Is Bitcoin Really Anonymous? Debunking Privacy Myths

5 de diciembre de 2025

by Coinmetro Editorial Team

5 de diciembre de 2025

Bitcoin has gained a reputation as a digital currency that provides users anonymity. Many people assume that using Bitcoin keeps their transactions and identities completely private. However, this is not entirely accurate. While Bitcoin offers some level of privacy, its design does not make it fully anonymous. Misunderstandings around its privacy features have led to myths about what it can and cannot protect.

This article aims to debunk these myths about Bitcoin’s anonymity. We’ll explain how Bitcoin transactions work, clarify the privacy limitations users face, and discuss the risks and options available for protecting your identity when using Bitcoin.

In this blog, you will learn about:

- What makes Bitcoin seem anonymous?

- How Bitcoin transactions work

- Bitcoin’s limitations on privacy

- Common myths about Bitcoin’s privacy

- The role of blockchain analytics in tracing transactions

- Privacy-focused alternatives to Bitcoin

- How to enhance Bitcoin privacy

▶️ Watch - The Secrets of Bitcoin Wallets and Private Keys

For many, cryptocurrencies like Bitcoin offer a big draw with their privacy promise. People enjoy making transactions without revealing their identity, especially in a world where data privacy is increasingly at risk. With worries about government surveillance and corporate tracking, the idea of an "anonymous" currency is very appealing.

Users often think Bitcoin's structure guarantees complete privacy. This belief stems from Bitcoin's use of pseudonymous addresses. Unlike bank accounts tied to real names, Bitcoin transactions use unique codes. This setup suggests anonymity since no personal names are linked to transactions.

The pseudonymous nature of Bitcoin can give users a sense of privacy and security. They often miss that all transactions are logged on a public blockchain, where anyone can see the history. Even though Bitcoin addresses don't show names, connecting them to individuals is possible with extra clues like IP addresses or exchange data. This misconception happens because users might not understand that Bitcoin's design leans more towards transparency than true anonymity.

Bitcoin Addresses and Public Ledger: Every Bitcoin transaction uses a unique address. This address shows up on the blockchain, a public record of all transactions. When you send or receive Bitcoin, transactions link to these addresses, letting anyone follow the money's path.

Transparency of the Blockchain: Bitcoin's blockchain is open to everyone. All transactions are recorded publicly, showing how much Bitcoin was moved and to which addresses. This openness helps track Bitcoin movement, enhancing security but reducing privacy.

Pseudonymity vs. Anonymity: Bitcoin transactions provide pseudonymity, not anonymity. Pseudonymity uses a code instead of your real name. Even though an address doesn't show who you are, smart tracking can connect it to you. Real anonymity would hide all traces of identity, but Bitcoin only masks it, not fully hiding it.

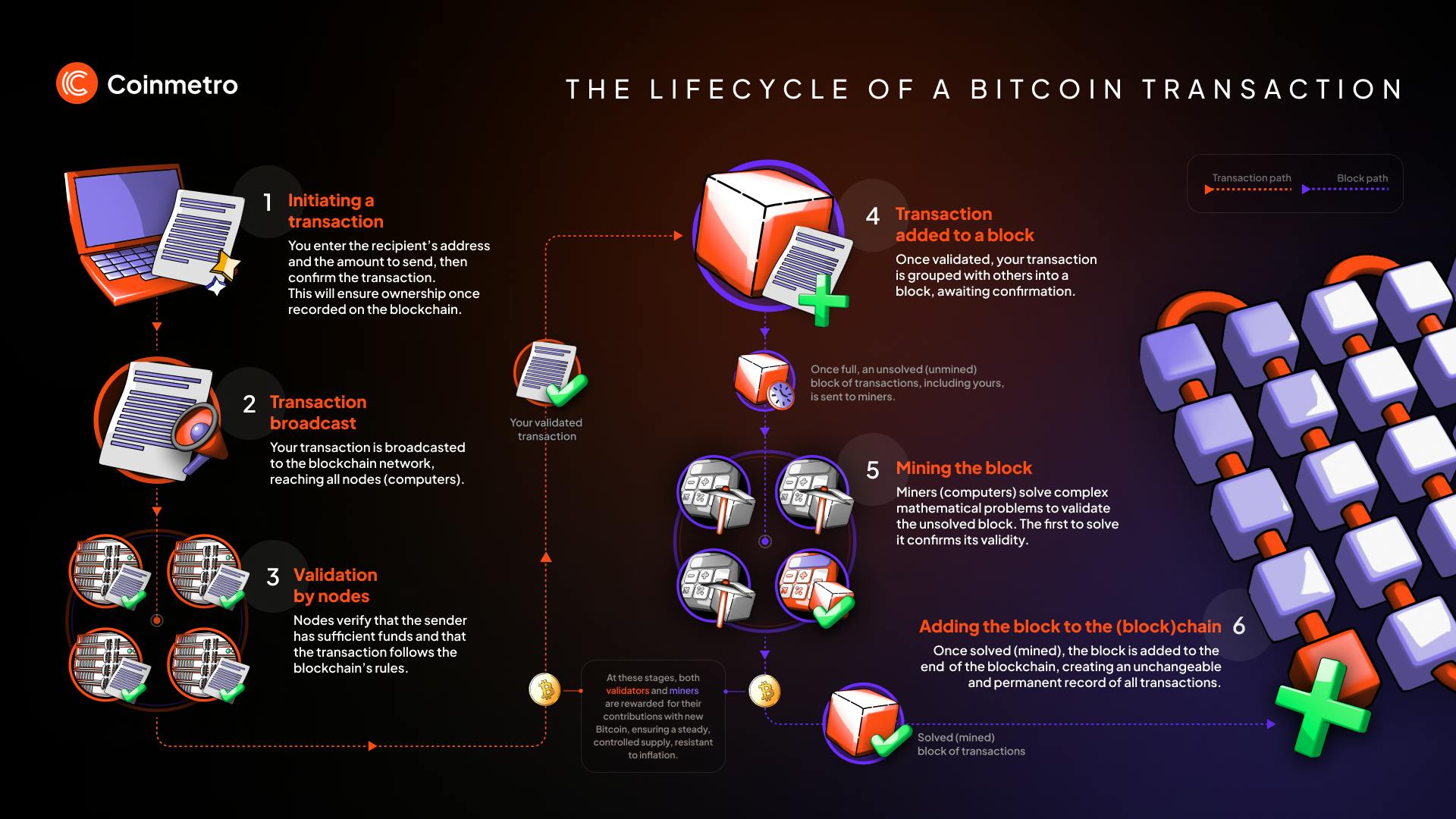

Get to Know: What Happens in a Bitcoin Transaction? A Step-by-Step Guide

Tracking Through Public Ledger: As mentioned, every Bitcoin transaction is on a public ledger, the blockchain. This means anyone can see where Bitcoins have been. Although names are hidden, patterns in transactions can still link addresses.

IP Address Exposure: When users connect to the blockchain, their IP can leak. This might tie a Bitcoin address to a real place. Monitoring these connections could potentially trace transactions to users.

Third-party Exchanges and KYC: Many Bitcoin exchanges must follow KYC practices. These rules require exchanges to collect personal information from users. Once an address links to a verified account, privacy drops, as exchanges might share this data with authorities.

Blockchain analytics firms track Bitcoin transactions using advanced tools. They help law enforcement catch users linked to illegal activities by analyzing patterns and connecting addresses. This shows Bitcoin isn't fully private.

Using new addresses for each deal adds some privacy. But if you move funds between these addresses, they can still be traced. This means address changes don't fully protect your privacy.

Mixers and tumblers mix your Bitcoin with others to hide tracks. However, these services don't make transactions invisible. Analytics firms have ways to track through mixing, so while they help, they don't guarantee untraceability.

Blockchain analytics firms use smart software to follow money on the blockchain. They look at how transactions connect, group addresses, and use machine learning to trace Bitcoin from start to end. This helps them link transactions even if they use different wallets.

Blockchain analysis has been key in big cases, aiding in fund recovery and crime tracking. In 2021, the FBI used it to get back Bitcoin paid in the Colonial Pipeline hack. In 2020, it helped catch those behind a child exploitation site, leading to arrests. These examples show how analytics can give a clear picture of transaction history.

Though Bitcoin uses pseudonyms, analytics can expose transaction paths. Tools like mixers don't always keep transactions hidden from experts. This means Bitcoin isn't completely anonymous; skilled analysts can often find where the money comes from and goes.

Monero and Zcash: Monero and Zcash aim for more privacy than Bitcoin. Monero uses ring signatures and stealth addresses to mix transactions, making them hard to trace. Zcash employs zk-SNARKs to keep transactions secret, hiding who sends or receives and how much.

How Privacy Features Differ from Bitcoin: Unlike Bitcoin's open ledger, Monero and Zcash hide transaction details. Monero's ring signatures blend transactions, keeping them hidden. Zcash's zk-SNARKs let transactions be checked without revealing personal info.

Limitations and Challenges of Privacy Coins: Despite their privacy advantages, these coins face challenges. Many exchanges limit or ban them due to legal worries, reducing their use. Also, regulators closely watch these coins for illegal activities, making their acceptance harder in finance.

Discover Crypto Mixers: Privacy Tools and Regulatory Challenges

Users can take several steps to improve their privacy when using Bitcoin. While these methods don’t provide complete anonymity, they can help reduce data exposure and make tracing more difficult.

Use a VPN to Hide IP Addresses when Accessing Wallets: A Virtual Private Network (VPN) masks your IP address, making it harder to link your location with your Bitcoin address. This adds an extra layer of privacy by keeping your internet activity anonymous.

Consider Privacy-Focused Wallets that Minimize Data Exposure: Some wallets prioritize privacy by avoiding data collection or providing features like address randomization and enhanced security. These wallets reduce the chance of your transaction data being linked to your identity.

Limitations of These Methods: Even with these privacy measures, Bitcoin doesn’t offer foolproof anonymity. Advanced blockchain analytics and tracking tools can still trace transactions. These methods can help increase privacy but won’t guarantee complete protection.

Bitcoin provides pseudonymity, not true anonymity. Its public blockchain makes transactions traceable, emphasizing the importance of understanding this transparency when making privacy decisions.

As privacy concerns rise, new methods like CoinJoin, Taproot, stealth addresses, privacy DEXs, and the Lightning Network are improving Bitcoin privacy. CoinJoin mixes transactions to confuse trackers, while Taproot disguises complex transactions. Stealth addresses give each transaction a new address, DEXs bypass KYC, and the Lightning Network keeps deals off the main blockchain. These tools increase privacy control but don’t offer full anonymity.

Read More - Guide to Using Bitcoin Anonymously

Join the Coinmetro community on Discord and Telegram, where forward-thinking traders and investors gather to share insights, explore new opportunities, and dive deep into cryptocurrencies. Should you need any help, please contact our world-class Customer Support Team via 24/7 live chat or email at hello@coinmetro.com.

To become a Coinmetro user today, Sign Up now or head to our new Exchange if you are already registered to experience our premium trading platform.

Etiquetas

Artículos relacionados

Blockchain en la educación: transformando el aprendizaje y la acreditación

¿Qué pasaría si tu expediente académico pudiera verificarse al instante, en cualquier lugar del mundo? Esta es solo una de las preguntas que reflejan…

7m

Cómo comprar Ethereum (ETH) en Coinmetro - paso a paso

¿Quieres comprar Ethereum al instante sin complicaciones? Coinmetro lo hace rápido, sencillo y seguro. Esta guía te muestra los pasos simples para…

3m

Cómo hacer staking de Ethereum (ETH) en Coinmetro de forma rápida, sencilla y segura

¿Quieres ganar ingresos pasivos con tu Ethereum? Con Coinmetro, hacer staking de ETH es un proceso fluido, seguro y fácil para principiantes. En esta…

3m

El papel de la cadena de bloques en la trazabilidad de la cadena de suministro

En 2021, un escándalo sacudió al sector alimentario. Varios proveedores habían etiquetado carne caducada como si fuera fresca. El resultado fue la…

11m