Non-Custodial Staking: Complete Guide

18 de fevereiro de 2025

by Coinmetro Editorial Team

18 de fevereiro de 2025

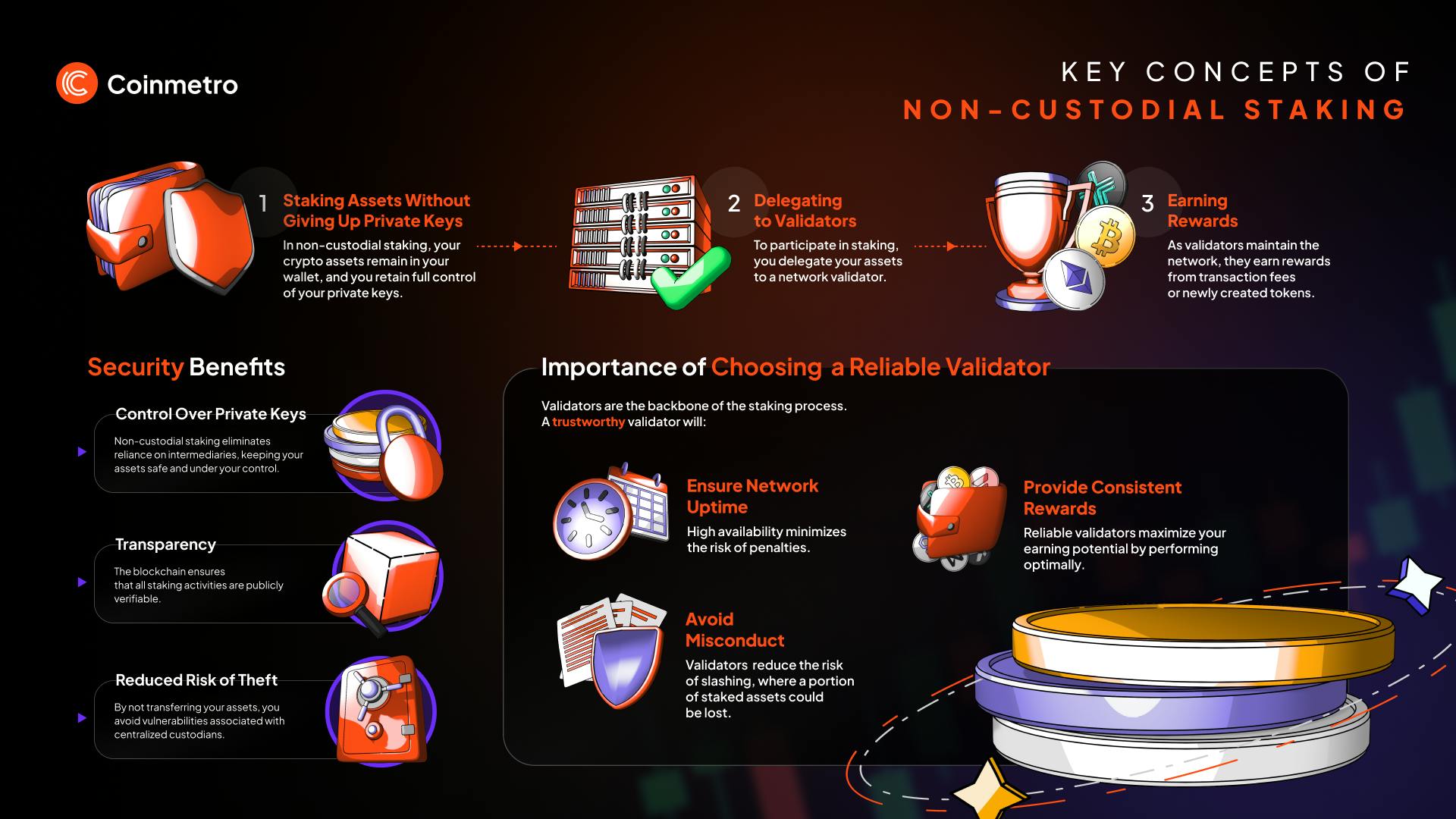

Non-custodial staking enables crypto holders to secure blockchain networks and earn rewards while maintaining control. Your staked assets remain in your wallet, not handed to a third party. By managing your private keys, your assets remain secure.

The risks associated with centralized staking services have increased awareness. Non-custodial staking is gaining traction as more users prioritize asset control and security. Staking while keeping custody of your assets embodies blockchain's decentralized principles. It empowers users to contribute directly to network consensus without taking on unnecessary risks.

In this blog, you will learn about:

- What is non-custodial staking?

- How non-custodial staking works

- Benefits

- Risks and considerations

- Getting started with non-custodial staking

- Best practices

Discover Passive Income in Crypto: A Guide to Staking, Lending & Yield Farming

Non-custodial staking refers to participating in a blockchain's staking mechanism (validating the network) without giving up control of your assets. In this system, your funds remain in your wallet, and you retain full access to your private keys. Doing so contributes to network security and consensus while keeping your crypto secure. The key characteristic of non-custodial staking is the ownership and control you maintain over your assets, which helps reduce security risks.

Difference From Custodial Staking: Custodial staking requires you to hand over control of your funds to a third party, like an exchange or staking pool. This means the service provider manages your private keys and can stake on your behalf. While custodial staking offers convenience, it potentially exposes your assets to risks, such as hacks or mismanagement. In contrast, non-custodial staking ensures that only you can access your funds, making it a more secure choice for long-term asset protection.

Non-custodial staking lets you lock your crypto assets in a wallet to support a blockchain network. You control your private keys fully, ensuring your assets stay secure. Here’s how it works in detail:

When you stake your assets, you delegate them to a validator. The validator then uses your stake to help confirm transactions and maintain network security. Your funds stay in your wallet and are never transferred to the validator or a third party. This keeps your assets safe and under your control.

Validators: These network participants validate new transactions and create new blocks. They must maintain high uptime and perform well to avoid penalties.

Delegators: As a delegator, you provide your assets to a validator without handing over your private keys. This helps the validator perform its duties and earn a share of the staking rewards. It's essential to pick a reliable validator, as their performance directly impacts your rewards and the risk of penalties.

Staking rewards come from newly created tokens or transaction fees. The network distributes these rewards to validators and delegators based on their contributions. However, if a validator fails to perform correctly or acts maliciously, they may face penalties, such as slashing. Slashing refers to reducing the validator’s staked tokens, which can affect your delegated assets.

Carefully choose a trustworthy validator and monitor your stake regularly to maximize rewards and minimize risks.

Security - Control Over Private Keys: Non-custodial staking keeps your private keys in your hands. You don't need to rely on a third party, reducing the risk of theft from hacking or data breaches. If you maintain proper security measures, your funds remain safe.

Autonomy - Complete Control Over Your Funds: With non-custodial staking, you can move or use your assets whenever you wish. There's no need to ask for permission or wait for approval. You're in charge of your funds and decisions at all times.

Transparency - Clear Interaction with the Blockchain: All transactions and processes are visible on the blockchain when you stake non-custodial. This transparency ensures you can verify operations easily, boosting trust and clarity. You always know what's happening with your staked assets.

When engaging in non-custodial staking, it's important to be aware of the potential risks and challenges that can impact your assets and overall staking experience:

Validators must perform their jobs well. If they don't, networks can penalize them with "slashing." If validators mess up or go offline, they might lose staked funds. In some cases, it may mean losing the opportunity to stake altogether.

Pick a validator with a good track record, high uptime, and strong security. Check their history and community feedback. Use staking dashboards to see how reliable they are.

Not following security best practices can risk your stake. Keep devices secure, protect your keys, and use strong passwords and two-factor authentication. Store keys in hardware wallets and keep software updated to lower risks.

Getting started with non-custodial staking might seem complex, but with the right steps, you can securely earn rewards while maintaining full control of your assets. Here's a straightforward guide to help you choose the right wallet, select a reliable validator, and effectively manage your stake.

Choose a Compatible Wallet: Pick one that supports non-custodial staking for your cryptocurrency. Make sure it allows you to keep control of your private keys.

Select a Trustworthy Validator: Research validators with strong performance and high reliability. A good validator should have a proven uptime record and a positive community reputation. Use tools like staking dashboards to compare and choose wisely.

Delegate and Manage Your Stake: Once you pick a validator, delegate your tokens using your wallet's staking feature. Monitor your rewards and the validator's performance. Be aware of unbinding periods during which your tokens are locked and cannot be moved.

Security Measures for Protecting Your Keys: Secure your private keys with hardware wallets to keep them offline. Enable two-factor authentication and never share sensitive info. Regularly back up keys in a safe physical spot.

Tips for Selecting the Best Validator: Choose validators with good reputations and performance. Look for high uptime, low slashing, and clear operations. Compare metrics on staking platforms and read community feedback.

Regularly Monitoring Staking Activity: Keep an eye on your staking rewards and validator performance. Watch for changes in staking protocols. If your validator underperforms, switch to another. Monitoring ensures your assets earn well and stay safe.

Non-custodial staking lets you earn rewards while keeping full control of your assets. It requires careful planning to keep funds safe and boost returns. Protecting your private keys is essential. Use hardware wallets, strong passwords, and two-factor authentication to secure your funds.

Selecting a reliable validator is absolutely vital for secure staking. Validators with high uptime and strong security protect your staked assets. Always research and compare validators using clear metrics and community reviews.

Always monitor your staking activity to track your rewards. Regularly monitor your validator's performance, network updates, and emerging risks. Stay proactive and well-informed to engage in non-custodial staking with confidence. Thoughtful, secure practices today can lead to long-lasting rewards tomorrow.

▶️ Watch: Types of Crypto Staking Explained

Join the Coinmetro community on Discord and Telegram, where forward-thinking traders and investors gather to share insights, explore new opportunities, and dive deep into cryptocurrencies. Should you need any help, please contact our world-class Customer Support Team via 24/7 live chat or email at hello@coinmetro.com.

To become a Coinmetro user today, Sign Up now or head to our new Exchange if you are already registered to experience our premium trading platform.

Etiquetas

Artigos relacionados

Fornecedores de Dados do Mercado de Criptomoedas: Garantindo Transparência e Precisão

Dados precisos e transparentes são essenciais para os mercados de criptomoedas, onde os preços podem mudar rapidamente e a informação pode estar…

8m

Negociação Demo de Criptomoedas: Pratique Negociação sem Riscos

A negociação demo de criptomoedas, ou paper trading, permite que você pratique negociação sem risco financeiro. Ela simula condições reais de…

6m

Indicadores de Sentimento do Mercado Cripto: Além do Índice de Medo e Ganância

Os indicadores de sentimento são cruciais na análise da psicologia dos investidores no mercado de criptomoedas. Essas ferramentas medem o humor…

10m

Yield Farming 2.0: Novas Estratégias na Provisão de Liquidez em DeFi

Yield farming, também conhecido como liquidez mining, tem desempenhado um papel significativo no crescimento das finanças descentralizadas (DeFi).…

10m