Regulatory Sandboxes: Fostering Crypto Innovation Within Legal Frameworks

December 5, 2025

by Coinmetro Editorial Team

December 5, 2025

The cryptocurrency industry’s fast rise fuels an important debate. Innovation aims to transform finance, enhancing speed and access. Yet, regulators lag behind, striving to safeguard consumers and stabilize markets. This conflict tests both startups and major crypto firms.

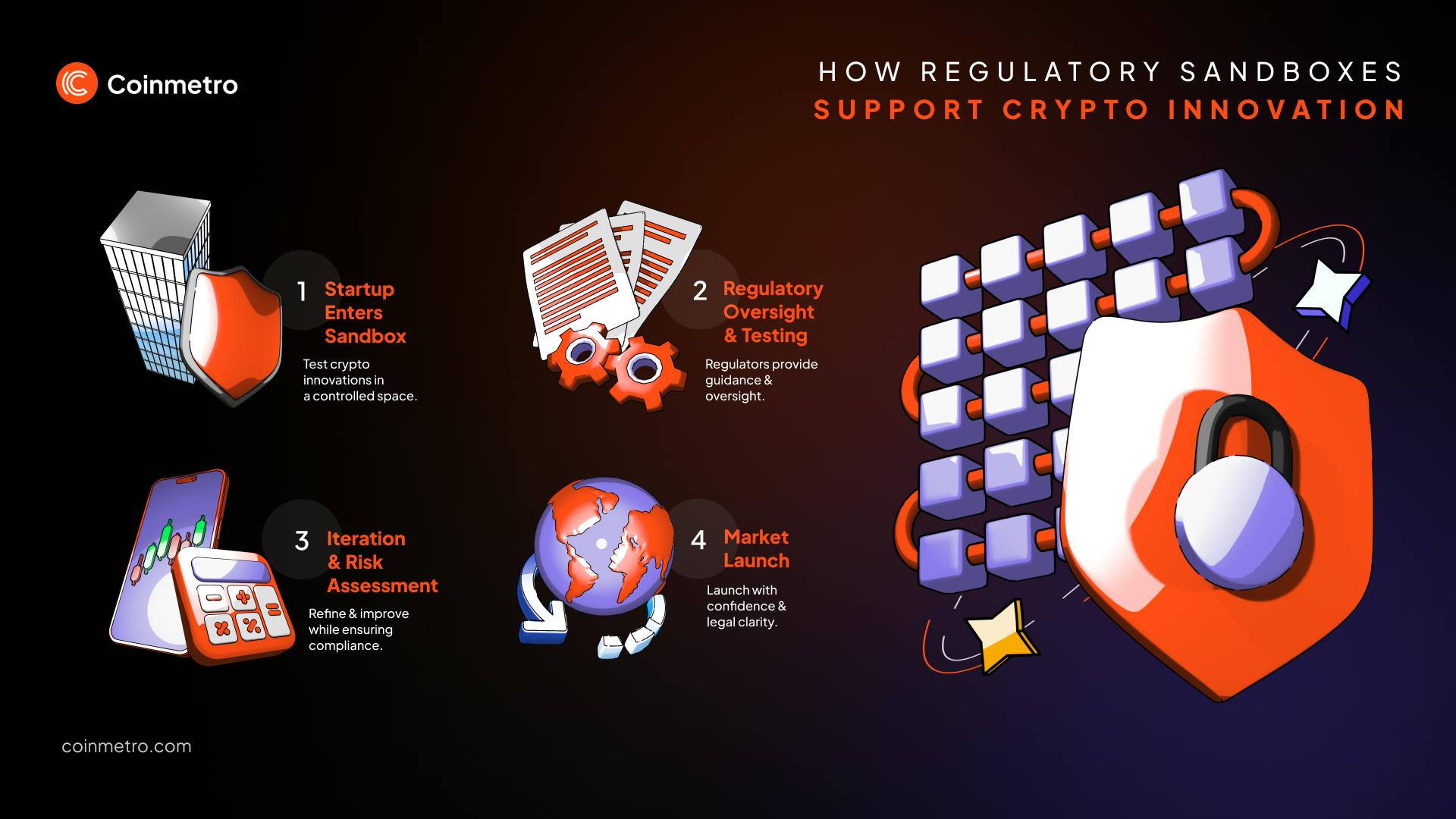

Regulatory sandboxes provide a practical answer. These setups allow companies to test blockchain innovations safely. Regulators monitor and adapt, learning from the process. Born in fintech, sandboxes now aid crypto growth within legal limits.

This article examines how regulatory sandboxes can drive crypto progress. It explores their strengths, like accelerating development, and drawbacks, such as resource demands. It also considers how they align bold innovation with necessary oversight.

This blog will outline:

- Understanding regulatory sandboxes

- The role of regulatory sandboxes in crypto innovation

- Key benefits

- Challenges and limitations

- The future of regulatory sandboxes

A regulatory sandbox is a legal framework allowing companies to test new products in a safe space. Firms try out innovations, like blockchain solutions, under regulatory watch. This setup cuts compliance pressure while protecting consumers and markets.

Companies work within clear rules and time limits in sandboxes. Regulators study technologies, such as cryptocurrency systems, and refine oversight. This teamwork helps both sides manage innovation and compliance effectively.

The UK’s Financial Conduct Authority started the first sandbox in 2016. It sought to grow fintech while keeping standards firm. The FCA’s work has since launched many new financial tools. Singapore followed with its own regulatory sandbox in 2016, targeting fintech progress. By 2020, over 50 regions had sandboxes, adapting to cryptocurrency and blockchain. These systems now reflect the financial sector’s changing needs.

United Kingdom: The FCA's regulatory sandbox has supported over 140 firms since 2016. Notable participants include Revolut, which tested its banking services before full-scale deployment.

Singapore: The Monetary Authority of Singapore's sandbox has been instrumental in promoting fintech innovations. In 2020, BondEvalue launched the world's first blockchain-based bond exchange under this framework.

United Arab Emirates: The Abu Dhabi Global Market (ADGM) introduced its sandbox, known as the RegLab, in 2016. This platform has supported various crypto and fintech startups, enabling them to test and develop their offerings within a regulated environment.

Regulatory sandboxes create a safe space for companies to test new ideas. Firms can experiment with blockchain innovations and refine products before market launch. This freedom lets startups prioritize development over complex regulatory demands.

Regulators also gain from this setup. They observe emerging technologies, like cryptocurrency systems, and refine oversight. Startups help shape smarter rules, balancing innovation with consumer protection.

Sandboxes cut risks tied to new crypto technologies and business models. Companies test products in a controlled setting, spotting issues early on. This matters in crypto, where flaws can trigger big losses or security breaches. Regulators track sandbox activities to enforce compliance with laws and standards. If risks appear, they can step in fast, protecting markets and users. Essentially, this approach builds a more stable financial system.

Several crypto companies have successfully leveraged regulatory sandboxes to develop and refine their products.

Revolut: Revolut, mainly a fintech firm, now operates in the crypto sector as well. It used the UK’s FCA sandbox to test its cryptocurrency exchange services. This let Revolut polish its offerings while meeting UK regulatory standards and building a strong presence.

Blockchain.com: Blockchain.com, a crypto wallet and exchange provider, also stands out. It joined the UK FCA sandbox to trial new digital asset trading features. Regulators oversaw the process, ensuring compliance during testing. Through the sandbox, Blockchain.com tackled potential issues early. This prepared it for a successful full-scale launch.

Reduced Time to Market: Regulatory sandboxes speed up product launches for crypto startups. Companies skip lengthy approval processes by testing in a controlled setting. This lets firms refine offerings with real users, hitting the market faster. Startups gain an edge, adapting quickly to customer needs. Sandboxes generally outpace traditional regulatory timelines.

Enhanced Regulatory Compliance: Sandboxes help crypto firms understand and comply with legal standards. Startups get direct regulator input during development. This cuts compliance risks after launch, building stronger products early.

Investor Confidence: Sandboxes lift investor trust in crypto ventures. Participation shows a commitment to regulated development. This can lower perceived risks, signaling thorough scrutiny and preparation. Investors favor sandbox-tested firms, boosting funding prospects and driving support for innovative crypto projects.

Limited Scope: Regulatory sandboxes help but have inherent limitations. They work in specific regions, keeping benefits local. Firms expanding globally face varied rules across jurisdictions. Furthermore, sandboxes generally focus on areas like fintech or blockchain, ignoring other emerging tech. This potentially restricts their wider impact.

Regulatory Arbitrage: Sandboxes carry a risk of regulatory arbitrage. Firms might use the relaxed rules to skip broader compliance. This harms fair regulation and enforcement consistency. Companies dodging full rules in sandboxes may land in hot water later in their journey. This can pose risks to competition, consumer protection, and market stability.

Scalability Issues: Sandboxes boost innovation yet pose scaling challenges. Their controlled setup differs from real market conditions. Successful sandbox products may still face compliance challenges across regions. When regulatory support ends, firms must navigate compliance alone, potentially slowing growth.

Regulatory sandboxes continually adjust to the fast-changing crypto world. They reflect the evolution of digital assets and blockchain technology. Regulators use sandboxes to keep up with innovation while updating legal frameworks to keep users safe.

Sandboxes offer a flexible space for testing new rules. They tackle issues like DeFi, NFTs, and cross-border transactions. This keeps regulation effective in a dynamic industry.

Sandboxes could help set global cryptocurrency standards. Different regions running sandboxes may align their regulatory approaches. This matters in crypto, where assets cross borders easily.

Cooperation via sandboxes can standardize rules for transactions, cutting regulatory arbitrage and boosting crypto legitimacy. Firms can gain a clearer path across multiple markets.

Regulatory sandboxes strive to align crypto innovation with effective oversight. They give startups room to experiment while protecting consumers and market stability. Striking this balance defines their lasting impact.

Future frameworks might focus on DeFi platforms and stablecoins as well, each demanding distinct regulatory solutions. Perfecting this tailored approach keeps sandboxes vital to crypto’s progress.

▶️ Watch: Understanding MiCA - the EU Crypto-Asset Regulation

Join the Coinmetro community on Discord and Telegram, where forward-thinking traders and investors gather to share insights, explore new opportunities, and dive deep into cryptocurrencies. Should you need any help, please contact our world-class Customer Support Team via 24/7 live chat or email at hello@coinmetro.com.

To become a Coinmetro user today, Sign Up now or head to our new Exchange if you are already registered to experience our premium trading platform.

Tags

Related Articles

Regulatory Sandboxes: Fostering Crypto Innovation Within Legal Frameworks

The cryptocurrency industry’s fast rise fuels an important debate. Innovation aims to transform finance, enhancing speed and access. Yet, regulators…

5m

Crypto Options Trading: Strategies and Market Insights

Cryptocurrency markets have rapidly expanded beyond simple buying and selling. One of the most significant developments has been the rise of…

6m

The Rise of Social-Fi: Blending Social Media with Decentralized Finance

In recent years, social media and finance have started to merge, creating Social-Fi. This concept blends the engagement of social platforms with…

6m

DeFi Insurance Platforms to Watch in 2024

Decentralized Finance (DeFi) insurance addresses the growing need for insurance against hacks, smart contract failures, and other DeFi-related risks.…

7m