USDT Explained: A Stablecoin for Crypto On-Ramps, Payments, and More

December 5, 2025

by Coinmetro Editorial Team

December 5, 2025

USDT, introduced by Tether in 2014, is the first and most widely used stablecoin in the crypto market. It is pegged to the U.S. dollar at a 1:1 ratio, aiming to maintain price stability, unlike other volatile cryptocurrencies and assets. USDT simplifies entry into crypto trading by offering a stable on-ramp for new users. Moreover, traders use it to secure gains without cashing out to fiat currencies. For payments, it enables fast, low-cost transactions across borders with minimal volatility and fees.

In 2024, Tether achieved a net profit exceeding $13 billion, reflecting its robust financial performance. This substantial profit underscores Tether's dominant position in the stablecoin market and its pivotal role in the broader cryptocurrency ecosystem. Read on to understand what has driven Tether’s continued success and how you can benefit from the world’s most popular stablecoin on Coinmetro Exchange.

This blog will outline:

- What is USDT and how does it work

- Key benefits of using USDT

- How to buy USDT: Step-by-step guide

- Using USDT for crypto trading

- USDT as a payment solution

- USDT risks and regulation

Learn More about Stablecoins: Purpose, Types & Influence on the Crypto Market

Tether was launched in 2014 and founded by Brock Pierce, Reeve Collins, and Craig Sellars. It aimed to bridge fiat and crypto, easing trading and liquidity on exchanges. Today, USDT dominates as a key tool for traders and payments.

USDT functions as a stablecoin tied to the U.S. dollar. It maintains a 1:1 peg, offering price stability amid crypto market volatility. Unlike other cryptocurrencies, USDT avoids wild price swings by design.

Tether Ltd. states that it backs each USDT with reserves, primarily U.S. dollars and equivalents. It adjusts supply through issuance or burning to align with demand and peg stability. Audits and transparency reports seek to verify this backing continuously, though some criticism persists.

Explore which USDT Pairs Are Available on the Coinmetro Exchange

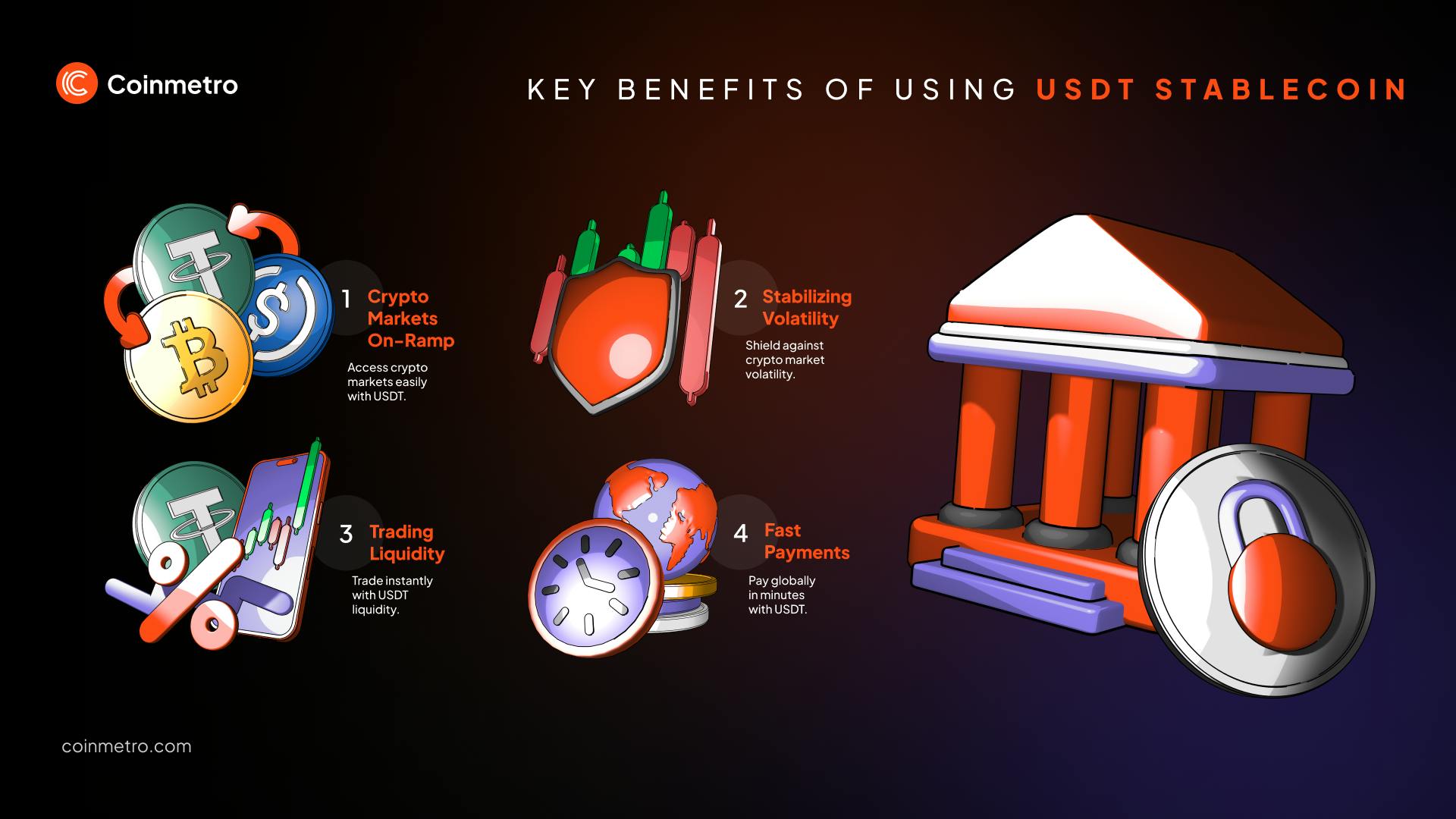

Stability Amidst Crypto Volatility: USDT offers a steady value, pegged 1:1 to the U.S. dollar. Traders rely on it to hedge against sharp market drops in assets like Bitcoin. This stability preserves capital during crypto’s unpredictable swings.

Easy Access & Global Acceptance: Exchanges worldwide list USDT, making it simple to acquire and use. Its broad adoption spans reputable platforms like Coinmetro and decentralized protocols. Users enter crypto markets effortlessly with this stablecoin.

Fast, Low-Fee Payments: USDT enables quick, low-cost payments on blockchains like Ethereum or Tron. Transactions settle in minutes, unlike banks that delay transfers and charge high fees. Its stable value protects recipients from crypto volatility when the situation calls.

Growing Adoption for Global Transactions: Merchants and firms adopt USDT as an alternative to slow fiat systems. Its efficiency and reliability suit cross-border payments for businesses and individuals. Usage rises as trust in its pegged value strengthens.

Discover Innovations and Challenges in Algorithmic Stablecoins

Coinmetro stands out as a regulated exchange supporting USDT purchases with fiat. Based in Tallinn, Estonia, it complies with the Estonian Register of Economic Activities, the U.S. Financial Crimes Enforcement Network (FinCEN), and the Australian Transaction Reports and Analysis Centre (AUSTRAC).

The intuitive Coinmetro platform suits both beginners and pros, offering an easy on-ramp into crypto via the USDT stablecoin, other stablecoins like USDC, DAI, or direct Credit Card crypto purchases.

Simply register on Coinmetro using your email, a secure password, and basic personal details. Submit a government-issued ID and proof of address for KYC verification. Most users complete this process in under 10 minutes, enabling trading instantly.

Fund your account via SEPA transfer, SWIFT, or Debit and Credit Card after verification. Simply buy USDT with just a few clicks and start trading, sending payments, or holding a stable digital asset with ease.

Learn How Decentralized Stablecoins like DAI, FRAX, and sUSD Work

USDT acts as a critical conduit linking fiat currencies to crypto markets seamlessly. Exchanges like Coinmetro, Coinbase, and Kraken list USDT trading pairs for crypto assets like Bitcoin, Ethereum, and other altcoins.

You can convert dollars or euros into USDT instantly. USDT’s liquidity allows you to buy and trade crypto on the fly. When ready, you can seamlessly convert digital assets back to USDT, locking in gains, avoiding volatility, and ensuring uninterrupted access between crypto markets and traditional finance.

USDT’s 1:1 price peg to the U.S. dollar offers traders a shield against crypto’s wild price swings. This stability lets them wait out turbulence without cashing out to fiat, preserving capital for future moves. Experienced traders pair it with stop-loss strategies, using USDT as a buffer against sudden dips. Its reliability has cemented its role as a cornerstone in risk management across the crypto space.

As mentioned, USDT delivers fast, low-cost international payments via blockchain networks like Ethereum or Tron. You can send funds across borders in minutes, avoiding bank delays and high fees. Traditional wire transfers often cost 1-5% and take days to settle, especially in underserved regions. In contrast, USDT transactions incur minimal fees and are confirmed in seconds. This efficiency makes it a compelling alternative for global financial transactions.

Migrant workers use USDT for remittances, slashing costs and delays compared to services like Western Union. Freelancers globally, such as designers on Upwork, accept USDT to bypass slow bank payouts and currency conversion losses. In Argentina, small merchants accept USDT payments, dodging inflation and slow fiat systems. Travel platforms like Travala also accept USDT for hotel bookings, proving its versatility. These cases highlight USDT’s growing role in everyday finance.

Businesses accepting USDT tap into a global customer base unbound by fiat restrictions. You can process payments instantly, cutting out intermediaries and reducing transaction fees significantly. The stablecoin’s pegged value shields revenue from crypto volatility, unlike accepting crypto directly. E-commerce sites like Shopify integrate USDT, boosting sales from crypto users. Firms save on cross-border costs, with fees as low as 0.5% versus 3% for credit cards. Plus, offering USDT signals innovation, attracting tech-savvy clients and enhancing brand appeal.

Tether claims each USDT token matches one dollar in reserves. Critics question this, citing limited independent audits. In 2021, Tether settled a $41 million fine with the CFTC over misleading reserve statements.

However, today, Tether releases quarterly attestations, not full audits, showing cash and equivalents. These reports confirm reserves but lack detail on asset quality or liquidity. Still, Tether’s dominance in trading pairs across so many exchanges sustains its use. Transparency gaps persist, so assess this risk before investing.

USDT operates in a dynamic regulatory landscape. The U.S. pushes for stablecoin oversight, with bills like the Clarity for Payment Stablecoins Act in focus. Compliance could force Tether to improve reserves and reporting.

Across the Atlantic, the EU’s MiCA framework imposes strict reserve rules on stablecoins, fully effective since December 30, 2024, with a mandatory compliance deadline in 2026. Tether, headquartered in the British Virgin Islands, is not yet 100% compliant with demands for an EU e-money license and 60% cash reserves in European banks. This has triggered delistings across some exchanges operating in Europe.

However, as of March 2025, until the 2026 compliance deadline, USDT remains tradable and custodial on various European crypto exchanges, including Coinmetro.

Tether’s USDT holds its ground as the top stablecoin, driven by a $13 billion profit in 2024. Its dominance is fueled by deep liquidity, widespread adoption, multi-chain availability, and a strong presence in global payments and trading. Traders value USDT’s liquidity and its role in dodging crypto volatility effectively. For payments, it outperforms slow fiat systems, gaining traction with merchants and freelancers alike.

Still, doubts over fully audited reserves and regulatory hurdles persist. Securing your holdings and watching legal changes remain key to its safe use. Tether’s future rests on proving its reserves and meeting global compliance demands. It excels as a crypto on-ramp and payment tool when challenges are managed well.

▶️ Watch: What’s Next for USDT? Interview With Tether CEO

Join the Coinmetro community on Discord and Telegram, where forward-thinking traders and investors gather to share insights, explore new opportunities, and dive deep into cryptocurrencies. Should you need any help, please contact our world-class Customer Support Team via 24/7 live chat or email at hello@coinmetro.com.

To become a Coinmetro user today, Sign Up now or head to our new Exchange if you are already registered to experience our premium trading platform.

Tags

Related Articles

Regulatory Sandboxes: Fostering Crypto Innovation Within Legal Frameworks

The cryptocurrency industry’s fast rise fuels an important debate. Innovation aims to transform finance, enhancing speed and access. Yet, regulators…

5m

Crypto Options Trading: Strategies and Market Insights

Cryptocurrency markets have rapidly expanded beyond simple buying and selling. One of the most significant developments has been the rise of…

6m

The Rise of Social-Fi: Blending Social Media with Decentralized Finance

In recent years, social media and finance have started to merge, creating Social-Fi. This concept blends the engagement of social platforms with…

6m

DeFi Insurance Platforms to Watch in 2024

Decentralized Finance (DeFi) insurance addresses the growing need for insurance against hacks, smart contract failures, and other DeFi-related risks.…

7m