Your First Crypto Purchase: A Step-by-Step Guide

December 5, 2025

by Coinmetro Editorial Team

December 5, 2025

As more people recognize the potential of digital currencies, understanding how to make your first purchase becomes essential. Approximately 5% of the global population owns some form of cryptocurrency, which translates to around 400 million people worldwide (statistics vary). As awareness and acceptance grow, estimates suggest that this number could rise to over 1 billion users by 2028, accounting for around 12% of the global population.

Making informed decisions in this fast-paced market can lead to better outcomes and greater investment satisfaction. In this guide, you will learn about cryptocurrencies, how to choose the right one for your needs, set up your account, fund it, and ultimately make your first purchase. You'll also discover best practices for managing investments and storing assets securely.

This blog will outline:

- Understanding cryptocurrency

- Choosing the right crypto

- Setting up your account

- Funding your account

- Making your first crypto purchase

- Storing your digital assets

- Best practices for first-time buyers

Cryptocurrencies are digital assets secured by cryptographic technology, ensuring transaction integrity and regulating the creation of new units. Unlike traditional money, it’s not run by governments or banks. It uses decentralized blockchain networks instead. Blockchain ensures transparency, security, and immutability, allowing users to trade directly without intermediaries.

Blockchain technology logs every transaction across a decentralized network of computers. Its immutability stops fraud and boosts user control over assets. People can send money worldwide easily. That’s why it challenges old financial systems.

Blockchain is a decentralized digital ledger that encrypts transactions across a network of computers. Each transaction is grouped into a "block" linked to the previous block, forming a "chain." This structure ensures transparency and security, as altering any block requires changing all subsequent blocks.

To validate transactions and add new blocks, blockchain networks use consensus mechanisms. Common methods include:

Proof of Work (PoW): Miners compete to solve complex problems, with the winner adding the next block.

Proof of Stake (PoS): Validators create blocks based on the number of coins they hold and are willing to "stake."

Delegated Proof of Stake (DPoS): Coin holders vote for delegates to validate transactions and maintain the blockchain.

These mechanisms ensure all participants agree on the blockchain's state, enhancing security and fostering trust.

Bitcoin (BTC) was launched in 2009 as the first cryptocurrency, pioneering the concept of a decentralized, incorruptible digital currency for peer-to-peer transactions. With Bitcoin, transactions occur directly, with no intermediaries—a radical departure from traditional finance.

As the most secure and widely adopted cryptocurrency, Bitcoin stands apart due to its fixed supply of 21 million coins, ensuring scarcity and protecting against inflation. Its proof-of-work consensus mechanism makes it the most secure blockchain, resistant to censorship and manipulation. Unlike fiat currencies controlled by central banks, Bitcoin operates on a trustless, permissionless, and decentralized network, giving users full sovereignty over their wealth.

Litecoin debuted in 2011 with faster transaction speeds but less decentralization. Ethereum arrived in 2015, introducing smart contracts. Developers started building decentralized apps on its network. DeFi and Web3 took off as the automation of trust allowed more and more economies and ecosystems to develop securely.

Other notable cryptocurrencies include Polkadot (DOT), Avalanche (AVAX), Tron (TRX), and others, which aim to enhance blockchain interoperability, scalability, and beyond. This enables seamless communication between different networks and supports the development of decentralized applications.

Before making your first purchase, consider the following factors:

Market Capitalization: Market capitalization (market cap) represents the total value of a cryptocurrency. A higher market cap usually indicates a more established and stable asset.

Use Case and Technology: Evaluate the purpose of the cryptocurrency. Does it solve a specific problem or offer innovative technology? Look for projects with real-world applications and strong technology backing.

Community and Developer Support: A strong community and active developers are crucial for a cryptocurrency's success. Engaged users and consistent updates signal a healthy project.

Bitcoin (BTC): The first and largest cryptocurrency by market cap, widely accepted and considered a store of value.

Ethereum (ETH): Known for its smart contract functionality, enabling developers to build decentralized applications.

Polkadot (DOT): Aims to enable different blockchains to communicate and share data, facilitating a more interconnected and scalable ecosystem.

Avalanche (AVAX): Designed for fast transactions and low fees, Avalanche supports smart contracts and aims to provide a scalable platform for decentralized applications.

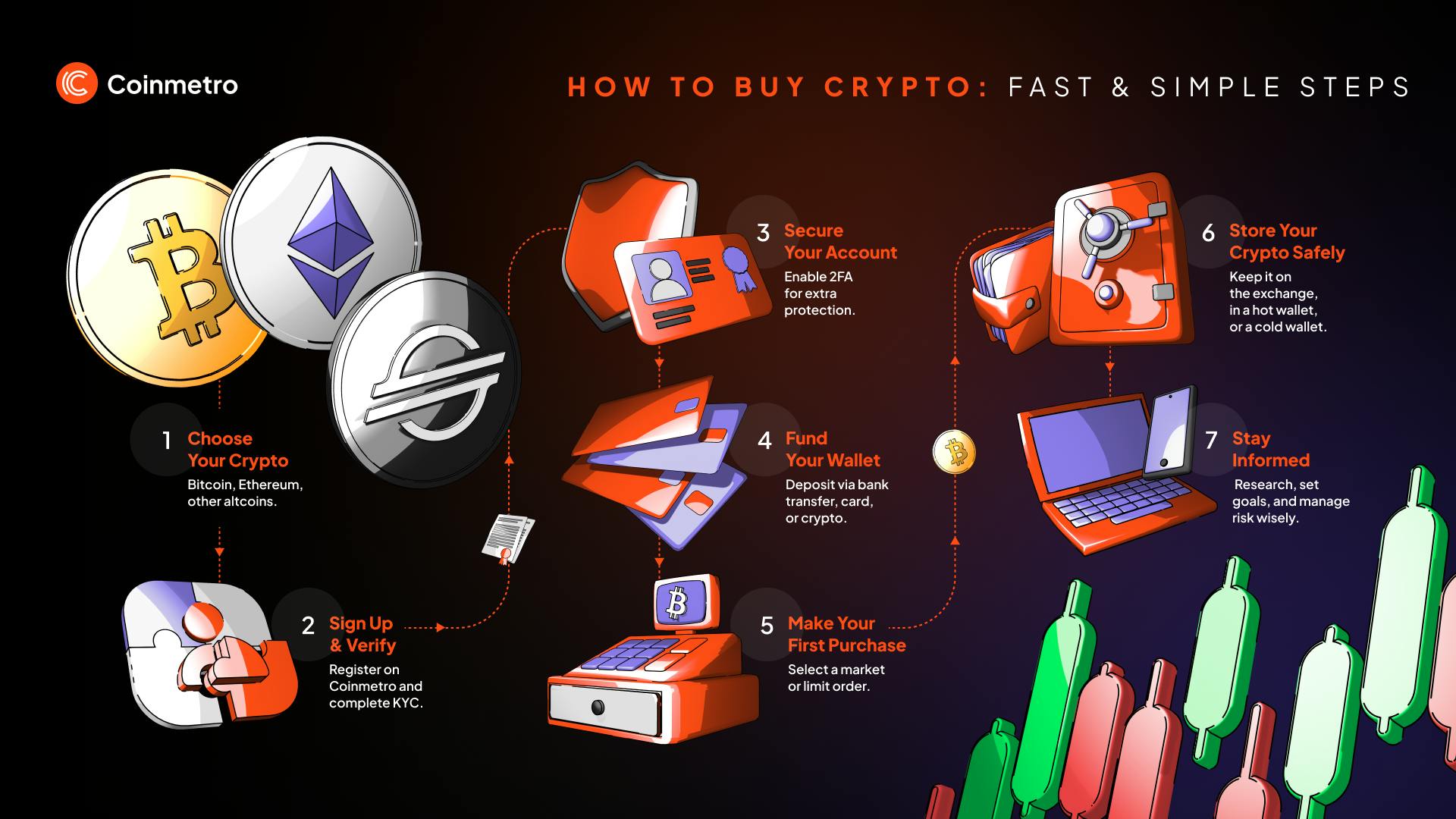

Step-by-step process to create an account on Coinmetro Exchange

Visit Coinmetro's Website: Go to the official Coinmetro website and click on "Sign Up."

Download the Mobile App: For added convenience, download the Coinmetro Mobile App from your device's app store. This allows you to manage your account and make trades on the go.

Provide Your Information: Fill out the registration form with your email address and a secure password.

Verify Your Email: Check your inbox for a verification email and click the link to confirm your account.

Complete KYC Verification: In order to stay compliant, Coinmetro requires identity verification. Please provide necessary documents, such as a government-issued ID and proof of address.

Two-factor authentication (2FA)

Activate 2FA to enhance security. This adds an extra layer of protection by requiring a code sent to your phone or email during login. This is important because it significantly reduces the risk of unauthorized access, even if someone obtains your password.

You can fund your Coinmetro account using several methods, including bank transfers, credit/debit cards, and cryptocurrencies:

Pros: Usually has lower fees; safe and secure.

Cons: Slower processing times; may take several days to reflect in your account.

Pros: Instant deposits; user-friendly.

Cons: Higher fees compared to bank transfers.

Pros: Almost instant transaction confirmation; great for those who already own crypto.

Cons: Requires prior knowledge of crypto transfers; network fees may apply.

- Log in to Your Account: Go to the Coinmetro dashboard.

- Select “Deposit”: Choose the funding method you prefer.

- Enter Deposit Amount: Specify how much you want to deposit.

- Follow On-Screen Instructions: Complete the deposit process as prompted.

Learn More - Cryptocurrency Explained With Pros and Cons for Investment

- Log in to Your Coinmetro Account: Access your account.

- Go to the “Markets” Section: Browse available cryptocurrencies.

- Select Your Desired Cryptocurrency: Choose the coin/token you want to buy.

- Choose Order Type: Select either a market or limit order.

Market Order: Buy immediately at the current market price. Ideal for beginners wanting a quick purchase.

Limit Order: Set a specific price to buy. This order executes only when the cryptocurrency reaches your desired price.

- Start small to familiarize yourself with the market.

- Monitor your investment regularly.

- Set realistic goals and adjust your strategy as needed.

A crypto wallet is a digital tool that allows you to store, send, and receive cryptocurrencies. Wallets can be software-based (hot wallets) or hardware-based (cold wallets):

Hot Wallets: Connected to the internet. Easier to use but more vulnerable to online threats.

Cold Wallets: Offline storage. More secure but less convenient for quick transactions.

Coinmetro Exchange: Storing your crypto on Coinmetro is a safe and trusted option. As a reputable exchange, Coinmetro employs secure practices and offers a user-friendly platform for managing your assets daily.

Hardware Wallets: Devices like Ledger Nano S or Trezor are popular choices among users, offering high security for long-term storage.

Mobile Wallets: Apps like Trust Wallet or Exodus provide easy access for daily transactions.

Discover - How to Deposit Crypto Into Your Coinmetro Account

Doing Your Own Research (DYOR): Research is critical before investing. Understand the cryptocurrency's purpose, technology, and market trends. Connect with the community and study the team behind the project. Read the whitepaper to understand better what the project stands for.

Understanding Market Volatility: Cryptocurrencies can experience significant price swings. Be prepared for fluctuations and only invest what you can afford to lose. Study past charts to understand better the magnitude of volatility your desired asset can experience.

Setting Realistic Expectations and Investment Goals: It’s important to define clear goals, whether you’re aiming for long-term growth or focusing on short-term gains. Tailor your investment strategy based on your objectives, whether it’s day trading for quick profits or building a portfolio for sustained growth over time

Stay Vigilant Against Scams and Fraud: Always verify the legitimacy of sources and platforms before taking any action. Be cautious of unsolicited messages or offers that seem too good to be true, and ensure you use secure and reputable services.

Avoid Emotional Decision-Making: Emotional reactions, particularly those fueled by fear of missing out (FOMO), can lead to rash decisions. Take the time to step back and evaluate your options logically, focusing on your long-term investment strategy rather than immediate market fluctuations.

Conduct Thorough Research: Don’t make investment decisions based solely on hype or trending news. Instead, take the time to perform in-depth research on the assets you're interested in, including their fundamentals, market trends, and potential risks. This informed approach will help you make better decisions aligned with your financial goals.

Embarking on your cryptocurrency journey is more than just a transaction; it explores a rapidly evolving financial landscape. By equipping yourself with a solid understanding of the various cryptocurrencies, selecting the one that aligns with your investment goals, and adhering to best practices in security and research, you position yourself for success in this dynamic market.

As you navigate this innovative space, remain adaptable and informed, recognizing that the cryptocurrency ecosystem continually evolves. By fostering a continuous learning mindset, you can make well-informed decisions that align with your financial objectives.

Engage with the community—your insights and inquiries can be valuable to others embarking on similar journeys. We can build a more informed and robust network of cryptocurrency enthusiasts. Start your journey today with Coinmetro and become part of the future of finance.

Buy Crypto in Seconds on Coinmetro Exchange

Join the Coinmetro community on Discord and Telegram, where forward-thinking traders and investors gather to share insights, explore new opportunities, and dive deep into cryptocurrencies. Should you need any help, please contact our world-class Customer Support Team via 24/7 live chat or email at hello@coinmetro.com.

To become a Coinmetro user today, Sign Up now or head to our new Exchange if you are already registered to experience our premium trading platform.

Tags

Related Articles

Regulatory Sandboxes: Fostering Crypto Innovation Within Legal Frameworks

The cryptocurrency industry’s fast rise fuels an important debate. Innovation aims to transform finance, enhancing speed and access. Yet, regulators…

5m

Crypto Options Trading: Strategies and Market Insights

Cryptocurrency markets have rapidly expanded beyond simple buying and selling. One of the most significant developments has been the rise of…

6m

The Rise of Social-Fi: Blending Social Media with Decentralized Finance

In recent years, social media and finance have started to merge, creating Social-Fi. This concept blends the engagement of social platforms with…

6m

DeFi Insurance Platforms to Watch in 2024

Decentralized Finance (DeFi) insurance addresses the growing need for insurance against hacks, smart contract failures, and other DeFi-related risks.…

7m