Crypto Tax Loss Harvesting Strategies

5 de diciembre de 2025

by Coinmetro Editorial Team

5 de diciembre de 2025

Cryptocurrency investments are growing popular, bringing both opportunities and tax duties. The IRS views most cryptocurrencies as property in the United States, applying capital gains tax when sold or traded. This means profits from selling or trading digital assets must be reported.

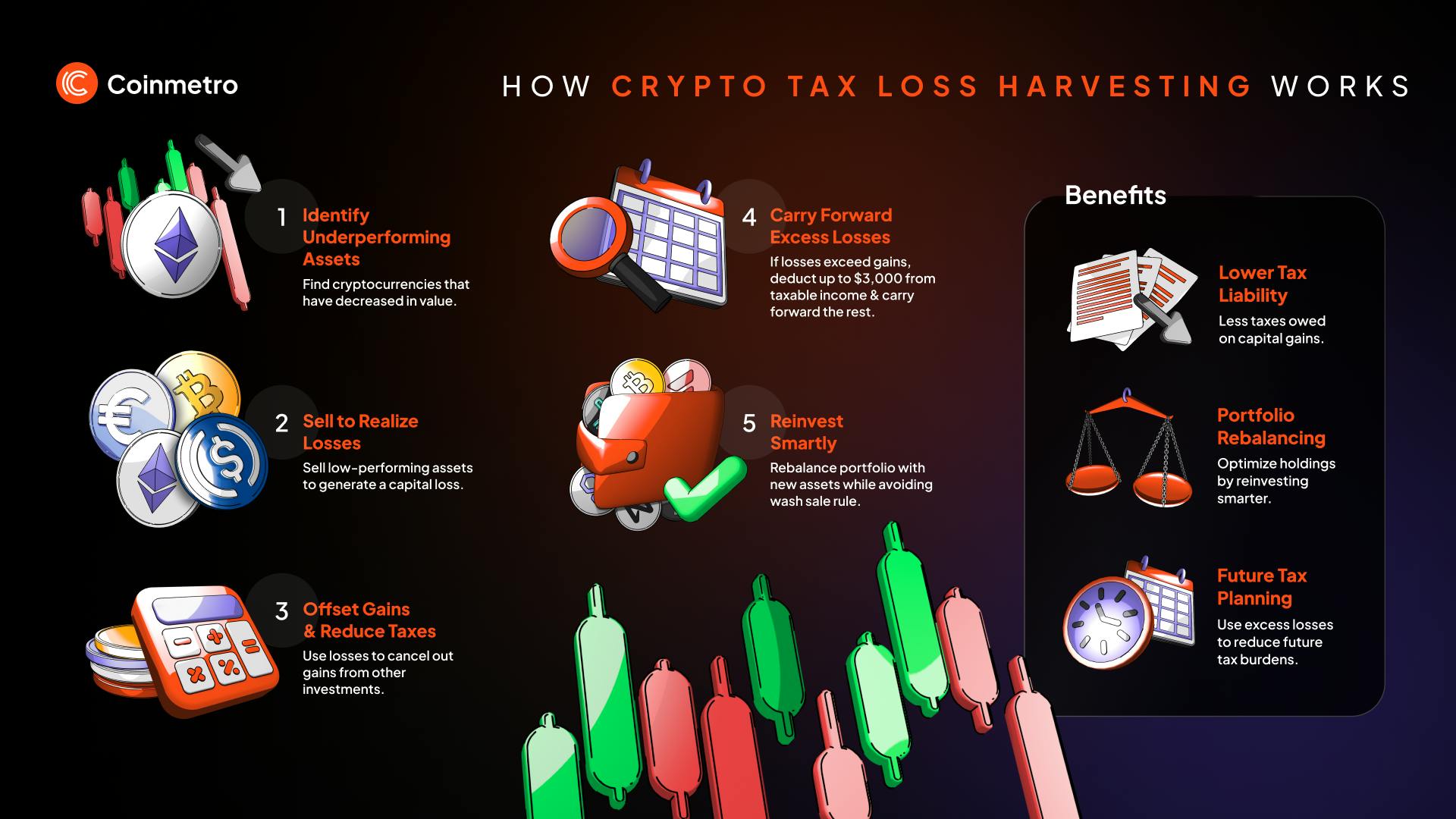

Tax loss harvesting lets investors sell assets at a loss to reduce capital gains. For cryptocurrencies, this means selling digital assets that lost value to offset gains elsewhere. This approach can lower tax bills and boost after-tax profits.

Knowing how to use tax loss harvesting is key for smart tax planning. This strategy helps lower your current tax bill and lets you use leftover losses to reduce taxes on future profits. Staying updated on tax rules helps investors make wise choices and improve financial results.

In this blog, you will learn about:

- Understanding crypto tax loss harvesting

- Key benefits

- Implementing tax loss harvesting in crypto

- Understanding the wash sale rule

- Timing your harvesting

- Potential risks and considerations

- Best practices

Discover More - Cryptocurrency Taxes: A Guide to Taxation of Digital Assets

Tax loss harvesting is a strategy investors use to reduce their tax liability. It involves selling assets that have lost value to realize a loss. This loss is then used to offset capital gains from other investments, lowering the amount of taxable income.

When investors sell a cryptocurrency at a lower price than they paid, they generate a capital loss. These losses can balance out capital gains from other profitable investments. If an investor has more losses than gains, they may use the excess loss to reduce their taxable income up to a certain limit. Any remaining losses can often be carried forward to offset future gains.

Example Scenario: Suppose an investor bought Bitcoin for $10,000 but sold it for $7,000. This transaction results in a $3,000 capital loss. If the investor made a $3,000 gain from selling Ethereum, they could use the Bitcoin loss to cancel out the gain. As a result, the investor wouldn’t owe taxes on the $3,000 gain from Ethereum. If the investor’s losses exceed gains, they could use up to $3,000 of the excess loss to reduce their taxable income, with any additional losses carried forward to future years.

Tax Reduction: Tax loss harvesting helps investors cut their taxable income effectively. Selling assets at a loss lets them offset capital gains from winning investments. If losses top gains, they can deduct up to $3,000 from regular income, lowering taxes.

Portfolio Rebalancing: Selling underperforming assets gives investors a chance to adjust their portfolios. They can review holdings and pick investments that match their financial goals. This move boosts diversification, improves performance, and uses tax benefits smartly.

Future Tax Planning: Unused capital losses carry over to future tax years without waste. Investors can apply these losses to offset gains in profitable years. This long-term perk helps plan ahead and reduces tax burdens over time.

Step 1 - Identify Underperforming Assets: Review your crypto portfolio to find assets that have significantly dropped in value compared to the purchase price. Analyze price history, current market trends, and the long-term potential of each asset. Consider whether holding onto a depreciated asset aligns with your investment strategy or if selling to realize a tax benefit is smarter.

Step 2 - Sell to Realize Losses: Once you’ve identified underperforming assets, sell them to lock in the capital loss. Document the transaction details, including the date and sale price. Accurate records are crucial for tax reporting. Ensure you complete the sale before the tax year ends to include the losses in that year’s tax calculations.

Step 3 - Offset Gains: Use your realized losses to offset gains from other profitable crypto trades. If your losses exceed your gains, you can deduct up to $3,000 from your other income, such as wages or salary. Any remaining losses can be carried forward to future tax years, providing ongoing tax benefits.

Step 4 - Reinvest: Consider reinvesting in different cryptocurrencies after selling underperforming assets. Be careful to avoid triggering the wash sale rule if it ever gets applied to crypto assets. Diversify your reinvestments to align with your overall financial goals, and stay up-to-date with tax regulations to ensure compliance.

Discover How Much You Can Deduct by Crypto Tax-Loss Harvesting

The Wash Sale Rule, a key regulation in traditional investing, carries significant implications for tax planning and could soon impact cryptocurrency transactions.

Explanation of the Wash Sale Rule: The Wash Sale Rule affects stocks and securities in traditional investing. It stops investors from claiming tax deductions on losses if they repurchase the same asset within 30 days. This prevents selling at a loss for tax benefits without truly changing ownership.

Current Status of the Rule Concerning Cryptocurrencies: The Wash Sale Rule does not yet cover cryptocurrencies. The IRS treats most digital assets as property, not securities, allowing repurchasing after a loss without delay. Still, Congress or the IRS might update this, so investors must stay alert.

Importance of Staying Updated on Potential Regulatory Changes: Cryptocurrency tax rules are changing fast. Lawmakers may soon apply the Wash Sale Rule to digital assets, affecting tax strategies. Staying informed helps investors remain compliant and adapt to reduce tax burdens effectively.

Importance of Timing for Tax Efficiency: Timing plays a crucial role in maximizing the benefits of tax loss harvesting. Selling assets at a strategic time can significantly impact your tax savings. By carefully planning the sale of underperforming assets, investors can ensure they offset gains when it matters most, reducing their overall tax liability.

Why Many Investors Consider End-of-Year Harvesting: Many investors focus on tax loss harvesting near the end of the tax year. At this point, they have a clearer picture of their total gains and losses. Harvesting losses before the tax year ends allows them to adjust their tax liability effectively. It also allows them to finalize tax planning strategies, ensuring all gains are offset as needed.

Potential Benefits of Periodic Harvesting Throughout the Year: While end-of-year harvesting is popular, periodic harvesting can offer unique advantages. Investors can react to market downturns by evaluating losses regularly and capturing losses when they occur rather than waiting. This proactive approach can smooth out tax planning and avoid the rush at the end of the year. Additionally, it helps manage risk better and maintain an optimized portfolio.

Before implementing tax loss harvesting, investors should carefully consider several risks and challenges that could impact the effectiveness of their strategy:

Market Volatility: Cryptocurrency prices swing wildly and unpredictably. Selling at a loss might mean missing gains if prices bounce back fast. Investors need to balance tax savings with the chance of asset growth.

Transaction Fees: Buying and selling crypto often racks up hefty transaction fees. These costs depend on the platform and network demand, cutting into returns over time. Investors should factor in fees and pick low-cost platforms like Coinmetro to keep profits intact.

Regulatory Changes: Tax rules for cryptocurrency keep shifting. New laws might limit tax loss harvesting, like applying the Wash Sale Rule to digital assets. Staying updated and consulting tax pros helps investors adjust and stay compliant.

Following best practices can ensure accuracy, compliance, and efficiency to maximize the benefits of crypto tax loss harvesting.

Maintain Detailed Records: Accurate and thorough documentation is essential. Record every transaction, including dates, amounts, and the reason for each sale. Keeping a detailed log helps when it’s time to report taxes and ensures you don’t miss any losses you can claim. Proper records also make audits easier to manage if they ever happen.

Consult Professionals: Seeking advice from tax professionals familiar with cryptocurrency can save you money and stress. Tax rules for digital assets are complex and subject to change. A tax expert can guide you through the latest regulations, help optimize your tax strategy, and ensure you stay compliant. Professional guidance is especially valuable if you have a significant investment in crypto.

Use Tax Software: Specialized tax software simplifies tracking and calculating your crypto transactions. These tools automatically track gains, losses, and the cost basis of assets. Using software reduces human error and saves time when preparing tax returns. Popular programs integrate with major exchanges, providing an efficient way to manage your crypto tax obligations.

Tax loss harvesting is a powerful strategy for cryptocurrency investors. Selling assets at a loss can reduce your tax liability and improve your financial outcomes. When implemented correctly, tax loss harvesting provides immediate tax savings and offers long-term benefits through future tax planning.

▶️ Watch This to Learn How to Save Money On Your Taxes

Join the Coinmetro community on Discord and Telegram, where forward-thinking traders and investors gather to share insights, explore new opportunities, and dive deep into cryptocurrencies. Should you need any help, please contact our world-class Customer Support Team via 24/7 live chat or email at hello@coinmetro.com.

To become a Coinmetro user today, Sign Up now or head to our new Exchange if you are already registered to experience our premium trading platform.

Etiquetas

Artículos relacionados

Blockchain en la educación: transformando el aprendizaje y la acreditación

¿Qué pasaría si tu expediente académico pudiera verificarse al instante, en cualquier lugar del mundo? Esta es solo una de las preguntas que reflejan…

7m

Cómo comprar Ethereum (ETH) en Coinmetro - paso a paso

¿Quieres comprar Ethereum al instante sin complicaciones? Coinmetro lo hace rápido, sencillo y seguro. Esta guía te muestra los pasos simples para…

3m

Cómo hacer staking de Ethereum (ETH) en Coinmetro de forma rápida, sencilla y segura

¿Quieres ganar ingresos pasivos con tu Ethereum? Con Coinmetro, hacer staking de ETH es un proceso fluido, seguro y fácil para principiantes. En esta…

3m

El papel de la cadena de bloques en la trazabilidad de la cadena de suministro

En 2021, un escándalo sacudió al sector alimentario. Varios proveedores habían etiquetado carne caducada como si fuera fresca. El resultado fue la…

11m