How to Long and Short on Margin Trading

December 5, 2025

by Kamil S

December 5, 2025

When diving into the topic of margin trading, you will soon come across such terms as long and short positions. Experienced traders will integrate both long and short orders into their trading, taking advantage regardless of market conditions. Read on to find out how long and short trading can help you become more efficient in the markets.

Margin trading implies you can open positions that are considerably larger than your current account balance. In simpler terms, with a small amount of money, you can open a much larger trade in the asset markets, otherwise called a leveraged position.

Margin trading and leverage are intrinsically linked concepts. Leverage, in essence, amplifies your potential to increase your purchasing power in the markets. More specifically, it's the orders of magnitude by which your position is bolstered. This is achieved through a process known as margin trading, which allows you to potentially make large profits with just a slight shift of the price in your favor.

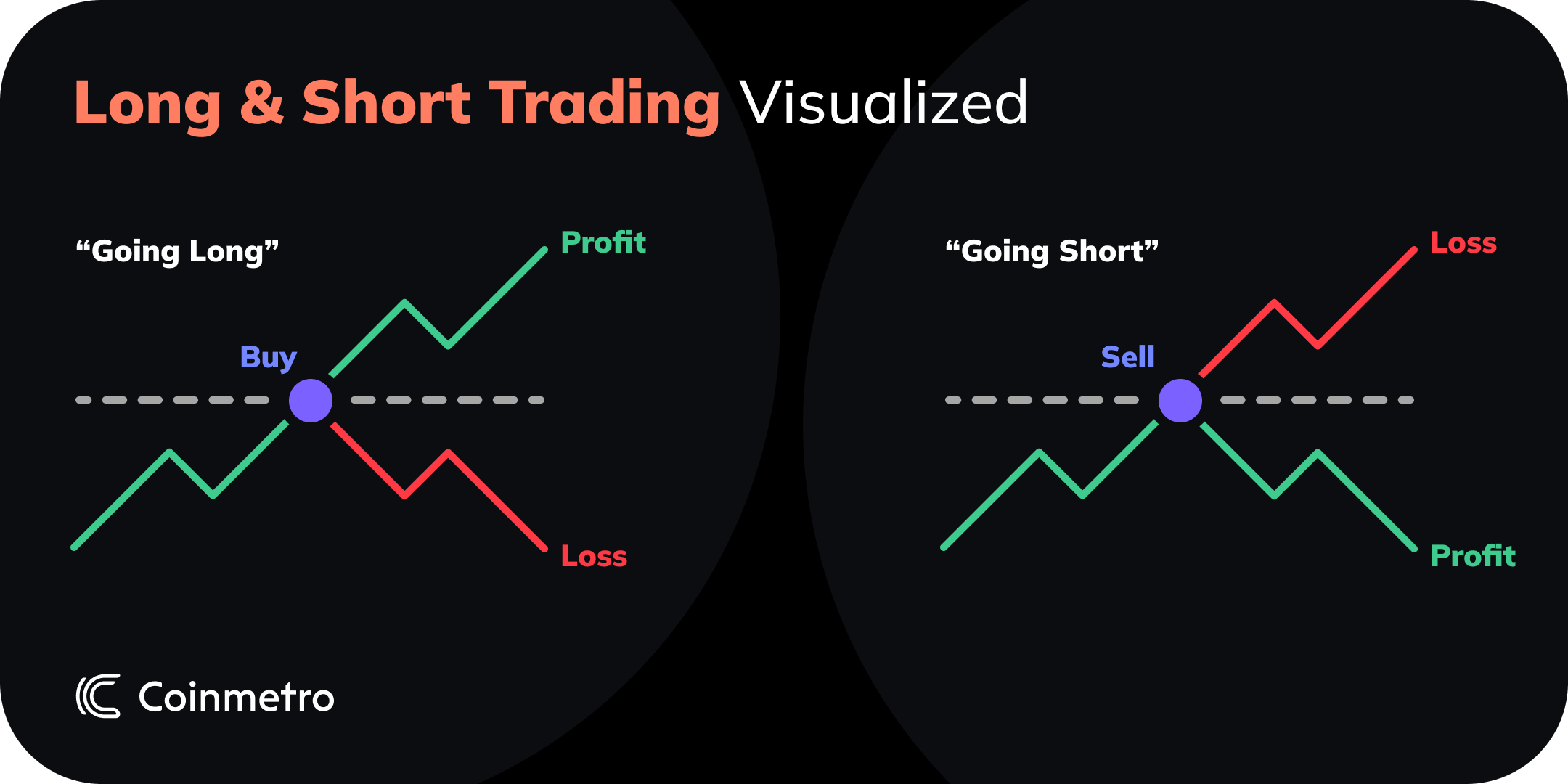

Whenever a trader holds a long position, it is a clear indication of anticipation that an asset's price will increase over time. When this happens, it will result in a profitable return on the initial investment. If an asset is sold for a higher price than initially purchased, you can profit from the difference in price.

Trading on margin, you can borrow assets to buy or hold other tradable assets. Once you sell the other tradeables, you can pay back the borrowed assets and interest, or a fee imposed for the use of an asset.

As can be guessed, a short position is the opposite of a long position. To explain, holding a short position indicates anticipation of a decline in asset value over time. When a trader first borrows, then sells an asset with the purpose of later repurchasing or covering it at a lower price, they are creating a short position. By doing this, you are able to pay back the borrowed asset, while making profits from buying back the security at a lower price than what you initially paid.

It is crucial to understand the difference in risk between long and short positions.

When opening a long trade, your total risk equals the sum of your investment. For example, if you purchase some coins worth $50 and the price drops to $0, you will lose $50 - the entire amount you invested.

Now, your potential risk when going short is infinite as you must eventually buy back the asset you shorted. The tricky thing is that an asset’s price can theoretically increase indefinitely in the meantime. For instance, you short for $50, and the asset’s price then jumps more than 100% and continues to rally. Eventually, you owe $50 plus whatever the amount of money that keeps accumulating on top of the 100% increase.

Learn more about the risks of margin trading and how to mitigate them.

Did you know that recently Coinmetro pushed forward one of the biggest product updates in recent times? Among several innovations in UX/UI, Spot exchange and Mobile App, we introduced a brand new Margin Platform that has been designed with the purpose of giving you a performant, safe and user-friendly experience, while helping you learn and develop your trading skills.

For sure, one of the advantages of margin trading is that you can profit from both long and short positions. If you are skilled enough, you can make money regardless of market conditions. While currently no coin or token is going #tothemoon, let us ask you this: Do you have a trading strategy for the current bear market?

Find some inspiration and get knowledgeable by learning about margin trading. Read more in this Learning Lab: Margin Trading for Beginners article.

If you are just starting out, we advise you to opt for a margin trading demo experience with Coinmetro, just so that you become familiar and start building some experience.

When you feel confident and are ready to margin trade live, we welcome you to open a Coinmetro account. Are you a registered user? You can head over to the exchange now.

To stay current on the most urgent crypto topics and chat with like-minded people, you can also join our Discord and Telegram communities.

Tags

Related Articles

Regulatory Sandboxes: Fostering Crypto Innovation Within Legal Frameworks

The cryptocurrency industry’s fast rise fuels an important debate. Innovation aims to transform finance, enhancing speed and access. Yet, regulators…

5m

Crypto Options Trading: Strategies and Market Insights

Cryptocurrency markets have rapidly expanded beyond simple buying and selling. One of the most significant developments has been the rise of…

6m

The Rise of Social-Fi: Blending Social Media with Decentralized Finance

In recent years, social media and finance have started to merge, creating Social-Fi. This concept blends the engagement of social platforms with…

6m

DeFi Insurance Platforms to Watch in 2024

Decentralized Finance (DeFi) insurance addresses the growing need for insurance against hacks, smart contract failures, and other DeFi-related risks.…

7m