ADA holders vote on changes, keeping governance decentralized. Ethereum's governance happens off-chain through community proposals.

In summary, Cardano is built with academic backing for security and scale, while Ethereum grows through quick updates and a wide user base.

Read more: Discover how Cardano Compares to Ethereum

In a resurfaced video, Charles Hoskinson, Cardano's CEO, once questioned Bitcoin's future. He suggested the crypto world might not need Bitcoin anymore. This view stirred debate in the crypto community. Despite this, Cardano now uses BitcoinOS's Grail Bridge to leverage Bitcoin's market for its DeFi projects.

Hoskinson has stirred controversy with his thoughts on blockchain governance. He criticized Bitcoin's system for lacking leadership, drawing ire from Bitcoin fans. Furthermore, his bold statements and development timelines for Cardano have faced skepticism. Still, Cardano pushes forward, growing its platform and ecosystem.

Cardano provides a solid blockchain platform. It focuses on security, scalability, and sustainability. Its Ouroboros system ensures energy-efficient transactions. The design separates how transactions and smart contracts work. This setup boosts both flexibility and security. Cardano's development relies on peer-reviewed research for reliability.

Cardano aims to shape decentralized tech's future. It supports many applications and services with a focus on interoperability and scalability. Since adding smart contracts in 2021, Cardano has grown its network, working with various groups and governments. This suggests a strong, promising future in blockchain technology.

Trade and Explore Cardano (ADA) with Coinmetro

Join the Coinmetro community on Discord and Telegram, where forward-thinking traders and investors gather to share insights, explore new opportunities, and dive deep into cryptocurrencies. Should you need any help, please contact our world-class Customer Support Team via 24/7 live chat or email at hello@coinmetro.com.

To become a Coinmetro user today, Sign Up now or head to our new Exchange if you are already registered to experience our premium trading platform.

Tags

Related Articles

Regulatory Sandboxes: Fostering Crypto Innovation Within Legal Frameworks

The cryptocurrency industry’s fast rise fuels an important debate. Innovation aims to transform finance, enhancing speed and access. Yet, regulators…

5m

Crypto Options Trading: Strategies and Market Insights

Cryptocurrency markets have rapidly expanded beyond simple buying and selling. One of the most significant developments has been the rise of…

6m

The Rise of Social-Fi: Blending Social Media with Decentralized Finance

In recent years, social media and finance have started to merge, creating Social-Fi. This concept blends the engagement of social platforms with…

6m

DeFi Insurance Platforms to Watch in 2024

Decentralized Finance (DeFi) insurance addresses the growing need for insurance against hacks, smart contract failures, and other DeFi-related risks.…

7m