Shorting Cryptocurrencies: An Insider's Guide to Profit & Risk

December 5, 2025

by Kamil S

December 5, 2025

Investors and traders are constantly seeking opportunities to profit from the market's volatility. While many are familiar with the concept of buying and holding cryptocurrencies with the hope of long-term gains, there's another side to the coin – shorting cryptocurrencies. Shorting allows traders to profit from falling prices, presenting a unique set of strategies and risks that can be highly lucrative when executed with precision.

Whether you're an experienced trader looking to diversify your strategies or a newcomer eager to understand the ins and outs of shorting, join us as we explore various shorting strategies, dissect the potential risks, and uncover ways to optimize your crypto trades regardless of market sentiment.

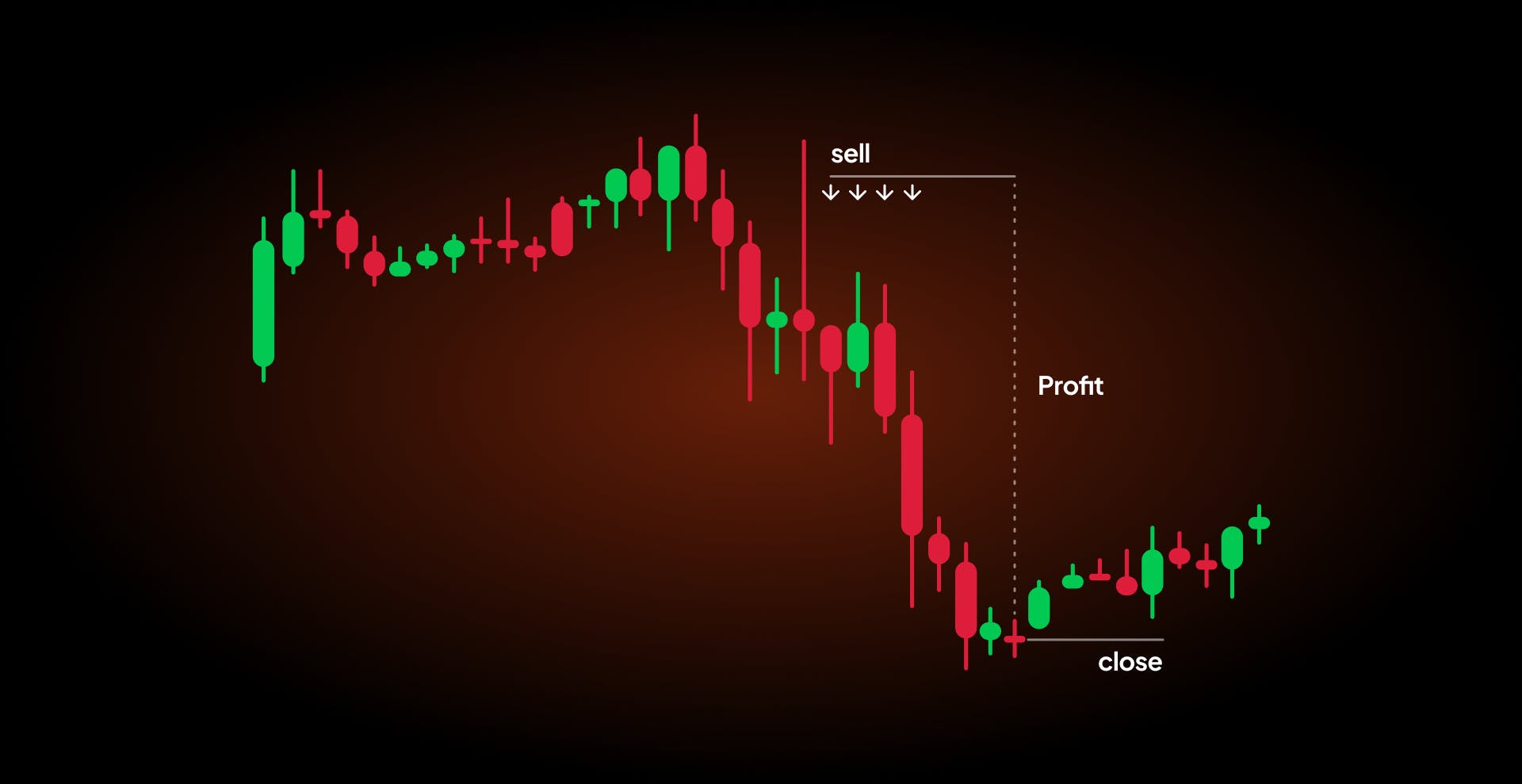

Before we dive into the intricacies of shorting cryptocurrencies, let's establish a fundamental understanding of what it means to "short" an asset. Shorting, also known as short selling or "going short," is a trading strategy used when an investor anticipates that the price of an asset will decline. Instead of buying an asset and holding it with the expectation of selling it later at a higher price (going long), shorting involves borrowing an asset and selling it at its present market price, with the goal of buying it back at a lower price later. This allows the trader to repay the borrowed asset and pocket the price difference as profit.

The process of shorting cryptocurrencies typically follows these steps:

Borrowing: The trader borrows a specific quantity of a cryptocurrency from a lender or exchange, often paying a fee for this borrowing privilege.

Selling Short: The borrowed cryptocurrency is immediately sold on the market at its current price.

Market Decline: The trader waits for the price of the cryptocurrency to fall, ideally to a level significantly lower than the initial selling price.

Buying to Cover: Once the price has fallen as desired, the trader repurchases the cryptocurrency from the market.

Returning the Borrowed Asset: The trader returns the cryptocurrency to the lender or exchange, closing the short position.

Profit or Loss: The trader's profit or loss is determined by the difference between the selling price and the repurchase price, minus any associated fees.

Shorting cryptocurrencies isn't a one-size-fits-all strategy. Various approaches and techniques cater to different market conditions and risk tolerances. Let's explore some of the most popular shorting strategies employed by traders in the crypto space:

Margin Trading: Margin allows traders to borrow funds to amplify their short positions. By utilizing leverage, traders can control larger positions with a relatively smaller capital investment. However, margin trading magnifies both profits and losses, making it a high-risk strategy.

Futures Contracts: A type of agreement wherein you commit to buying or selling a particular asset at a predetermined price on or before a specified future date. Shorting through futures allows for flexibility and can be used to hedge existing positions.

Options Trading: Options grant traders the privilege, without the obligation, to sell or buy a cryptocurrency at a predefined time and price in the future, known as the strike price. By acquiring put options, traders can capitalize on price decreases without the need to engage in short selling the asset.

Bearish Swing Trading: Swing traders look for short-term price swings within the broader trend of a declining cryptocurrency. This strategy involves capturing profits from short-term price declines in a similar fashion as you would do with shorting on margin, without the added leverage.

Hedging: Some investors use shorting as a hedging strategy to protect their long positions. By shorting when they anticipate a market downturn, they offset potential losses on their long holdings, giving themselves a better chance at mitigating risk.

As you venture into the world of shorting cryptocurrencies, it's important to understand that these strategies offer a range of possibilities and risks. Seasoned traders often combine these techniques to adapt to ever-changing market conditions. For instance, some may use margin trading to amplify their positions during highly volatile periods, while others might employ options trading to benefit from precise price predictions. Additionally, the use of shorting as a hedging tool can provide investors with a valuable safety net in times of uncertainty. Successful shorting in the crypto space requires not only a solid understanding of these strategies but also a keen awareness of market sentiment, news, and developments that can significantly impact cryptocurrency prices.

While shorting cryptocurrencies offers enticing profit potential, it also comes with inherent risks that can lead to significant losses if not managed effectively. It's crucial for traders to be aware of these risks and take appropriate precautions:

Unlimited Losses: Unlike going long, where the maximum loss is the initial investment, shorting can potentially result in unlimited losses if the price of the cryptocurrency rises substantially. Traders may be forced to cover their short positions at a much higher price.

Leverage Risk: Margin trading and leveraged short positions amplify both gains and losses. High leverage can lead to rapid liquidation if the market moves against the trader.

Volatility: Cryptocurrency markets are known for their increased volatility. Sudden price spikes can trigger short squeezes, making short sellers close their positions at a loss.

To maximize your chances of success when shorting cryptocurrencies, consider the following tips:

Thorough Research: Conduct extensive research on the cryptocurrency you intend to short. Understand its market dynamics, news, and events that could influence its price.

Stop Loss & Position Sizing: Implement strict risk management strategies, including setting stop-loss orders to limit potential losses. Additionally, traders can determine the size of their short positions based on their risk tolerance and overall portfolio size. Limiting the size of each short position can help mitigate potential losses.

Diversification: Instead of concentrating all short positions on a single cryptocurrency, diversifying by shorting multiple assets can spread risk. A decline in one asset may be offset by gains in another.

Risk-Reward Ratio: Calculating and adhering to a favorable risk-reward ratio is essential. Traders should aim for trades where the potential reward justifies the risk taken. For example, they might strive for a 2:1 or 3:1 risk-reward ratio, meaning they are willing to risk $1 to make $2 or $3.

Use Technical Analysis: Incorporating technical analysis is a valuable strategy for identifying opportune moments to enter and exit short trades when shorting cryptocurrencies. Study chart patterns and look for multiple technical indicators aligning in favor of a short trade. Remember that technical analysis is a tool to assist in decision-making, but it doesn't guarantee success in shorting cryptocurrencies. It's essential to combine technical analysis with thorough research, market understanding, and a well-thought-out trading plan.

Emotional Discipline: Emotional discipline is a crucial aspect of risk management. Emotion-driven decisions can lead to impulsive actions that undermine well-thought-out strategies. Traders should remain cool-headed and adhere to their risk management plan.

Practice on Demo Accounts: If you're new to shorting, consider practicing on the Coinmetro demo account to gain experience without risking real capital.

Let’s consider Alex, an investor with a long-term cryptocurrency portfolio. Alex believed in the long-term potential of cryptocurrencies but was wary of market volatility. To protect his portfolio from potential downturns, he embraced shorting as a risk-mitigation strategy.

Alex periodically analyzed the cryptocurrency market's sentiment and technical indicators. When he detected signs of an impending bearish trend, he executed short positions on specific assets while maintaining his long-term holdings.

This way, Alex successfully shielded his portfolio from substantial losses during market downturns. While he did not always profit from his short positions, his overall portfolio remained resilient, and he avoided the panic selling that often accompanies market crashes.

This case study exemplifies one approach and outcome of cryptocurrency shorting. While each trader may have a unique strategy and risk tolerance, they should all share some common traits: meticulous research, disciplined execution, and an unwavering commitment to risk management.

Shorting has emerged as a compelling strategy for those seeking to profit from price declines.

Through an exploration of the strategies, risks, and methodologies linked to shorting cryptocurrencies, individuals can gain access to a realm of trading opportunities that extends beyond traditional long-term investment strategies. Furthermore, by leveraging short positions, traders can profit regardless of market conditions.

Here are the primary insights to draw from our investigation into shorting cryptocurrencies:

Fundamental Comprehension: Shorting entails the act of borrowing and selling a cryptocurrency with the anticipation of repurchasing it at a reduced price in the future. Following this strategy, the borrowed asset is eventually returned to the lender, while the profit generated from the price difference is retained by the trader. This strategy is employed to secure gains from declining asset prices.

Diverse Tactical Approaches: A spectrum of strategies accommodates varied market circumstances and risk appetites. These encompass margin trading, futures contracts, options trading, bearish swing trading, and hedging.

Striking a Balance Between Risk and Reward: Shorting cryptocurrencies carries inherent risks, inclusive of unlimited losses, leverage-associated risks, and market volatility. Successful shorters prioritize risk management, implementing mechanisms such as stop-loss orders, position diversification, and the calculation of favorable risk-reward ratios.

Emotional Control: Maintaining emotional discipline stands as a critical factor in executing judicious decisions. Traders must exhibit composure and adhere to their risk management strategy, averting impulsive actions driven by emotional responses and the eventual public hype.

Practical Experience and Proficiency: For those who are new to shorting, honing their skills on demo accounts offers a valuable learning experience devoid of genuine capital risk. This allows traders to refine their approaches and build confidence.

As you embark on your journey of shorting cryptocurrencies, bear in mind that education and an unceasing quest for knowledge are your allies. Stay informed, adapt to the ever-changing dynamics of the market, and refine your methodologies to optimize your prospects of success. Whether you stand as a seasoned trader or a newcomer to the realm of shorting, the potential for profit and risk control remains within your grasp. By mastering the craft of shorting cryptocurrencies, you can infuse a dynamic dimension into your trading portfolio, empowering yourself to thrive in both bullish and bearish market conditions.

Join the Coinmetro community on Discord and Telegram, where forward-thinking traders and investors gather to share insights, explore new opportunities, and dive deep into the world of cryptocurrencies. Should you need any help, feel free to reach out to our world-class Customer Support Team via 24/7 live chat or email at hello@coinmetro.com.

To become a Coinmetro user today, Sign Up now, or head to our new Exchange if you are already registered and experience our premium trading platform.

Tags

Related Articles

Regulatory Sandboxes: Fostering Crypto Innovation Within Legal Frameworks

The cryptocurrency industry’s fast rise fuels an important debate. Innovation aims to transform finance, enhancing speed and access. Yet, regulators…

5m

Crypto Options Trading: Strategies and Market Insights

Cryptocurrency markets have rapidly expanded beyond simple buying and selling. One of the most significant developments has been the rise of…

6m

The Rise of Social-Fi: Blending Social Media with Decentralized Finance

In recent years, social media and finance have started to merge, creating Social-Fi. This concept blends the engagement of social platforms with…

6m

DeFi Insurance Platforms to Watch in 2024

Decentralized Finance (DeFi) insurance addresses the growing need for insurance against hacks, smart contract failures, and other DeFi-related risks.…

7m