Understanding Crypto Tokenomics – XCM, Utility Tokens, and Beyond

December 5, 2025

by Coinmetro Editorial Team

December 5, 2025

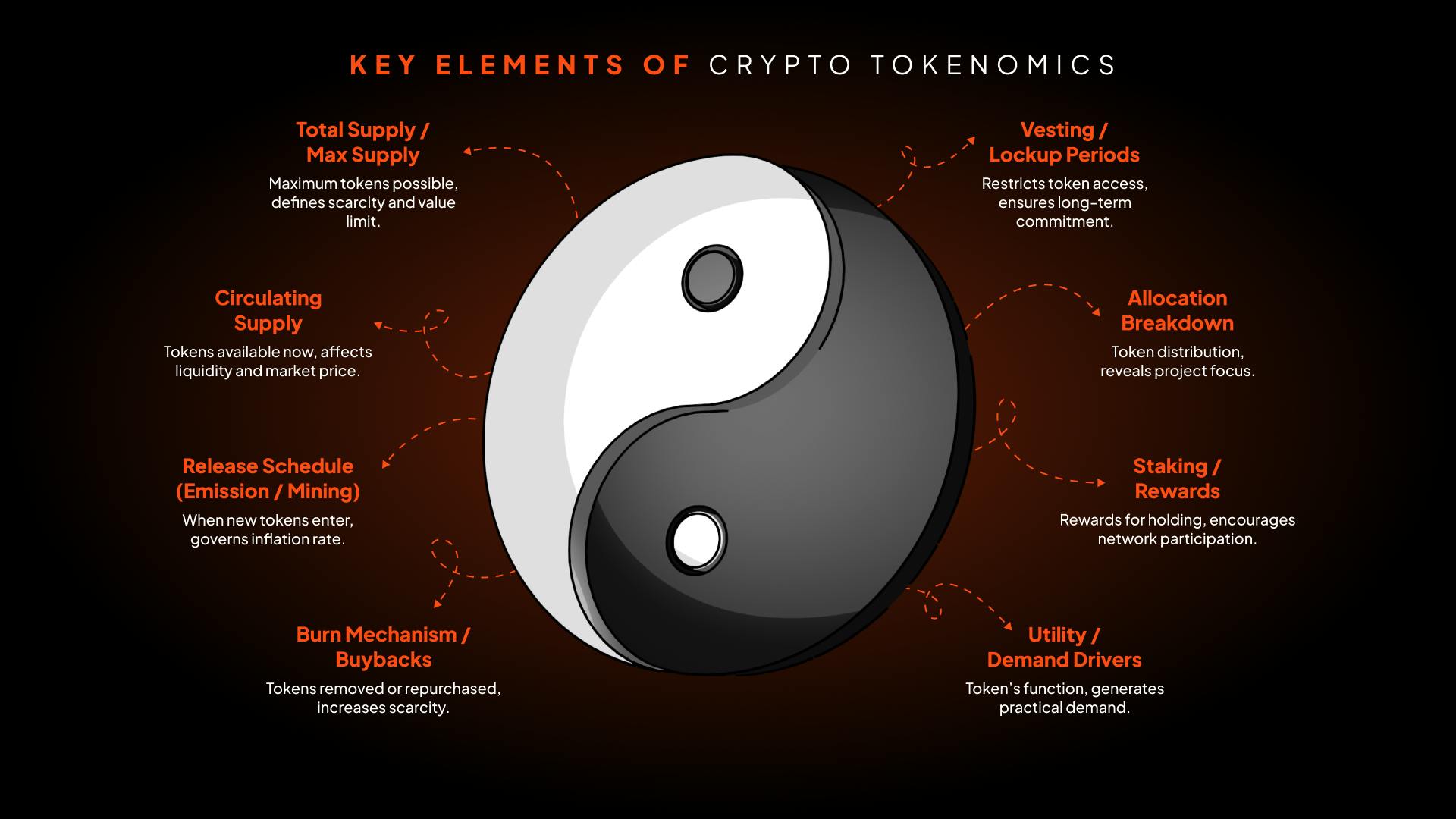

Tokenomics combines "token" and "economics" to describe a cryptocurrency’s economic model and value dynamics. It outlines how tokens work, including supply, demand, and distribution rules. Investors and developers use tokenomics to assess a project’s potential success.

This concept matters because it drives a token’s value and purpose. Clear tokenomics can signal a strong, reliable project. Poor design may lead to instability or failure over time.

Good tokenomics benefits investors by showing a token’s growth potential. It helps them predict returns based on supply limits or usage incentives. Projects with solid tokenomics attract more funding and trust.

For sustainability, tokenomics ensures a project’s long-term survival. It balances rewards, costs, and token circulation to maintain stability. Without this, even promising projects can collapse quickly.

XCM, Coinmetro’s utility token, powers specific functions within its ecosystem. It demonstrates how thoughtful tokenomics can support real-world use. With a deflationary model and built-in rewards, XCM offers real utility while supporting platform growth. Let’s explore how XCM and other tokenomics shape crypto success.

In this blog, you will learn about:

- Crypto tokens and tokenomics models

- Coinmetro’s XCM unique tokenomics and utility

- How tokenomics influences value growth

Cryptocurrencies fall into different categories based on their function and economic design. Each type has unique tokenomics that shape its value, demand, and long-term potential.

Utility tokens grant users access to platform features and services. They can offer trading fee discounts, staking rewards, governance rights, and other exclusive perks. These tokens power exchange platforms, DeFi protocols, and various blockchain systems.

Utility tokens include exchange tokens that improve cryptocurrency trading platforms. They may provide fee reductions, staking rewards, VIP access, and special features. Some, like Coinmetro’s XCM token, use buyback-and-burn methods to cut supply and boost value.

Such tokens enhance liquidity incentives, trading systems, and user participation. They remain vital for both centralized and decentralized exchanges

Examples include XCM (Coinmetro), KCS (KuCoin), OKB (OKX), and others.

Governance tokens give holders a voice in decentralized platform decisions. They work in DeFi systems and DAOs (Decentralized Autonomous Organizations), impacting fees, upgrades, and funds. Users can vote on plans, steer projects, and set rules.

Holders earn these tokens by staking, mining liquidity, or receiving airdrops. These rewards offer voting power to active community members and increase their involvement in blockchain networks.

Examples include UNI (Uniswap), COMP (Compound), and AAVE (Aave), which govern major DeFi platforms and ensure decentralized control over financial services.

Stablecoins are designed to keep a fixed value by being pegged to fiat currencies, goods, or using math rules. These tokens offer a steady exchange method in crypto markets. They cut down price swings and allow quick, cheap transfers.

Some stablecoins have physical backing, such as USDT (Tether) and USDC (USD Coin). These hold real dollars in reserve to keep a 1:1 rate. Others, like DAI (MakerDAO), are algorithmically maintained and backed by crypto collateral.

Stablecoins serve key roles in trading, DeFi applications, and payments. They bring both liquidity and price stability.

Meme coins grow from community support, social media buzz, and speculative trading. They often lack strong utility, relying on online hype and influencer backing. Examples like Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe Coin (PEPE) attract huge followings without clear purposes. Unlike utility or governance tokens, meme coins are more prone to swing with market mood. They depend on community energy and speculation, not function.

DeFi (Decentralized Finance) tokens power financial services such as lending, borrowing, staking, and trading without relying on traditional banks. They work in smart contracts and DEXs (Decentralized Exchanges) to support liquidity and governance.

Many DeFi tokens reward users for staking or adding liquidity. Examples include CRV (Curve) for stablecoin pools and SUSHI (SushiSwap) for trading. MKR (Maker) helps manage the DAI stablecoin system. Their value comes from protocol use, yield farming, and governance roles. DeFi tokens fuel the growth of decentralized finance networks.

Other types of specialized tokens serve distinct roles within the crypto ecosystem, expanding beyond standard utility, governance, and DeFi models:

Security Tokens: Security tokens represent ownership of real-world assets, such as stocks, real estate, or company equity, and are subject to financial regulations. These tokens provide dividends, revenue-sharing, or voting rights and must comply with securities laws.

Payment Tokens: Payment tokens function primarily as digital currencies for peer-to-peer transactions and potentially as a store of value. Examples like BTC (Bitcoin), LTC (Litecoin), and XRP (Ripple) are used for payments, remittances, and decentralized transfers without intermediaries.

Liquid Staking Tokens: Liquid staking tokens allow users to stake assets while maintaining liquidity for DeFi applications. stETH (Lido’s staked ETH) and rETH (Rocket Pool’s staked ETH) represent staked Ethereum, enabling users to earn staking rewards while using their tokens in DeFi.

Gaming & Metaverse Tokens: Gaming and metaverse tokens fuel virtual economies, allowing users to buy, sell, and trade in-game assets, virtual land, and NFTs. Examples like SAND (The Sandbox) and MANA (Decentraland) enable digital ownership and monetization within blockchain-based virtual worlds.

XCM is the utility token powering the Coinmetro exchange. It is designed to enhance your trading experience while offering multiple ways to earn and grow your crypto. Coinmetro integrates XCM into every service, ensuring real utility and practical use:

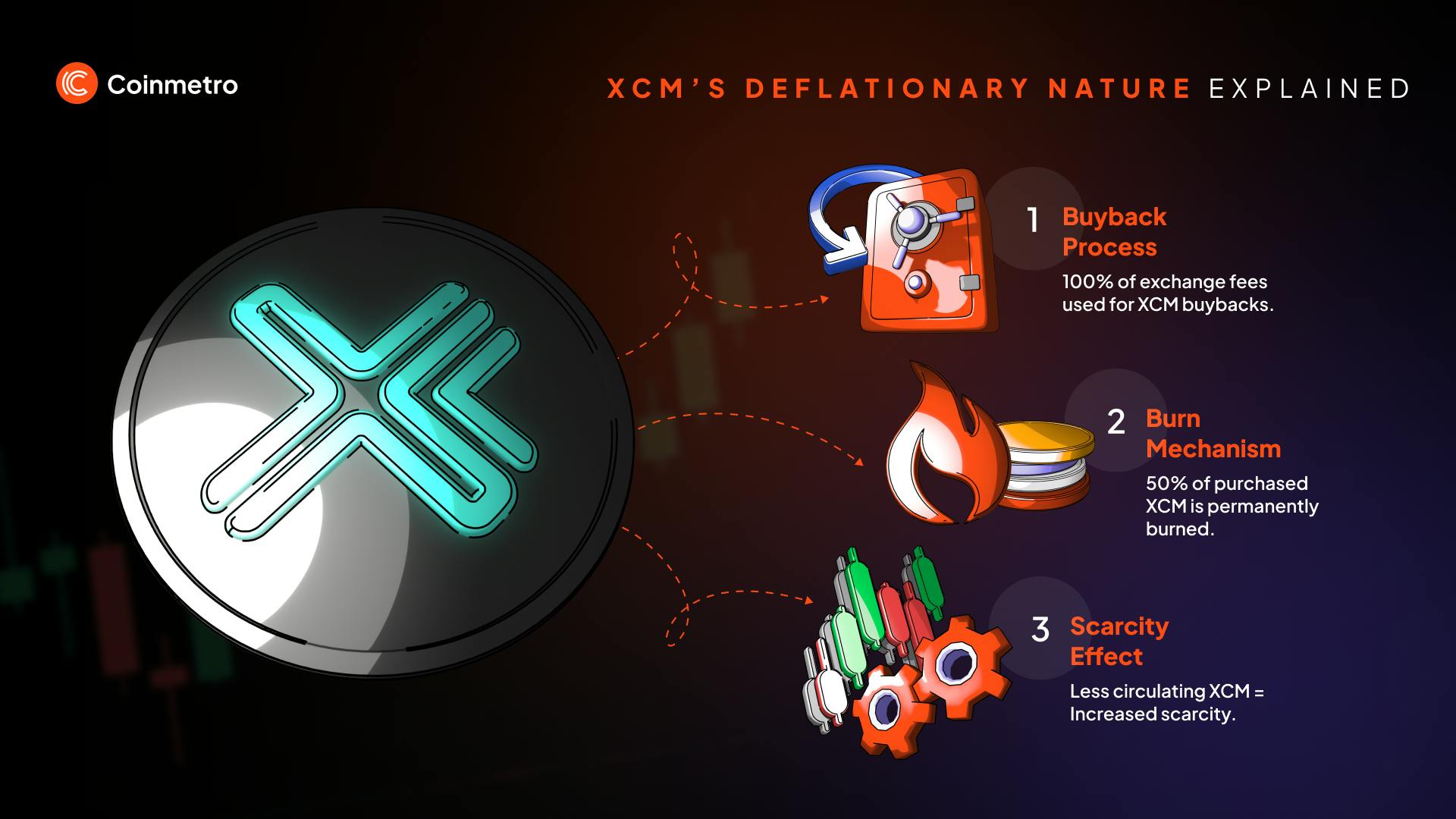

Coinmetro employs an ingenious deflationary model to support XCM's value. The platform uses 100% of all exchange fees to buy back XCM from the order book. Then, 50% of the purchased XCM is permanently burned and eliminated from circulation, reducing the total supply over time. This deflationary nature creates scarcity and is engineered to increase the price even if demand stays the same.

Staking XCM provides unique passive income opportunities. Through the Multi-Asset Rewards (MARs) program, staking XCM allows you to earn rewards in XCM and other cryptocurrencies like ADA, FLUX, and MATIC. This feature enables portfolio diversification while offering you a passive income plan that makes money while you sleep.

Stake XCM on MARs (Multi-Asset Rewards): The Unparalleled Passive Income Plan

Levels is Coinmetro's loyalty system that rewards active traders. Are you one? With every trade, you earn Points, and staking XCM multiplies these points, accelerating your progress through different Levels. Advancing in Levels unlocks king-size benefits such as fee discounts, free monthly swaps, and reduced withdrawal fees.

Tokenomics shapes a cryptocurrency’s value through supply rules and more. Bitcoin caps its supply at 21 million, creating scarcity that can increase the price over time. This is a hard-wired feature that cannot be changed. Some meme coins, on the other hand, often flood the market with tokens, diluting supply and potentially reducing value due to unsustainable economic mechanisms.

Scarcity is essential from an economic perspective because limited supply combined with steady or increasing demand drives value appreciation. In contrast, inflationary tokens often struggle to retain worth. Inflation can erode an asset's purchasing power because more “money” is now chasing the same amount of goods. This contrast highlights why careful supply design is crucial for long-term value in crypto and in finance at large.

As mentioned, XCM’s buyback system uses Coinmetro fees to purchase XCM tokens from the order book. Burning half of those tokens cuts supply and increases scarcity, aiming to increase XCM’s value over time. With less XCM in circulation but the same buying demand, the value increases. This deflationary mechanism puts XCM in a league of its own.

Solid tokenomics involves keeping a project running and growing potentially forever. Adoption rises when tokens offer real benefits, like XCM’s discounts, rewards, and deflationary nature. Sustainable models avoid quick hype and build steady use instead. Strong tokenomics can turn a coin into a reliable asset.

Tokenomics defines a cryptocurrency’s success by shaping its supply, demand, utility, and more. Strong tokenomics models prove that thoughtful design drives value and adoption in the long run because they are valid from a monetary engineering perspective. Investors and users benefit when projects prioritize sustainability over short-lived hype.

As an example, Bitcoin’s fixed 21-million-coin supply ensures scarcity, which has proved to amplify value appreciation as demand increases. Coinmetro’s XCM buyback-and-burn system actively cuts the circulating supply, creating a deflationary system.

Today, several cryptocurrencies have successful tokenomics models. However, the entire crypto landscape is no older than 16 years. Furthermore, the majority of the assets were created even more recently. At large, the industry is still young. History has shown that poorly engineered tokens fade fast due to oversupply, weak utility, and other irresponsible tokenomics. As humanity continues to redefine the meaning of money, smart tokenomics merges innovation, technology, and sound monetary principles to create a more efficient financial future.

▶️ Watch: Understanding Crypto Tokenomics and Fundamentals

Join the Coinmetro community on Discord and Telegram, where forward-thinking traders and investors gather to share insights, explore new opportunities, and dive deep into cryptocurrencies. Should you need any help, please contact our world-class Customer Support Team via 24/7 live chat or email at hello@coinmetro.com.

To become a Coinmetro user today, Sign Up now or head to our new Exchange if you are already registered to experience our premium trading platform.

Tags

Related Articles

Regulatory Sandboxes: Fostering Crypto Innovation Within Legal Frameworks

The cryptocurrency industry’s fast rise fuels an important debate. Innovation aims to transform finance, enhancing speed and access. Yet, regulators…

5m

Crypto Options Trading: Strategies and Market Insights

Cryptocurrency markets have rapidly expanded beyond simple buying and selling. One of the most significant developments has been the rise of…

6m

The Rise of Social-Fi: Blending Social Media with Decentralized Finance

In recent years, social media and finance have started to merge, creating Social-Fi. This concept blends the engagement of social platforms with…

6m

DeFi Insurance Platforms to Watch in 2024

Decentralized Finance (DeFi) insurance addresses the growing need for insurance against hacks, smart contract failures, and other DeFi-related risks.…

7m