EU Crypto Regulation: What’s Next?

May 23, 2022

by Kamil S

May 23, 2022

2022 might be the defining year for crypto regulation. On March 23, 2022, the European Parliament published the European Commission’s draft proposal regarding the Markets in Crypto-Assets (MiCA) framework. The MiCA framework, which is due to be formally adopted in legislation in 2024, seeks to harmonize the existing, largely disparate, crypto laws.As EU crypto regulation has now entered its next stage of discussions, let’s review the pains and benefits of the MiCA framework.

Markets in Crypto-Assets (MiCA) is a proposed regulation in European Union (EU) law that is intended to help streamline distributed ledger technology (DLT) and virtual asset regulation in the EU whilst protecting users and investors.

The key provisions of the MiCA Regulation cover compliance with transparency, disclosure, authorization, and supervision of transactions. These provisions are set to create a framework for strengthening regulatory supervision of crypto assets and maintaining consumer protection and market stability.

Equally important, the framework would develop effective preventive measures to combat money laundering and terrorist financing.

Since crypto assets are neither issued nor guaranteed by a central bank or public authority, they are currently out of the scope of EU law. A draft proposal was made to drive consumer protection and financial stability, as well as to prevent market manipulation and financial crime.

What’s more, mechanisms used to validate transactions in crypto assets – Proof-of-Work (POW) mechanisms in particular – have a substantial environmental impact; that is, they require a lot of energy, having a high carbon footprint and generating electronic waste.

The regulation draft proposed by the European Commission focuses on three main aspects that should ensure systematic regulation of crypto within the EU.

The requirement for having an organized legal framework for digital assets is considered most essential. In addition, the proposal discusses protecting consumers and safeguarding against market manipulation and financial crime. Finally, the draft highlights the need for including crypto mining within the EU taxonomy for sustainable activities by 2025 to reduce carbon footprint.

It is worth noting that the first two proposals have now been passed, meaning they have become part of the latest version of the proposed regulation. The third aspect touching on the subject of environmental sustainability of crypto assets was voted out of the proposed regulation.

This aspect called for limiting the use of Proof-of-Work crypto mining, based on the reason that it is an environmentally damaging practice.

The crypto landscape is preparing to embrace the newest set of regulations that will eventually form an efficient legal framework for crypto assets.

“By adopting the MiCA report, the European Parliament has paved the way for an innovation-friendly crypto-regulation that can set standards worldwide,” said MEP Stefan Berger. “The regulation being created is pioneering in terms of innovation, consumer protection, legal certainty and the establishment of reliable supervisory structures in the field of crypto-assets.”

To stay up to date with the latest crypto developments, we encourage you to join Coinmetro’s Discord or Telegram communities. If you wish to start trading right away, you can sign up to our platform in just a few steps.

Related Articles

Coinmetro 2026 Roadmap: Focus, Simplicity & Real-World Impact

This post explains not only what we’re building in 2026 — but why. This year represents a deliberate strategic choice. The exchange market has…

3m

Coinmetro Officially Files for MiCA in Malta

This is a major milestone for Coinmetro. We’re proud to announce that Coinmetro has successfully filed its MiCA application in Malta, marking the…

2m

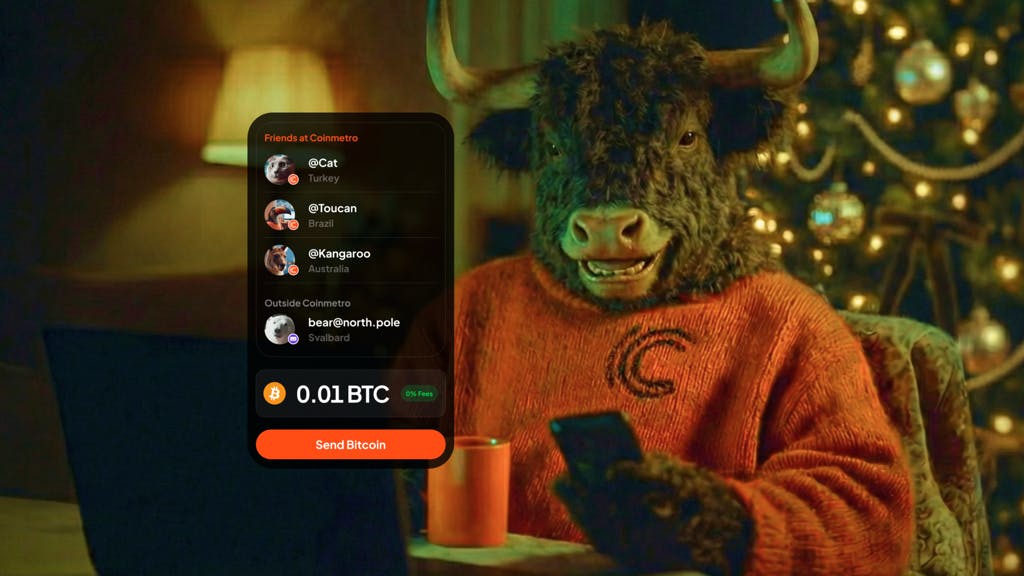

Zero Fees. Zero Waiting. Introducing Coinmetro Internal Transfers.

Moving value to friends and family just became instant, free, and borderless. Crypto was built to move at the speed of the internet. But too often,…

4m

Worldcoin (WLD) Now Listed on Coinmetro

We’re adding another asset to broaden user choice on Coinmetro: Worldcoin (WLD). This listing gives users who are interested in emerging…

2m