Companies & Banks Investing In Crypto & Blockchain

October 13, 2022

by Kamil S

October 13, 2022

Some years ago, Bitcoin and other digital assets were for adventurous investors only. An important inflection point in the current crypto timeline was when huge, successful companies started buying digital assets. These institutional investors did so by buying hundreds of millions worth of Bitcoin and other coins. The banking cartel joined the revolution. The likes of CitiBank, Standard Chartered or JP Morgan acquired blockchain companies and started offering digital assets trading to their clients, signaling the inevitable: worldwide adoption. Why are big companies such as Microstrategy or big banks acquiring huge positions in digital currency and how is this working out for them?

Topping the Bitcoin holders list is MicroStrategy – a company at the forefront of business analytics. For the last few years, the mobile and cloud-based services enterprise has continued to buy Bitcoin, gradually increasing its position. As of September 20, 2022, the software giant was holding 130,000 BTC, announcing a plan to buy more. Recently, MicroStrategy announced plans to sell $500 million worth of shares in order to buy more of the digital asset.

Even though the enterprise could have made a significant profit during the last bull market, it chose to hold and increase its position. Michael Saylor (MicroStrategy CEO) alone was holding around 17,732 BTC in 2021, worth more than $800 million at the time. It’s interesting to note that in 2013, Michael Saylor initially forecasted that Bitcoin’s days are numbered.

After announcing the BTC investment in 2021, MicroStrategy’s stock soared more than 400% in a very short time, with the tech giant registering all-time highs since the dot-com boom.

At the end of 2021, Tesla was holding $2 billion worth of Bitcoin. Not only this, but the company also accepted BTC as payment for its cars for a while. To put this into perspective, the electric car manufacturer had more Bitcoin than eight of the top ten corporate holders.

Elon Musk was frankly outspoken in regard to the future of crypto:

“I believe in the long-term potential of digital assets, both as an investment and also as a liquid alternative to cash”

At the time of purchase, the investment represented roughly 10% of Tesla’s cash reserve. It’s important to note that in Q1 2021, the company made more profits from Bitcoin than from selling cars. The $2 billion worth of the digital asset was acquired at a 25% lower price – with $1.5 billion – meaning that at the end of 2021 Tesla had roughly half a billion dollars in profit from BTC alone. At this point, the EV manufacturer still holds about 10,500 BTC.

But Bitcoin is not the only digital currency that the Mars explorer fancies. In 2021, Elon Musk also advocated for Dogecoin – widely known as the first meme coin. Elon repeatedly supported the currency in the last couple of years and now Tesla accepts Dogecoin as payment for merchandise. Moreover, SpaceX – the mogul’s space exploration company has announced it will soon follow suit.

Formerly known as Square, the company run by Jack Dorsey (former Twitter CEO) has an ongoing commitment to Bitcoin. In Dorsey’s own words: “the company plans to assess its aggregate investment in Bitcoin relative to its other investments on an ongoing basis”. In other words, the BTC buying won’t slow down, with the company being committed to long-term hodling.

At the moment, the payments enterprise owns around 8000 Bitcoin in its portfolio worth $152 million. But according to Dorsey’s plans, the company won’t stop there as Block has started building its own mining rigs. Plans for a Bitcoin hardware wallet are also in the works, as the tech giant has sealed its commitment to the digital currency.

We discussed how the corporate environment has made huge moves toward digital assets. But institutional investors aside, the banking system also started to take note and several years ago decided it was no longer convenient to watch from the sidelines.

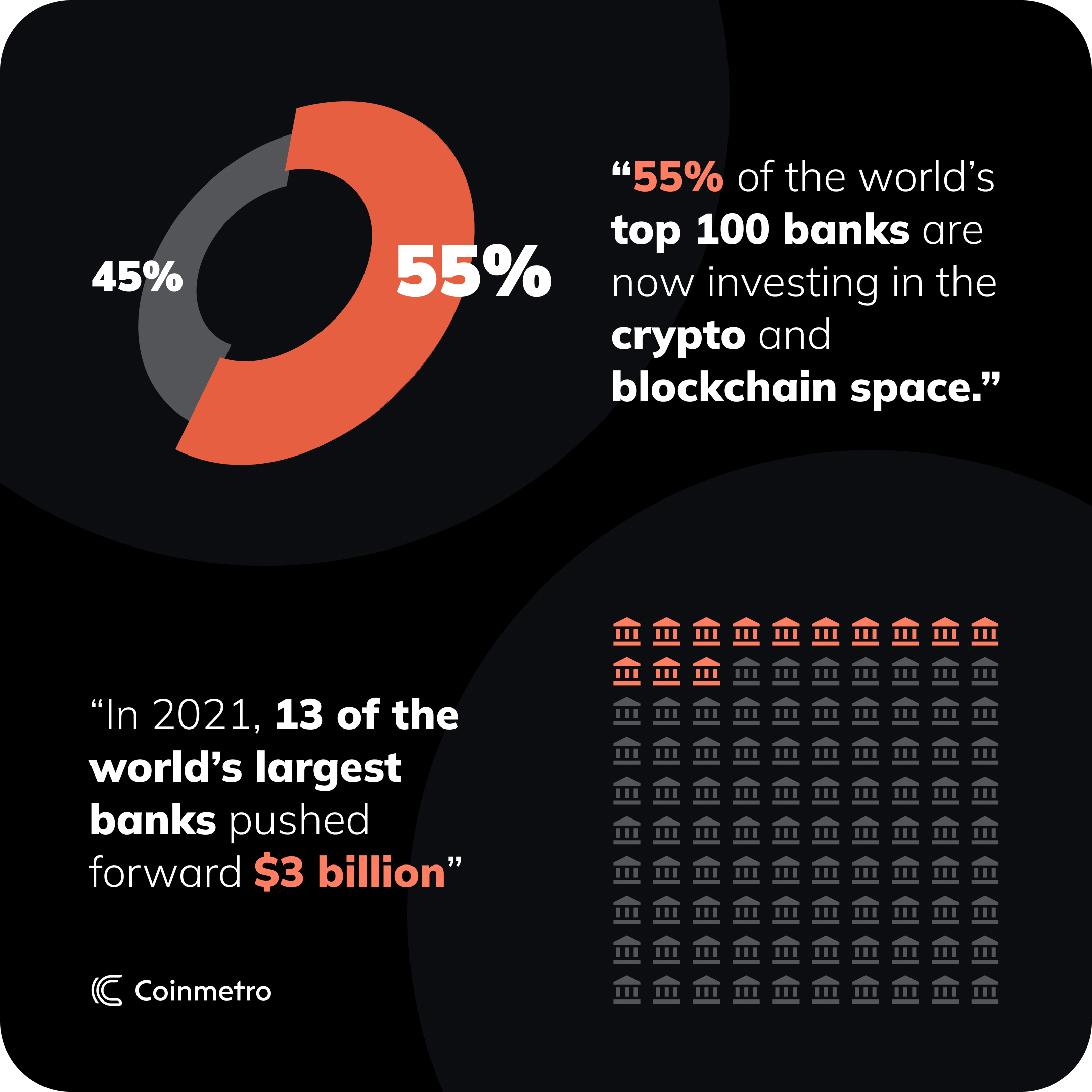

Just how big are the banks moving in on crypto? Around 55% of the world’s top 100 banks are now investing in the crypto and blockchain space. Not only do they hold assets, but they are also funding blockchain projects and start-up businesses because they want a hand in the entire crypto industry. More specifically, in 2021, 13 of the world’s largest banks pushed forward $3 billion in funding for companies that are making waves in the blockchain landscape. It’s an effort with long-term implications.

With all the pros and cons of the industry, it’s safe to say that banks smell where value and change can be found. Banks have financed all major developments of modern society: the railroad, the car, industrial developments, and now in the blockchain economy:

- London-based giant Standard Chartered leads the way with over $380 million spread across 6 investments. In its scope – Ripple – whose XRP token hovers in the top 10 crypto assets, for successfully disrupting the payments industry.

- On the other side of the ocean, JP Morgan has recently said (May 2022) that Bitcoin has “significant upside from here”, stating that the asset could rise to $38,000, unlike real estate – an industry which they do not currently fancy. All this while also investing in blockchain company TRM Labs.

- In 2021, Citibank launched a digital assets unit, confirming its crypto plans. Along this line, the bank is making plans for offering cryptocurrency trading, custody and financing options.

- Examples carry on with the likes of Wells Fargo and Goldman Sachs establishing digital currency teams and hiring intensively for the purpose.

Companies shaping today’s world for the better have well-understood the power of digital assets. The wave of institutional investors signals something more profound than just individuals making money from crypto. The fact that huge companies with decades of experience are choosing to invest in Bitcoin and other crypto is a strong display of mass adoption.

For banks, on the other hand, it’s not a question of whether or not crypto has a future. But rather – how can they get a hand in the industry so that they have leverage and control.

Going forward, crypto global adoption will be a thing of open collaboration between governments, financial institutions and all major corporate verticals. Today, banks already have a good grip on the crypto and blockchain sectors and they won’t slow down. Hopefully, this will add more value to people, bring innovation to the space and offer transparent and inclusive economic products.

If you would you like to read more similar articles, head over to the Crypto & Market News section on our blog to stay up to date with the rapid pace of crypto development. Dive into our Learning Lab and learn crypto from the inside out so you can become a better investor and trader. Let us know what you think on Coinmetro’s Discord and Telegram channels – a community focused on collective growth.

To start trading and investing today, sign-up for an account, or head to our new exchange if you are already a user, to experience a premium trading platform.

Related Articles

Coinmetro Officially Files for MiCA in Malta

This is a major milestone for Coinmetro. We’re proud to announce that Coinmetro has successfully filed its MiCA application in Malta, marking the…

2m

Zero Fees. Zero Waiting. Introducing Coinmetro Internal Transfers.

Moving value to friends and family just became instant, free, and borderless. Crypto was built to move at the speed of the internet. But too often,…

4m

Worldcoin (WLD) Now Listed on Coinmetro

We’re adding another asset to broaden user choice on Coinmetro: Worldcoin (WLD). This listing gives users who are interested in emerging…

2m

🚀 Coinmetro Lists $WLFI

Crypto’s momentum in the United States has never been stronger — and one of the most talked-about tokens of 2025 is officially coming to Coinmetro.…

3m