MEV (Maximal Extractable Value) Explained: Impact on Traders

5 de diciembre de 2025

by Coinmetro Editorial Team

5 de diciembre de 2025

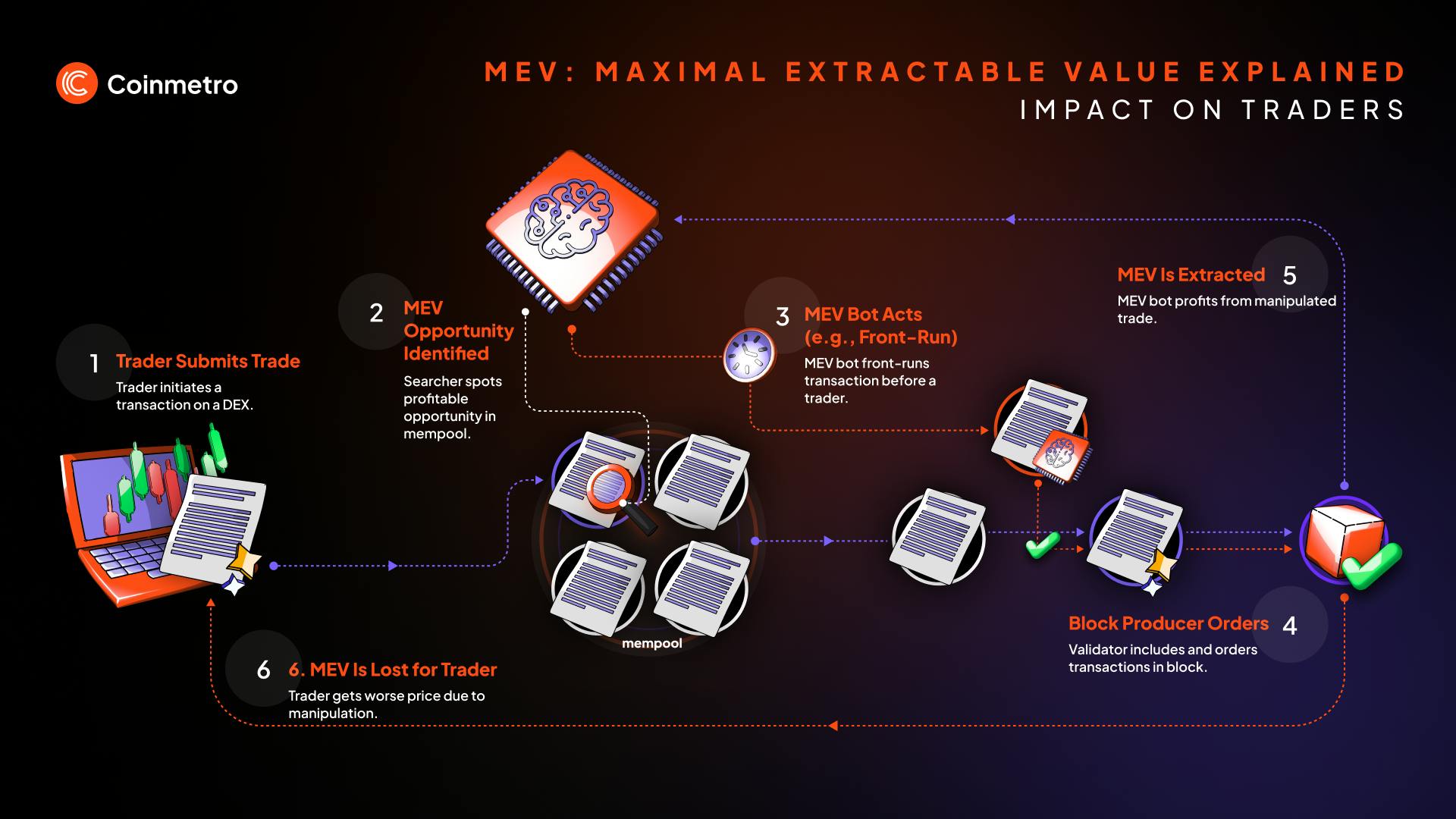

Maximal Extractable Value (MEV) plays an important role in decentralized finance (DeFi), affecting how traders execute transactions on blockchain networks. MEV refers to the extra value block producers, such as miners or validators, can gain by adjusting the order or inclusion of transactions within a block. This manipulation often leads to significant profits for block producers but poses serious challenges for everyday traders.

Understanding MEV is vital because it impacts transaction costs, trade execution, and the overall efficiency of DeFi markets. This article will explain how MEV works, examine its impact on traders, and discuss ways to reduce these risks effectively. By the end, you'll clearly understand MEV and how to safeguard your trades.

In this blog, you will learn about:

- What Is MEV (Maximal Extractable Value)?

- How MEV works

- Impact of MEV on traders

- How to mitigate MEV risks

Discover - Gas Fees Explained: Why Ethereum Transactions Can Be Expensive

MEV, or Maximal Extractable Value, is the additional profit block producers can earn by rearranging, including, or excluding transactions. This manipulation goes beyond collecting standard transaction fees. Like validators on Ethereum, block producers use their power to prioritize or change transaction orders. These adjustments can create opportunities for significant financial gains. For example, block producers can maximize their profits by front-running or sandwiching trades. More on this below.

Initially, MEV was called "Miner Extractable Value" because miners could manipulate transactions under the proof-of-work consensus model. However, Ethereum's switch to proof-of-stake in 2022 shifted control from miners to validators. As a result, the term evolved to "Maximal Extractable Value" to reflect the new environment where validators manage blocks. Despite this change, the core idea remains: those who produce blocks can extract extra value through strategic transaction ordering.

MEV is a significant concern for traders and the broader DeFi ecosystem. Block producers manipulating transactions can lead to higher costs for regular users. For instance, traders might experience increased slippage, paying more or selling for less than expected. Additionally, MEV can cause network congestion, raise gas fees, and slow transactions. These impacts make trading less predictable and expensive, creating an unfair environment for everyday users. As DeFi grows, understanding MEV and its implications becomes crucial for staying competitive.

Discover: What Is MEV (Maximal Extractable Value) in Crypto?

Block producers can reorder, include, or exclude transactions within a block to increase their profits. By observing transactions waiting to be confirmed in the mempool, these producers spot opportunities to manipulate the sequence. This manipulation affects other traders, often causing higher costs or unfavorable execution prices.

MEV exploits several strategies to generate profit:

Front-Running: Block producers detect a pending transaction and insert their own with a higher gas fee, ensuring it gets processed first. For example, if a user plans to buy a large amount of a token, a front-runner can buy the token first and then sell it for a profit after the large order has executed and increased the asset’s price.

Back-Running: This strategy places a transaction right after a significant trade. The goal is to profit from the immediate price impact of the large trade. For instance, if a big buy order pushes up a token’s price, a back-runner can buy immediately to capitalize on the upward momentum.

Sandwich Attacks: A sandwich attack involves placing a buy order before and a sell order after a target transaction. This strategy manipulates the token's price, ensuring the attacker profits. For example, suppose a trader initiates a large buy. In that case, the attacker first buys to increase the price, then sells after the trader’s order goes through, locking in a profit. This combines basically front and back running schemes.

Arbitrage: This technique identifies price differences across multiple decentralized exchanges (DEXs). The block producer buys the token at a lower price on one DEX and sells it at a higher price on another. While arbitrage helps balance prices, it can also increase fees for regular users during high demand.

MEV drives up transaction fees, especially during peak trading periods. Block producers prioritize transactions that pay higher gas fees, causing other users to increase their bids to confirm their trades. This competition for block space inflates overall network costs. Traders often experience price slippage, where they pay more or receive less than expected. For example, sandwich attacks raise token prices right before a trader's purchase and drop them immediately afterward, making trades less cost-effective.

MEV strategies frequently result in traders having worse execution prices. When block producers front-run a trade, they execute their transaction first, altering the token’s price. The trader receives a less favorable price when the original trade is processed. This manipulation is not only frustrating but also financially damaging. Slippage settings can limit losses, but traders still face uncertain trade outcomes, especially in highly volatile markets.

MEV activities increase network congestion, slowing down transaction speeds. When block producers engage in these strategies, they prioritize their transactions, delaying others. As congestion rises, gas fees spike, making it more expensive for users to perform even simple transactions. In extreme cases, this congestion can disrupt entire DeFi platforms, causing significant delays and reducing the system's reliability.

There have been well-documented instances illustrating MEV's impact on traders. One notable example occurred in April 2023, involving a bot named 'jaredfromsubway.eth.' This bot carried out over 238,000 sandwich attacks, affecting more than 100,000 traders. By strategically placing buy orders ahead of large trades and selling immediately afterward, the bot manipulated token prices and profited at the expense of unsuspecting traders. These activities caused traders millions in cumulative losses and led to a significant increase in Ethereum gas fees, impacting transaction costs for all network users.

Another significant instance occurred on May 1, 2022, during Yuga Labs' highly anticipated 'Otherdeed' NFT sale. The overwhelming demand for these NFTs led to severe network congestion. MEV bots exploited this situation by running front-running, driving average gas fees up to 474 gwei (Ether gas unit). This spike made transactions prohibitively expensive and severely disrupted transaction speeds for everyday users. These real-world cases underscore the serious financial and operational impact MEV has on the DeFi ecosystem.

Private transaction pools, known as "dark pools," can keep pending transactions hidden from the public mempool. Using these pools, traders can prevent front-runners from spotting and exploiting their transactions. Services like Flashbots bundle and deliver transactions directly to block producers, avoiding public exposure and reducing the risk of manipulation. These private pools have gained traction as an effective defense against MEV attacks.

Setting strict slippage limits on decentralized exchanges (DEXs) can help protect trades from price manipulation. Slippage occurs when the executed trade price differs from the expected price due to market volatility or MEV attacks. By setting a tight slippage limit, traders ensure that if the price moves beyond their acceptable range, the trade will not execute. This approach minimizes unexpected losses, making it a crucial strategy for high-value trades in volatile markets.

Several platforms have emerged to help traders minimize MEV risks. These MEV-aware platforms use advanced algorithms and transaction routing techniques to reduce exposure. For example, tools like CowSwap and KeeperDAO optimize trade execution by strategically timing transactions or using private mempools. By employing these platforms, traders gain additional protection from MEV attacks while enjoying smoother trade experiences.

Recent advancements in smart contract technology have introduced new ways to combat MEV. Developers are designing contracts that limit transaction order manipulation. For instance, some projects use "commit-reveal" schemes, where users commit to a trade without revealing specifics and only disclose details once the transaction is secured. Other solutions involve randomized transaction ordering or implementing batch auctions, making it harder for block producers to exploit transaction sequences. These smart contract innovations continue to evolve, offering more secure options for DeFi traders.

Learn More About Maximizing Liquidity and Minimizing Slippage

This article explores the Maximal Extractable Value (MEV) practice and its impact on DeFi traders. MEV refers to when block producers adjust transactions to increase profits using front-running and arbitrage methods.

MEV drives up fees, disrupts execution, and slows down DeFi networks. Understanding MEV helps traders safeguard funds and uphold efficiency in decentralized markets. Awareness of its effects is crucial for participants.

Private transaction pools can shield trades from block producers, reducing manipulation risks. Tight slippage limits curb losses when prices shift quickly. MEV-aware platforms and smart contracts can also offer strong protection.

MEV undermines fairness and speed in DeFi, affecting traders’ returns directly. Staying informed and using specialized tools and tactics described above can significantly improve safeguarding your trades from unwanted manipulation.

▶️ Watch: Vitalik Buterin Talking About MEV (Maximal Extractable Value)

Etiquetas

Artículos relacionados

Blockchain en la educación: transformando el aprendizaje y la acreditación

¿Qué pasaría si tu expediente académico pudiera verificarse al instante, en cualquier lugar del mundo? Esta es solo una de las preguntas que reflejan…

7m

Cómo comprar Ethereum (ETH) en Coinmetro - paso a paso

¿Quieres comprar Ethereum al instante sin complicaciones? Coinmetro lo hace rápido, sencillo y seguro. Esta guía te muestra los pasos simples para…

3m

Cómo hacer staking de Ethereum (ETH) en Coinmetro de forma rápida, sencilla y segura

¿Quieres ganar ingresos pasivos con tu Ethereum? Con Coinmetro, hacer staking de ETH es un proceso fluido, seguro y fácil para principiantes. En esta…

3m

El papel de la cadena de bloques en la trazabilidad de la cadena de suministro

En 2021, un escándalo sacudió al sector alimentario. Varios proveedores habían etiquetado carne caducada como si fuera fresca. El resultado fue la…

11m