Robinhood Competitors

February 7, 2021

by Kamil S

February 7, 2021

Millions of people have joined Robinhood lured by the promise of no trading fees. But why are these people now looking to transfer their digital assets elsewhere? Here’s a quick summary why that may be and a list of Robinhood competitors to choose from.

- In December 2020, Robinhood paid a $65 million fine to settle the charges by the Securities and Exchange Commission.

- In January 2021, Robinhood temporarily disabled a feature on its app that allows users to buy crypto securities instantly.

- Robinhood’s strongest competitors that everyone’s googling right now are Webull, E*trade, Stash, M1 Finance, and CoinMetro.

What happened to Robinhood and why are Robinhood competitors on their toes?

A catchy name with a hook, a sleek app, a massive success, an unbelievable number of users – how come Robinhood’s practices lead to more and more regulatory scrutiny, complaints, and fines?

Let’s dive into the crypto market’s hottest topic!

Robinhood’s story began at Stanford, where its co-founders Baiju Bhatt and Vlad Tenev were classmates and roommates.

Later, the two packed their bags for New York City and built two finance companies, selling their own trading software to hedge funds. This is how they came to discover that Wall Street giants were paying next-to-nothing to trade stocks. At the same time, most Americans were charged commission for every single trade.

So they decided to start a revolution by building a financial product that would enable everyone access to financial markets. In other words, Robinhood stands for democratizing finance. So does Coinmetro.

“Finance for all” is a bulletproof mission and vision that’s helped many companies to attract thousands and millions of users, pushing the greedy financial conglomerates to the side of the game. Which is only fair – we as customers want to be treated with respect and appreciate the price-quality ratio.

With Robinhood being one of the best crypto players in the industry, why are the users now looking to transfer their digital assets to its competitors?

How does Robinhood make money? Millions of people joined Robinhood lured by the promise of no trading fees.

In December 2020, the Securities and Exchange Commission claimed that Robinhood had misled its customers about how it was paid by Wall Street firms for passing along customer trades. Also, that the startup company had made money at the expense of its customers.

Robinhood agreed to pay a $65 million fine to settle the charges – pay attention to this – without admitting or denying guilt.

2021 starts with another outrageous move by Robinhood.

“Due to extraordinary market conditions, we’ve temporarily turned off Instant buying power for crypto. Customers can still use settled funds to buy crypto,” a Robinhood spokeswoman said last Friday.

In essence, what happened is that Robinhood disabled a feature on its app that allows users to buy crypto securities instantly.

Chances are, Robinhood users will soon be flocking to other crypto exchanges. What are the strongest Robinhood competitors and what makes them special?

Is Webull safe? Yes.

In fact, both firms offer very similar trading opportunities, allowing you to trade U.S. stocks, ETFs, options, and ADRs.

The biggest advantages of Webull app and desktop platform are a unique community experience and easy-to-use features that most young investors will find satisfying. Webull also supports short sales of stock. When it comes to everyday investing, however, Webull lacks the trading tools and features to compete with the industry leaders.

When it comes to crypto, Robinhood uses Robinhood Crypto to offer cryptocurrency investment options, while Webull uses its main brand.

E*trade has been in the brokerage industry for decades. It’s one of the first brokerages to gain online presence. That is why it’s much more user-friendly than Robinhood, and allows you to personalise and customise your experience on the go.

In addition, E*trade platforms and apps have more features. True, compared to E*trade, Robinhood offers a very humble selection of tools for investment analysis, for example. It’s been designed to make trading accessible and easy.

Overall, the services overlap, and you can buy the most popular securities and cryptocurrencies from both brokers.

Both providers are user-friendly and accessible to anyone looking to make an investment into ETFs or digital assets.

The main difference between Stash and Robinhood, however, is that Stash is definitely preferable for first-time investors as it offers more guidance. A good example of this would be SRI (socially responsible investing) portfolios. That is, users can make investments based on their values.

M1 Finance app and platform stand for good old investing. It offers features that are great for long-term and dividend investors, while Robinhood is a more beginner-friendly app that is better for those who want to make trades with individual positions or access options and cryptocurrency trading.

There are some unique features offered only through M1 Finance – for instance, retirement accounts or automatic portfolio rebalancing when adding or withdrawing funds.

Before launching, we learnt a lot from the mistakes of others, and even more. Coinmetro prides itself on being the industry’s best crypto platform and app available for both beginners and pros. Now the key thing is – you cannot deposit or withdraw crypto on Robinhood. So does this mean you are actually trading crypto? If you decide you want to trade somewhere else (or take advantage of arbitrage for example), you need to sell your crypto and then withdraw in fiat. This also comes with tax implications in many countries.

On Coinmetro you own your crypto. You can deposit and withdraw any time you like.

We took a step further right from the start and launched a demo version of our exchange. It saves a potential customer a lot of time to understand whether they want to continue with us or not. But what’s not to like?

Coinmetro is easy to use, offers an array of cool features, has an option of copy trading, and much, much more. Equally important, we made 24/7 assistance our priority and managed to form an amazing community – with a lot of blood and tears.

And if you’re looking for one of the most rewarding crypto affiliate programs in the industry – Coinmetro is your destination as well. It doesn’t get better than this.

Robinhood may not be as transparent as they claim to be. Generating income from payments for order flow is seen as a controversial practice.

Facing charges and taking outrageous actions, Robinhood may lose the customers’ trust. Alienating the core customer base will lead to the rise of Robinhood competitors – Webull, E*trade, Stash, M1 Finance, and CoinMetro among other popular names in the industry.

Meanwhile, you’re welcome to explore the crypto-verse through Coinmetro.

Why choose us? Believe it or not, crypto is the future, and Coinmetro is your time machine. There’s a lot to discover! Don’t hesitate to sign up today for the ultimate crypto-experience at real, close-to-zero fees.

Need assistance or guidance? We’re always there to help. Find out how you can contact us round the clock.

Related Articles

Coinmetro 2026 Roadmap: Focus, Simplicity & Real-World Impact

This post explains not only what we’re building in 2026 — but why. This year represents a deliberate strategic choice. The exchange market has…

3m

Coinmetro Officially Files for MiCA in Malta

This is a major milestone for Coinmetro. We’re proud to announce that Coinmetro has successfully filed its MiCA application in Malta, marking the…

2m

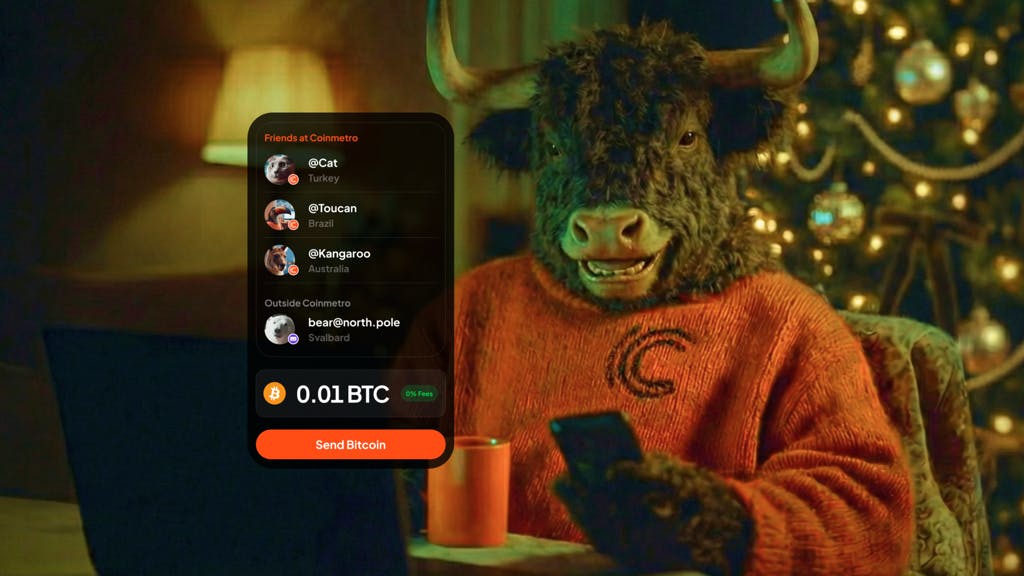

Zero Fees. Zero Waiting. Introducing Coinmetro Internal Transfers.

Moving value to friends and family just became instant, free, and borderless. Crypto was built to move at the speed of the internet. But too often,…

4m

Worldcoin (WLD) Now Listed on Coinmetro

We’re adding another asset to broaden user choice on Coinmetro: Worldcoin (WLD). This listing gives users who are interested in emerging…

2m